- Markets have rebounded significantly since their 2022 lows.

- Current assessments suggest elevated valuations.

- Investors should consider diversification and strategic adjustments to portfolio.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

Since hitting a bear market low in October 2022, markets have staged impressive recoveries. For investors who embraced the mantra of "time in the market, not timing the market," the rewards have been substantial.

Yet, two years later, it’s essential to take stock and assess where we stand. Are we in a position of strength, or is a shift on the horizon?

Let’s delve into the current state of the U.S. market.

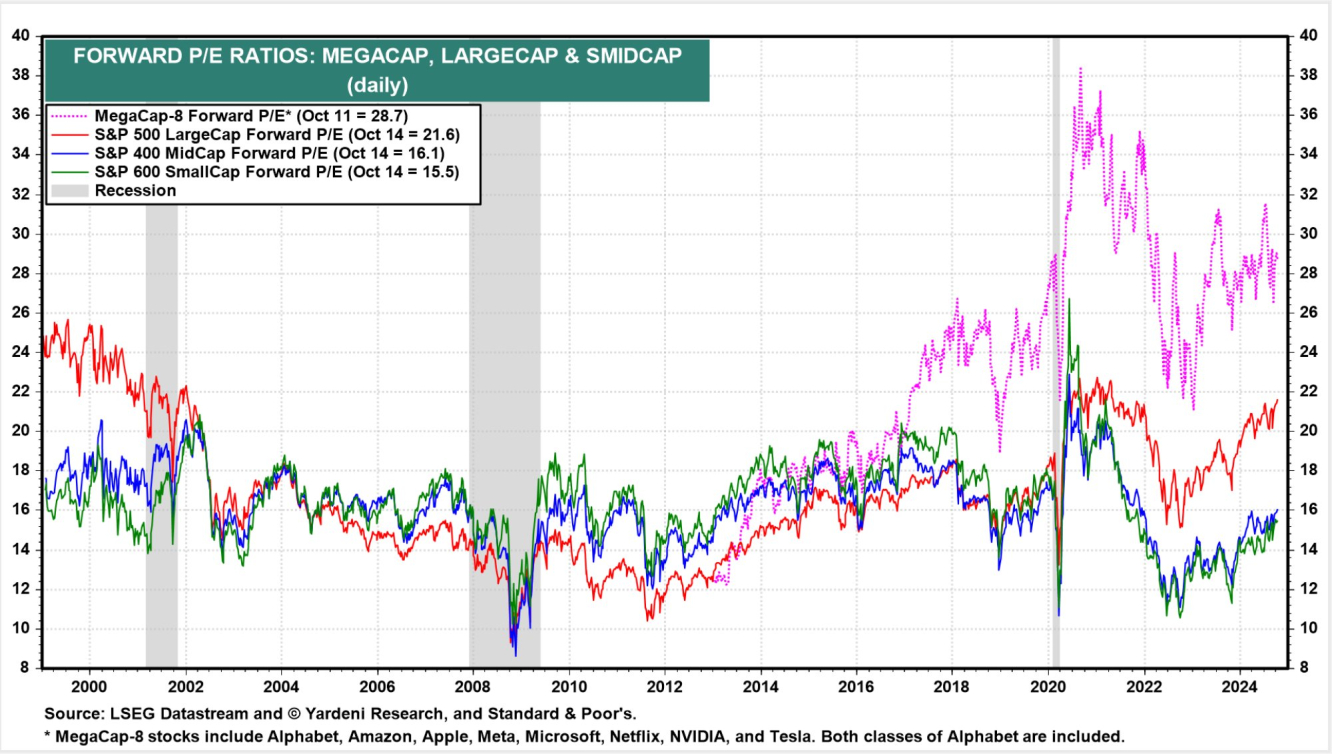

Take a look at the chart below. It highlights how “Mega Cap” stocks—think Nvidia (NASDAQ:NVDA), Microsoft (NASDAQ:MSFT), and Apple (NASDAQ:AAPL) - are currently valued well above historical averages.

Together, these giants now account for more than one-third of the S&P 500. This concentration drives the overall valuation of the U.S. index to above-average levels as well.

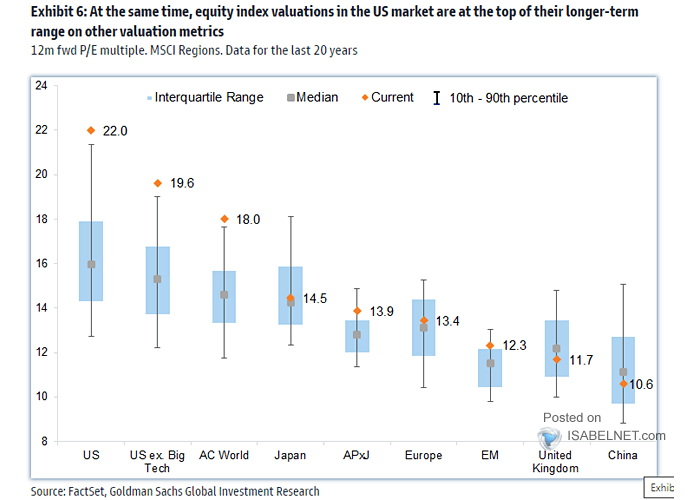

If we compare the current market to the past 20 years, it’s clear that stocks are relatively expensive.

But the implications extend beyond U.S. borders. The United States represents nearly 72% of the MSCI World Index and 64% of the MSCI All Country World Index (ACWI).

This means that both of these global indices are also trading at elevated valuations.

You might be wondering:

- Are we nearing a market reversal?

- What steps should we consider taking?

While I can’t predict the future (and neither can anyone else), it’s important to recognize that these market conditions could persist for some time.

However, the second question opens up a range of possibilities, especially for those who have capitalized on the rebound over the past two years.

Here are some strategies to consider moving forward:

- Switch (NYSE:SWCH) to an Equal Weighted Index: This approach can mitigate the risks associated with heavy concentration in a few large stocks.

- Diversify Geographically: Investing in international markets can balance your portfolio and reduce reliance on U.S. equities.

- Increase Your Bond Component: Bonds can provide stability and income, particularly in volatile markets.

- Boost Your Cash Reserves: Maintaining a tactical cash position allows you to seize opportunities during market dips.

- Lengthen Your Investment Horizon: A longer time frame can help you ride out market fluctuations and benefit from compounding returns.

These strategies are just starting points. The key is to have a well-defined strategy before making any decisions.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk rests with the investor. We also do not provide any investment advisory services.