We expect the Fed rate cut cycle to start soon and proceed gradually. Barring a financial crisis or a sharp and unexpected change in the path of inflation or unemployment, the upcoming rate-cutting cycle won’t be dramatic; we expect the Fed to make incremental, 25 bps cuts to its policy rate.

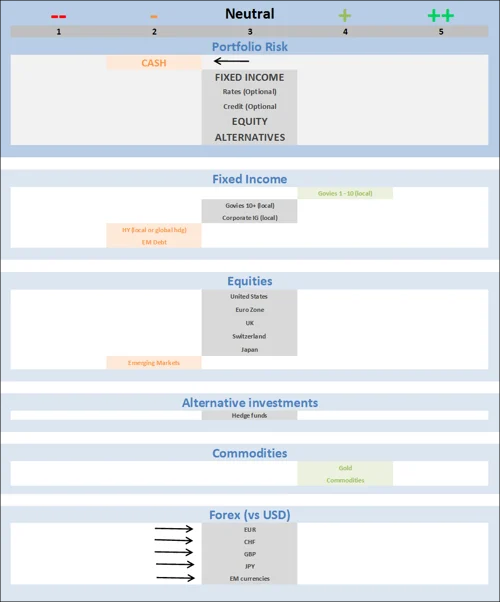

Moreover, the Fed is going to stay highly data-dependent and will calibrate accordingly. Overall, this is a rather positive scenario for risk assets. Still, equity market valuations are becoming rich, especially in developed markets. Consequently, we keep our neutral stance on equities. We are upgrading all currencies (EUR, CHF, CHF, JPY, EM currencies) back to neutral vs US Dollar (from Negative). Technicals have turned against the US dollar and the Fed has sent a clear signal about coming rate cuts.

In our H2 market outlook, we highlighted 5 key themes: 1) The normalization of global economic growth; 2) Labour market normalization; 3) Central banks kicking off the easing cycle; 4) The normalization of the equity market leadership, and 5) A pick-up in volatility.

Throughout the summer, several of these stories have taken center stage. We see tangible signs of a slowdown in the global economy, such as the positive momentum from the beginning of the year in Europe and China fading away, and the US economy gradually cooling down, although the risk of recession remains quite low. Still in the US, recent indicators show that the labor market is cooling off but remains supportive of robust consumption growth.

Regarding central banks, the expected global rate-cut cycle has started in Europe and will soon begin in the US. Rarely in recent history has a central banker (bank?) been as clear as during the last Jackson Hole Symposium: The Fed’s pivot is coming, i.e. the Federal Reserve will start to adjust its monetary policy as soon as September FOMC meeting.

The summer was also characterized by 2 market developments. First, a brief come-back of volatility. As mentioned in our August Asset Allocation Insight, global equities endured a technical correction in early August led by the unwinding of the yen carry trade and growth fears. While the spectacular spike in the VIX index (S&P 500 implied volatility) was very brief, it was a harsh reminder that market positioning is quite extended and that a market accident can take place at any time.

The other market development has been the early signs of a market-style and sector rotation. Indeed, the 2023 and H1 2024 market darlings – the US mega-caps tech stocks – are struggling to regain their all-time highs. Meanwhile, the equal weighted S&P 500 hits all-time highs. The trend thus remains positive while the participation is broadening, which is a positive development.

So where do we go from here? As explained in a recent FOCUS note, it is possible to find the good, the bad, and the ugly sides in the current fundamental and technical backdrop.

The Good

- Macro: There is no hard landing in sight and the disinflation trend remains in place

- Monetary policy & financial conditions (see below): Fed rate cuts are coming, and financial conditions (e.g. tight credit spreads) remain loose

- Earnings: Q2 earnings season was strong and share buybacks are becoming a tailwind again

- Technicals: the trend remains positive, market breadth is improving

- Cross-assets: Bonds are fulfilling their role (as portfolio diversifiers), lots of cash on the sideline

The Bad

- Macro: Recession risk remains, and the risk of a hard landing is most likely underappreciated by markets

- In the US, Q3 earnings forecasts are exhibiting negative revisions

- Technicals: we note that leadership is shifting to defensive

- Geopolitics: US election outcome remains very uncertain

The Ugly

- Geopolitics: The risk of a deterioration in the Middle Eastern situation and/or a worsening Russia-Ukraine conflict

- Macro: The risk of a French fiscal crisis

Asset Allocation Views

EQUITIES:

Regions, sectors, and styles

We remain neutral on equities on the backdrop of a resilient albeit still slowing growth environment and elevated valuation. From a regional perspective, we continue to favor US and European equities, as China continues to battle a weak internal demand and Japan's economic momentum remains soft.

From a sector/style perspective, we lean toward large/quality capitalization, with a reasonable valuation as some rotation is going on with investors expecting the easing cycle to start soon by the Fed. On the other hand, we don’t see yet conditions to increase exposure to smaller capitalizations and cyclicals, which would be early signs of a reacceleration of economic growth.

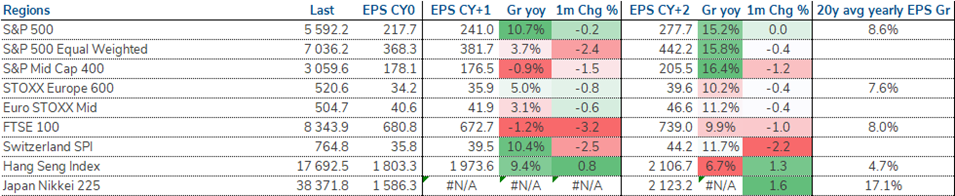

Earnings

The second-quarter earnings season is now behind us and was rather reassuring, with AI/technology and the high-end consumer in the US remaining resilient. Overall, guidance provided by corporations has confirmed the outlook for 2024 earnings, with negative revisions for cyclicals and smaller caps offset by positive revisions for mega caps.

Looking ahead, we speculate that the debate will center around: a) the pace of the earnings growth slowdown for large-cap tech, b) the sustainability of AI investment, and c) the realism of the sharp earnings acceleration.

Regarding the deceleration of earnings growth for large-cap tech, it is coming from a high base (+37% YoY in 2024) to still an attractive growth of >20% for 2025 that is above the market average.

On AI, more and more investors are questioning the future return on investment from the massive investments done by large technology companies. While the concern is valid, companies like Alphabet (NASDAQ:GOOGL) and Meta (NASDAQ:META) are already benefitting from AI-driven optimizations, and most recognize the need to keep investing to avoid falling behind competitors. Nvidia’s second-quarter results make us believe the investment cycle will likely continue into 2025. The next important milestone will be the capital expenditure (capex) guidance that large-cap tech companies, expected at the beginning of next year.

Regarding the third point, the sharp earning acceleration for the rest of the market is debatable to us. While there are some tailwinds such as lower inflationary pressure, a favourable base effect, and the prospect of lower interest rates, economic activity is not expected to accelerate meaningfully from here. Additionally, consensus earnings tend to be revised lower until the mid-year, so we should expect this negative revision process to unfold over the coming quarters for calendar 2025.

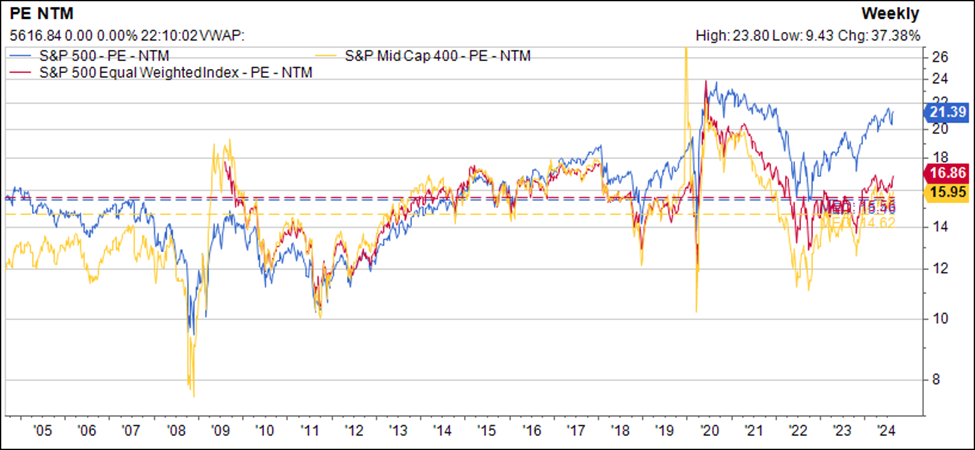

Valuations

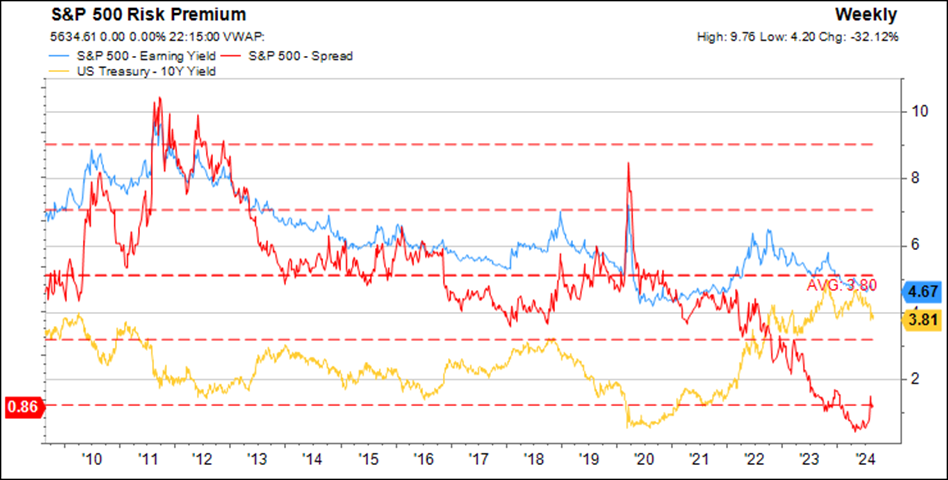

We are turning more cautious on valuation for equities as: a) the earnings slowdown in mega-caps is pressuring multiples, b) the economic activity continues to normalize (slow), c) earnings growth expectations in areas of the market such as mid/small-caps are high and should warrant lower valuation multiple in our view and d) the equity risk premium remains unattractive.

Overall, the US market remains expensive while the smaller spectrum of this market relies on optimistic earnings growth. This indicates investors should be more sensitive to valuation, and we have seen this occur over the recent weeks with richly valued stocks performing underperforming.

Additionally, looking across assets, the equity risk premium looks unattractive by historical standards.

Tactical Decisions With Asset Allocations

We started the year with an allocation to equities which was close to our Strategic Asset Allocation (SAA). Due to market effects, the allocation has been rising progressively to OVERWEIGHT throughout the first half of the year and we didn’t sell into strength.

However, during our July Tactical Asset Allocation Committee, we decided to rebalance portfolios towards a neutral allocation to equities, which means that we effectively reduced our exposure to equities in our clients’ portfolios. We did so by rebalancing our US equity exposure towards SAA neutral point (e.g. this implied a 2% reduction in balanced accounts).

Regarding Fixed Income, we also made some minor rebalancing moves within portfolios. For instance, in a balanced account we reduced the underweight of High Yield bonds, while staying slightly underweight vs our SAA across all 4 currencies (+1%). The two changes mentioned above resulted in a cash increase, typically by around +1% in balanced accounts.

As mentioned earlier, our stance on equities remains neutral but we expect market volatility to stay elevated for a while. We also note that the correlation between equities and bonds is turning negative, which improves the diversification characteristics of government bonds.

As such, the committee agreed to continue the move further toward neutral on the fixed income side, by moving the long end government bonds back to neutral while holding our equity allocation at neutral.

Matrix of preference moves (see below)

Cash to underweight (from neutral)

- The strong rebound of the main stock markets since the 5th of August has pushed the equity allocation to slightly overweight and lowered the cash allocation. As we are not rebalancing portfolios, we are downgrading the preference to cash from neutral to negative to represent the portfolio reality in our grids.

All currencies are back to neutral vs USD (from Negative)

- Technical indicators have turned against the US dollar, and the Fed has sent a clear signal about coming rate cuts. As a result, the Asset Allocation Committee agreed to remove the underweight position in all currencies against the US dollar.

Asset Allocation Grid