For decades interest rates have continually gravitated to zero like flies attracted to stink. For a split second in 2013, as long-term U.S. Treasury rates about doubled from 1.5% to 3.0% before reversing, it appeared the declining rate cycle could finally be broken. At the time, pundits of all types were calling for the “great rotation” out of bonds into stocks.

Half of this forecast came to fruition as stocks grinded to record highs in 2014, but even I the big stock bull admittedly did not expect interest rates on 10-Year Switzerland bonds to turn negative (see also Draghi QE Beer Goggles), especially after U.S. quantitative easing (QE) came to an end.

With rates already at a generational low, how could anyone be expected to accept a measly 0.3% annual return for a whole decade? Well, that’s exactly what’s happening in massive developed markets like Germany and Japan. While investors and retirees are painted into a corner by being forced to accept near-0% interest payments, savvy corporate borrowers are taking advantage of this once in a lifetime opportunity. Take for example the recently unprecedented $1.35 billion Switzerland bond issuance by Apple . (NASDAQ:AAPL), which included a tranche of bonds maturing in 2024 that yielded a paltry 0.25%.

In the U.S., the average S&P 500 stock is yielding approximately the same as the 10-Year Treasury Note (2.0%), but in other parts of the world, equity markets such as the following are offering significantly higher yields:

- iShares MSCI Australia (Yield 5.0% – EWA)

- Europe FTSE Europe (Yield: 4.6% – VGK)

- Market Vectors Russia (Yield 4.6% – RSX)

- iShares MSCI Brazil (Yield 4.0% – EWZ)

- iShares MSCI Sweden (Yield 3.8% – EWD)

- iShares MSCI Malaysia (Yield 3.8% – EWM)

- iShares MSCI Singapore (Yield 3.4% – EWS)

- iShares China (Yield 2.5% – FXI)

A New “Great Rotation” in 2015?

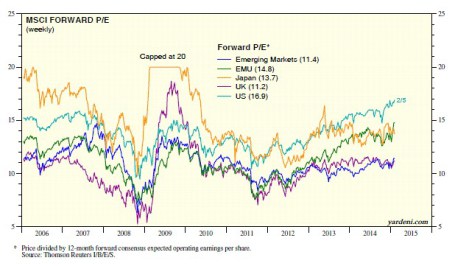

If you look at the 2014 ICI (Investment Company Institute) fund flow data, it becomes clear the great rotation out of bonds into U.S. stocks has not occurred. More specifically, despite the S&P 500 index reaching new record highs, -$60 billion flowed out of U.S. stock funds last year, and about +$44 billion flowed into all bond funds. Could the “great rotation” out of bonds into stocks finally happen in 2015? Certainly, this scenario is a possibility, but given the barren bond yield environment, perhaps the new “great rotation” in 2015 will be out of domestic equities into higher yielding international equity markets. In addition to the higher international market yields listed above, many of these foreign markets are priced more attractively (i.e., lower Price-Earnings (P/E) ratios) as you can see from the chart below created by strategist Dr. Ed Yardeni.

(Source: Ed Yardeni – Dr. Ed’s Blog)

Obviously, any asset shifting scenario is not mutually exclusive, and there could be a combination of investor reallocations made in 2015. It’s possible that previously unloved emerging markets and international developed markets could receive new investor capital from several areas.

With defensive sectors like utilities (up +25%) and healthcare (up +24%) leading the U.S. sector higher last year, it’s evident to me that “skepticism” remains the operative word in investors’ minds and there is no clear evidence of widespread euphoria hitting the U.S. stock market.

Valuations as measured by trailing P/E ratios have objectively moved above historical averages, however this has occurred within the context of all-time record low interest rates and inflation. If you take into account the near-0% interest rate environment into your calculus, current stock prices (P/E ratios) are well within historical norms (see also The Rule of 20 Can Make You Plenty), which still leaves room for expansion.

If some of the half-glass full economic waters spill into the half-glass empty emerging markets/international markets, conceivably the eagerly anticipated “great rotation” out of bonds into U.S. stocks may also flow into even more attractively valued foreign equity opportunities.

Disclaimer: Sidoxia Capital Management (SCM) and some of its clients hold positions in AAPL and certain exchange traded funds (ETFs) including VGK, EWZ, FXI, but at the time of publishing SCM had no direct position in EWA, RSX, EWD, EWM, EWS, and any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision.