In anticipation of the previous $2-tillion stimulus package that passed on March 27 and in its aftermath, stocks rallied, yet it wasn’t a one-way road. They had trouble overcoming the pre-stimulus highs, and actually sold off in the following week.

Today’s Fed announcement contained a $2.3-trillion loan package to support the economy. While stocks didn’t sell off in its immediate aftermath, they haven’t rallied profoundly in the run-up to further stimulus either.

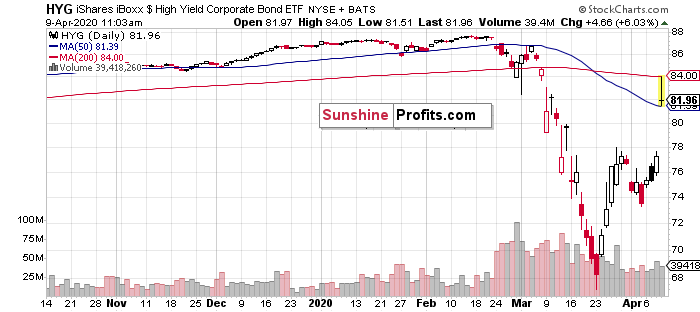

High-yield corporate debt (HYG) predictably rallied in response to the real economy support with loans, but the bulls are having issues adding to their opening gains. That’s a shooting star, a bearish candle.

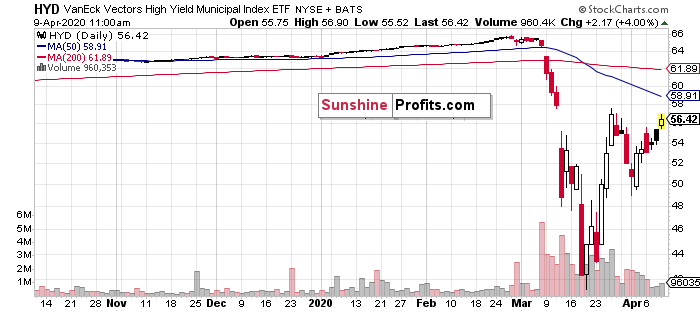

The already-supported municipal bonds haven’t overcome their late-March highs after this breaking news. Selling into strength is clearly visible here as well.

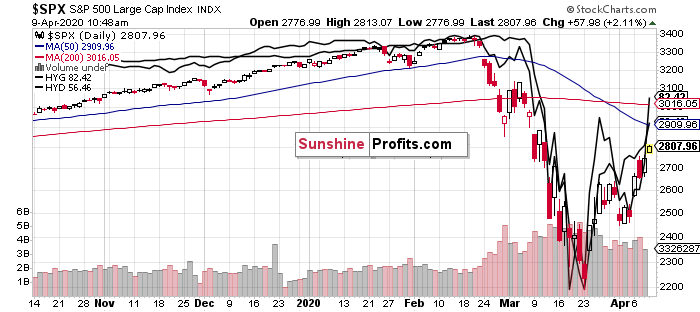

Finally, let’s see the intraday S&P 500 chart overlaid with these two debt markets.

While all three moved in unison higher, there appears to be less bang for a buck in this stimulus measure than in the preceding one. Should the credit markets lead higher and drag stocks along, that would be a game changer.

But the S&P 500 is currently trading sideways around 2785, and may very well sell off in the coming days similarly to the earlier fiscal stimulus aftermath.