My posts sometimes reflect the kind of hand-wringing, what-could-go-wrong mindset that is so endemic to my troubled soul. This time, I’d like to be an optimistic pessimist and speculate on what could go right with the bear case in the short and medium-term.

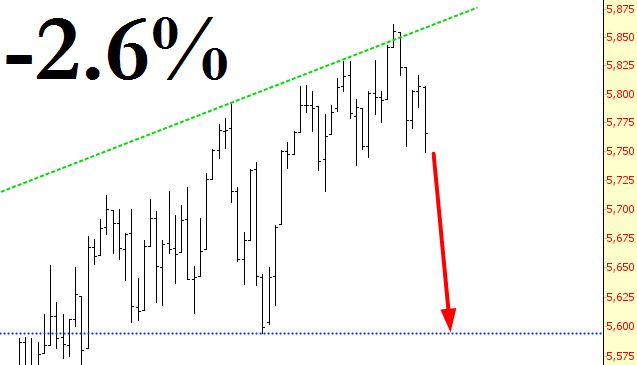

The market will be smellin’ Yellen on Wednesday, and between that and the Fed minutes, that could jostle things (to say nothing of the various and sundry geopolitical tensions simmering all around the world.) Looking at the Dow Composite, a drop to the lows we saw earlier this Spring seems altogether feasible, if not likely:

A very similar drop could be had with the Dow 30, sending it to the Big Round Number zone:

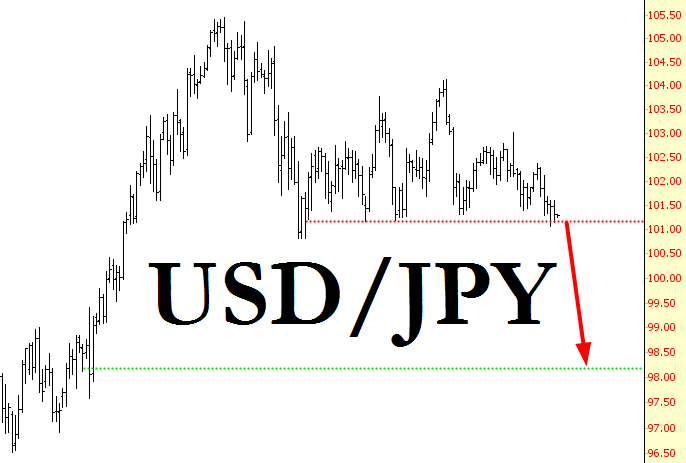

The real key, and the chart about which I’ve been drumming my fingers lately, is the US dollar/Japanes yen cross-rate. As I am mentioning with increasing frequency, a clean break through the line shown below would be just what the doctor ordered:

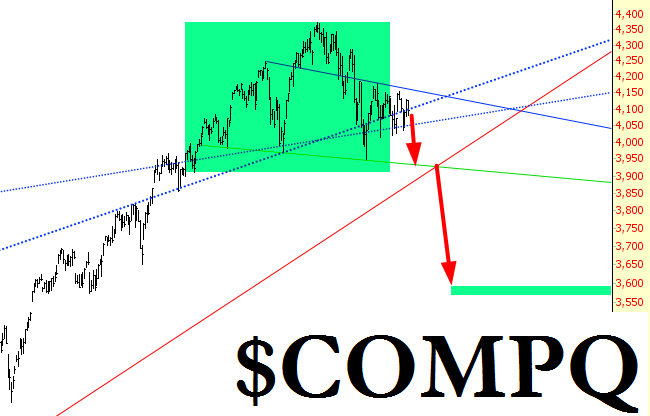

Given such a fall, it could set into motion a chain of market events that could get us to what would probably be the lowest levels we’ll enjoy in 2014, NASDAQ included, before the nimrods in D.C. come stumbling to the rescue again:

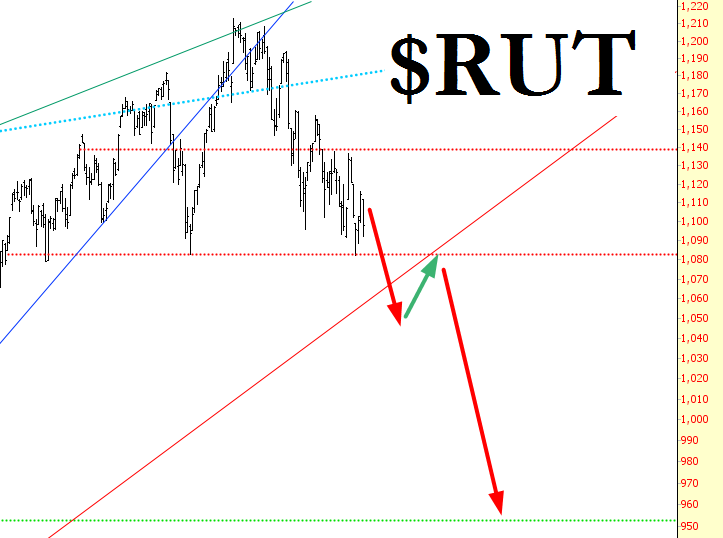

And, in turn………for the Russell 2000...

As exciting as these prospects are, I am taking things a tick at a time. Last Monday, I was utterly dejected. This Monday (that is, two days ago), I was similarly dejected. But, bit by bit, the breadth of the market is worsening, and things are falling apart. I have never had so many short positions in my entire life as I do right now. Put me in the front seat, baby, right where I belong: