In general, I am not in favor of reaching for yield as the practice can entail a high degree of risk that income oriented investors cannot tolerate. I do understand, however, the dilemma facing such investors who need a regular stream of income.

For those who are forced into stretching for yield, buying emerging market bonds may mitigate some of the risks involved.

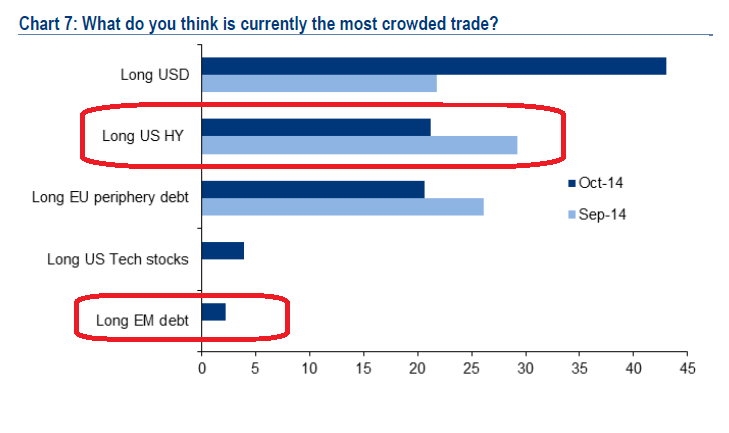

HY bonds: A crowded long compared to EM bonds

The latest BoAML Fund Manager Survey shows that many managers believe that US high yield, or junk bonds, are getting to be a crowded long. On the other hand, emerging market bonds, which carry similar levels of risk, are not. So if you're going to take extra risk and reach for yield, EM bonds may be a better alternative than US HY.

Falling USD = EM currency bullish

Moreover, the survey indicates that the US dollar is a crowded long whose price seems to be in the process of reversing itself (see my recent posts Overbought USD = Commodities poised to rally? and Get ready for the resource rally). The chart below of the weekly USD Index finally moved off its overbought RSI reading, which historically has signaled a decline. Such a decline should be bullish for EM currencies.

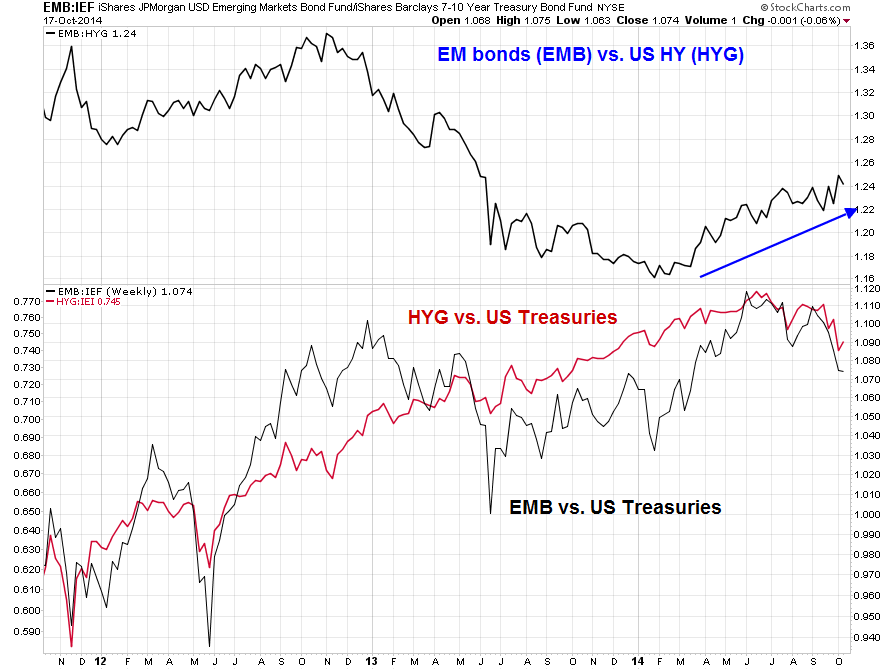

EM vs. HY bond relative returns

The top panel of the chart below shows the relative performance of iShares JP Morgan Emerging Market Bond Fund (NYSE:EMB), the EM bond ETF, against the iShares H/Y Corporate Bond (ARCA:HYG), the US HY bond ETF.

However, the duration of the EMB and HYG are different and buying one and selling the other involves an interest rate sensitivity bet as well as a bet on the relative credit quality as well as a bet on the USD (see my post Returning to high school, investment style for an explanation of duration).

Investors who want to keep a risk-adjusted yield maximization strategy simple can just buy EMB. A more sophisticated strategy might be to buy EMB and short HYG, but that would involve taking on interest rate risk. An interest rate neutral strategy would be to buy long EMB/short iShares Barclays 7-10 Year Treasury Bond (ARCA:IEF) pair and then short the HYG/IEI pair (long EMB, IEI, short HYG, IEF).

In any case, investors should be advised that reaching for yield can be highly speculative and these strategies are on the higher risk end of the investment spectrum. Nevertheless, I believe that, on a risk-adjusted basis, EM bonds might be a better way of reaching for yield in the current environment for those who can accept the risks involved.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.