Investment manager Jane Hwangbo wrote a terrific first post about what it's like to become an accomplished investment manager (emphasis added):

One of the strongest behavioral tendencies we possess as human beings, no matter what line of work we choose for ourselves, is that we never really want to leave high school. Let me explain: We would rather not go through the emotional pain again of being a freshman in a senior-dominated world. We like the feeling, once we have made it, of being one of the cool kids, and will actively promote it and behave in such a way that reassures that we never “start over”. In the world that I live in, managing people’s money and investing it in assets, there are many sets of cool kids – the bond managers, the equity managers, the currency kings, and so on. I have a strong professional history in equities (stocks), while others have a strong background in bonds (fixed income), currencies (e.g. US dollars vs. Japanese yen), or commodities (bets on future price swings of things like oil, natural gas, or corn).

As a general onlooker, you would think that as a particular fund manager grows more and more accomplished in a major field of the markets, say equities in my case, one would also become an expert on all things markets-related, like bonds and currencies and commodities as they are all connected to each other. However, the opposite really happens, because most of us never want to feel like a freshman again. It’s painful to start at ground zero, knowing nothing, how things move, and why they move the way they do. One must ask dumb-sounding questions to get going in accumulating a fresh knowledge base, and when you’re a highly respected specialist in the field you have mastered, this is a huge psychological barrier to becoming fluent in other asset classes. The equity managers I know have a very shallow understanding of how bonds trade, and most bond managers do not pay more attention to equities than noting the performance of the SP 500. These managers are very smart people, by any measure. This condition goes beyond asset managers – I have rarely met “in real life” an accomplished economist who can invest with great success. There are very few. The opposite applies to managers in markets – they are typically terrible economists.

Like Ms Hwangbo, my specialty is equities. However, as the saying goes, I know enough of other languages (bonds, derivatives) to get my face slapped.

A risk appetite warning gone wrong

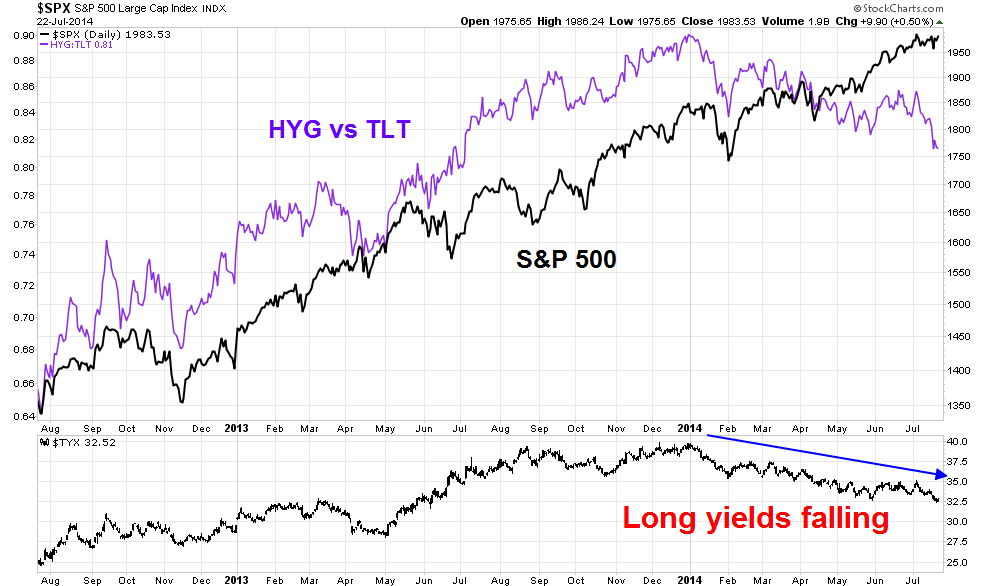

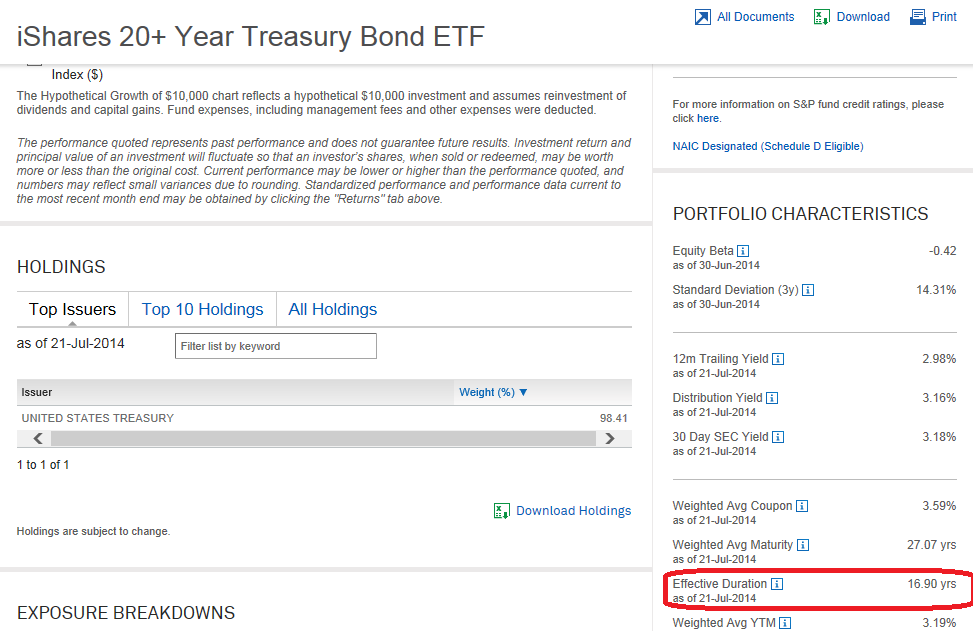

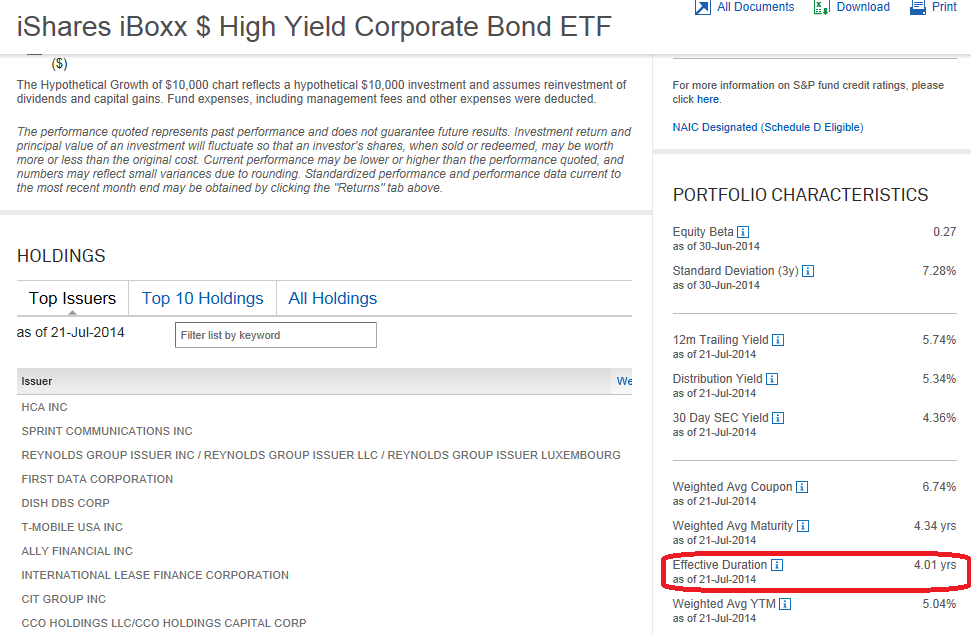

So it has been with some disappointment that I have recently seen analysis by accomplished equity specialists making erroneous conclusions about risk appetite and making conclusions about the stock market. One of many examples is to compare the relative performance of the junk bond ETF (iShares H/Y Corporate Bond (ARCA:HYG)) to the long Treasury ETF (iShares Barclays 20+ Year Treasury (ARCA:TLT)). As the chart below shows, the HYG-TLT ratio (in purple) started to roll over in January, while the stock market (in black) continued to advance. This analysis suggests a negative divergence that represents a warning of declining risk appetite.

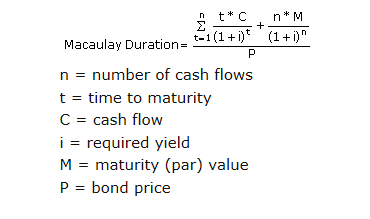

Nothing could be further from the truth. The HYG-TLT ratio is a relative price performance chart. As good bond investors know, price performance of a bond portfolio comes from principally two factors:

- Interest rate sensitivity (duration)

- Changes in credit spreads

- The longer the duration, the more sensitive the price is to changes in interest rates

- For bonds with equal coupons, a longer maturity bond will have a longer duration

- For bonds with equal maturities, a lower coupon bond will have a longer duration

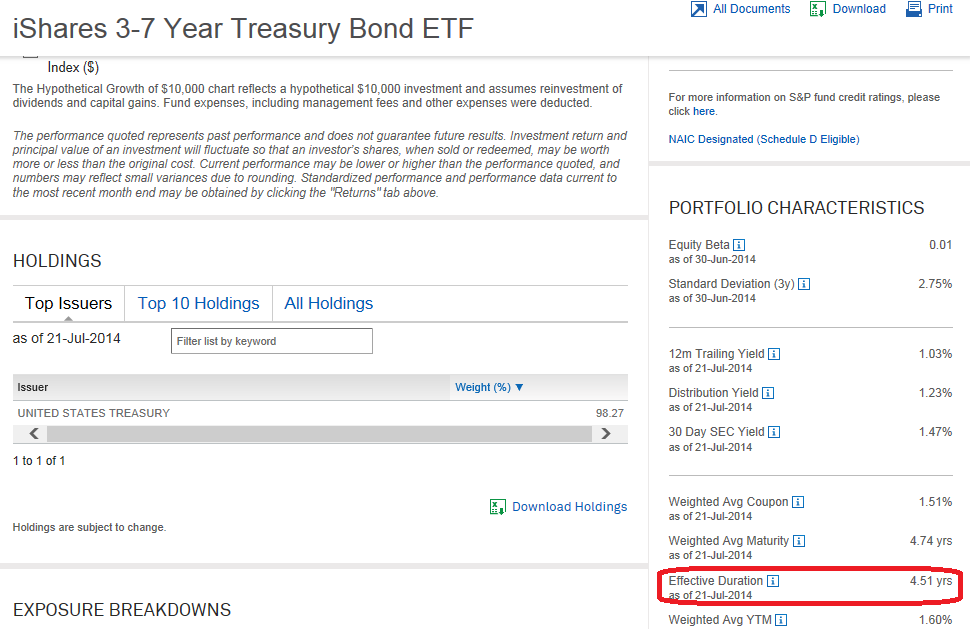

A better Treasury comparison for HYG would be iShares Barclays 3-7 Year Treasury Bond (ARCA:IEI), the 3-7 year Treasury ETF, with a duration of 4.5 years:

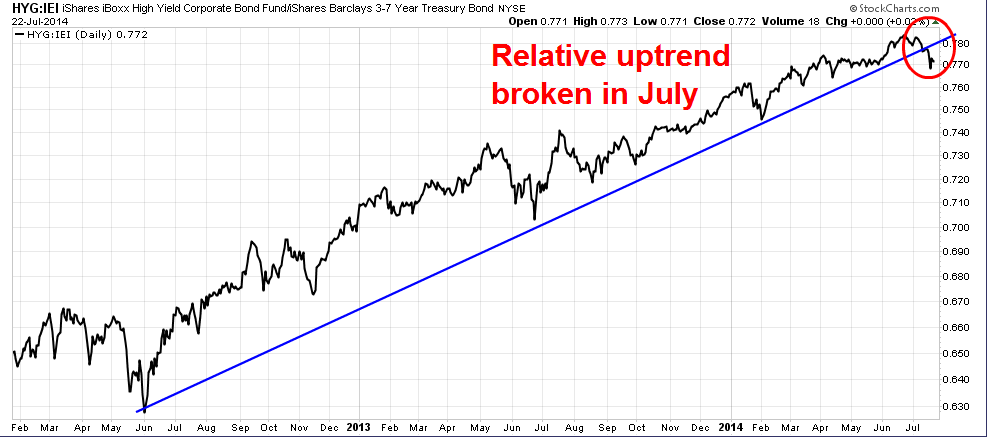

Better measures of risk appetite in bonds

With that analysis in mind, here is the HYG-IEI ratio as a better measure of risk appetite as duration risk between the two ETFs have been minimized. The relative uptrend of HYG to IEI was broken and turned down only this month, not in January as the HYG-TLT ratio showed. This broken relative uptrend represents an early warning of declining risk appetite that needs to be watched and confirmed by other indicators. The downturn in the HYG-TLT ratio was a false alarm.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.