- The stock market is reaching new highs as the S&P 500 exceeds 5,700 points.

- While tech stocks shine, healthcare is emerging as a key sector this earnings season.

- Promising revenue growth positions healthcare stocks as unique opportunities for investors.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

As we approach the Q3 earnings season, the stock market is soaring to new all-time highs.

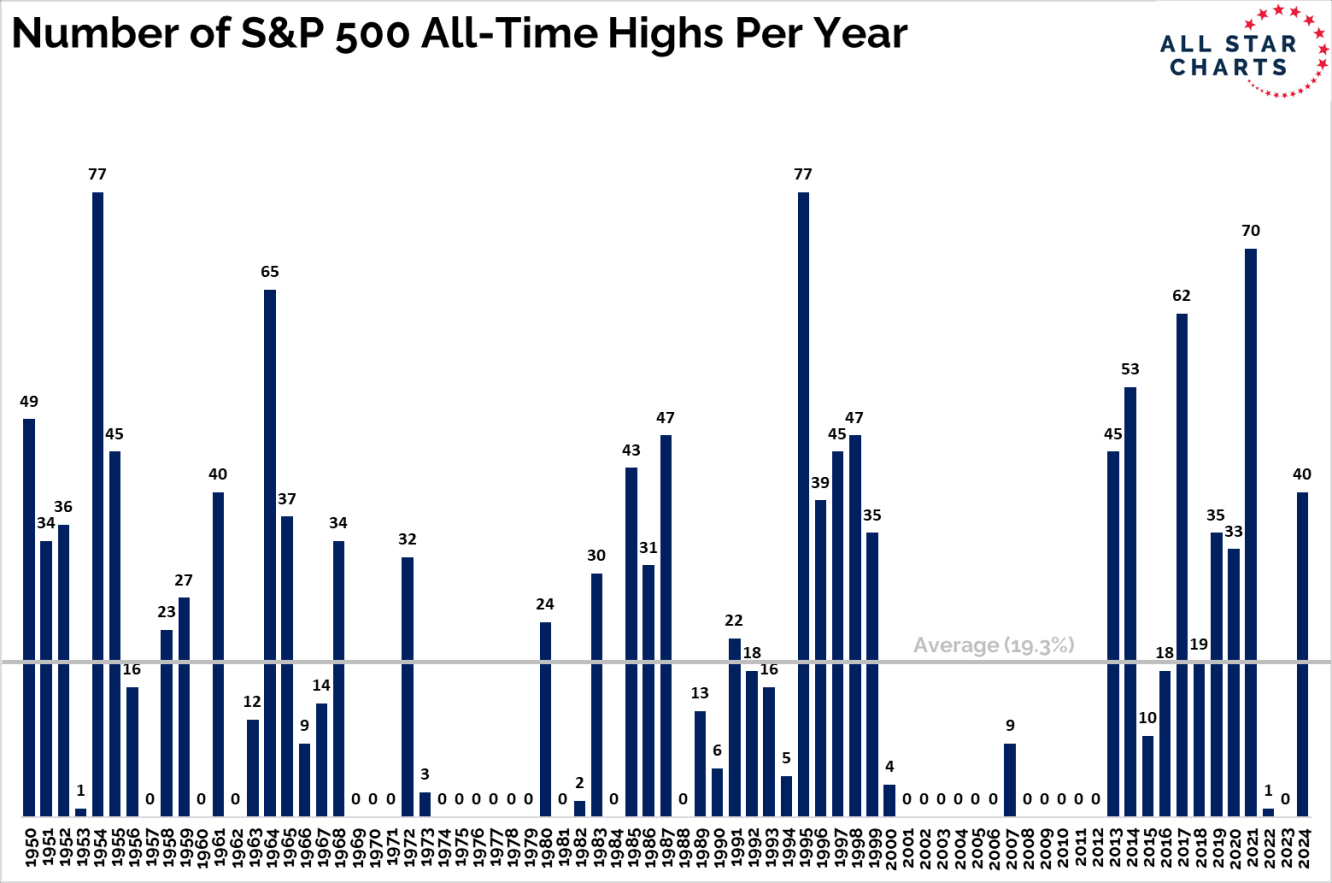

This year alone, we've recorded more than 40 new highs for the S&P 500, representing 22.3% of total trading days, which means we’ve set a new record more than once every five trading days.

Not too shabby, especially with the S&P 500 surging above 5,700 points today. By the end of the year, we'll see how well analysts and strategists from the big banks have fared against their January forecasts.

Investors are once again focusing their attention on the technology sector (NYSE:XLK), with the Magnificent Seven leading the charge.

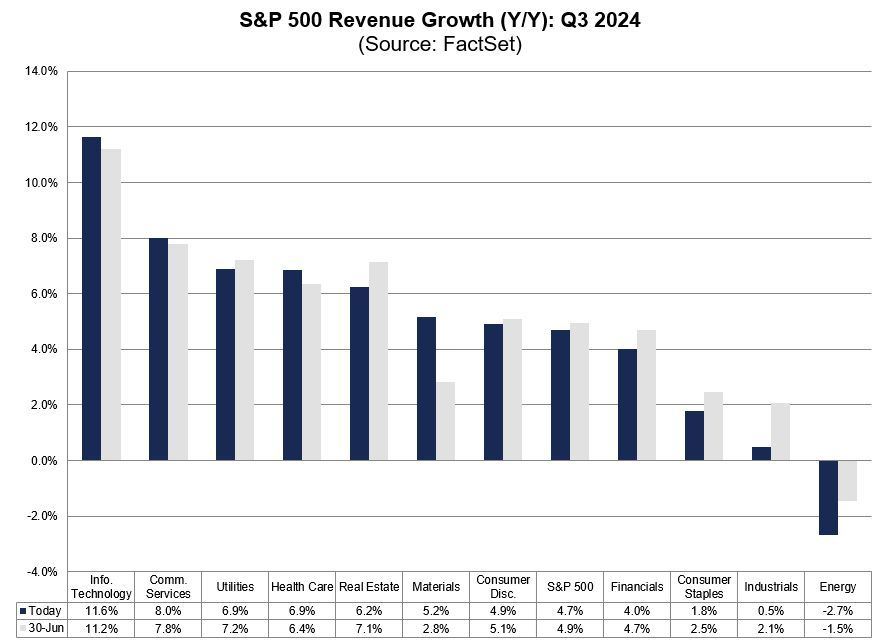

While we expect positive results overall, one sector has me particularly intrigued this earnings season: Healthcare (NYSE:XLV).

Healthcare Stocks Set to Outperform?

Current estimates not only show promising revenue growth, but Healthcare also boasts the highest positive revisions since June 30, up by 0.5%—even more than tech.

Consider this: since the post-COVID period, many pharmaceutical companies have faced significant declines, creating a unique opportunity:

- Valuations are in line with historical averages.

- Sentiment remains neutral to negative.

These two conditions open the door for interesting strategies. Think about what happened with China and PayPal (NASDAQ:PYPL), two examples I've frequently discussed. They were once overlooked but now draw significant interest.

When it comes to strategy, you have options. If you prefer broad exposure to the sector, consider using low-cost ETFs and various strategies like fractional entries or dollar-cost averaging while monitoring the sector's strength through rotational or relative strength strategies.

On the other hand, if you want to dive into stock picking, look for companies with stronger turnaround potential. Focus on those with recovering balance sheets, attractive valuations, and constructive chart patterns, especially as you assess their latest quarterly results.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.