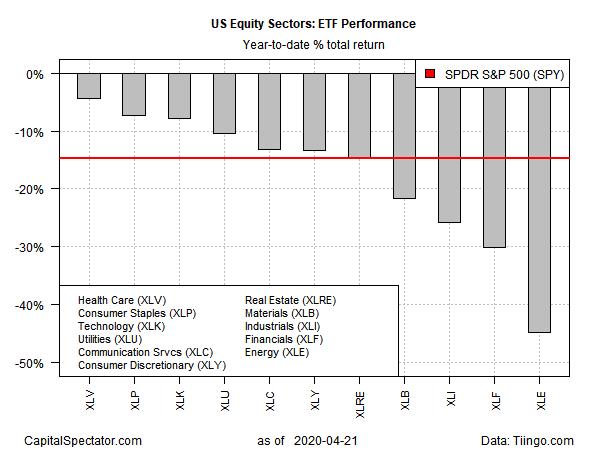

Every sector of the U.S. stock market has lost ground so far in 2020, but the dispersion of results is wide and health care shares have lost considerably less than the rest of the field, based on a set of exchange-traded funds.

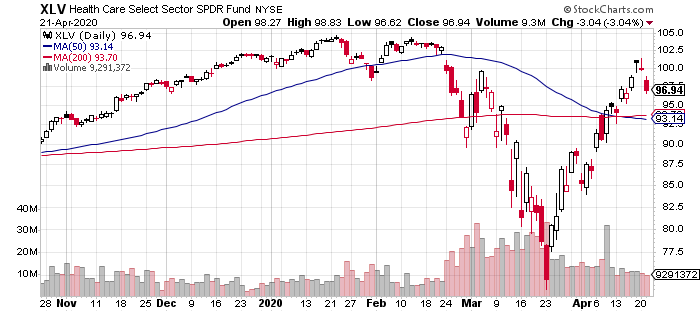

Health Care Select Sector SPDR (NYSE:XLV) has shed a relatively mild 4.3% so far this year through yesterday’s close (Apr. 21). That’s a rounding error compared to the deepest sector declines in 2020.

Part of the reason – perhaps the key reason – for health care’s durability: expectations that several of the companies in this corner will benefit from the coronavirus blowback by rolling out (eventually) vaccines and treatments.

Upbeat earnings reports of late are another factor. Johnson & Johnson (NYSE:JNJ) “got the earnings season off to a good start,” observed Bill Baruch, president and founder of Blue Line Capital, last week.

Consumer staples and technology are a close second- and third-place winners, respectively, this year in terms of comparatively soft setbacks. Consumer Staples Select Sector (NYSE:XLP) is off 7.3% year to date and Technology Select Sector SPDR (NYSE:XLK) is down only slightly more with a 7.7% decline.

By comparison, the market overall has shed 14.7% year to date, based on SPDR S&P 500 (NYSE:SPY). But even that cut looks mild next to the biggest sector losses in 2020. Indeed, Energy Select Sector SPDR (XLE (NYSE:XLE)) has collapsed 44.9%, the worst performer of the lot.

The critical factor: oil prices have suffered a dramatic collapse. The combination of excess supply and sharply lower global demand due to the coronavirus fallout has hit the energy sector hard. “There’s a lot of oil and no real place to put it right now, so no one wants to take delivery of it,” notes Randy Giveans, an analyst at Jefferies.

By some accounts, the deep slide in energy stocks represents opportunity. “If you’re a value investor, this is actually the kind of scenario you actually want,” says Boris Schlossberg, managing director of FX strategy at BK Asset Management. “Energy was 70% of the S&P at the height when oil was around $100 a barrel. Now it’s only 3% of the S&P. It’s a perfect mean reversion trade,” he opines.

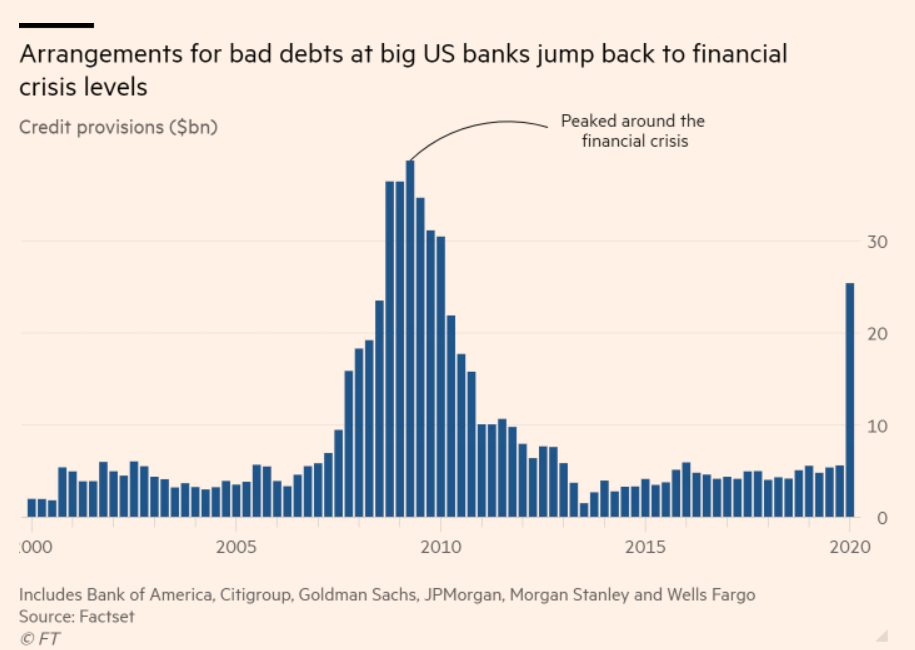

Another hard-hit sector this year: financials. Financial Select Sector SPDR (NYSE:XLF)is the second-worst performer year to date via a 30.2% decline.

Driving the negative sentiment: dark expectations for loan losses. As the FT noted a few days ago, the banking industry is facing “an expected surge in loan losses as the pandemic casts serious doubts over the capacity of consumers and companies to pay their debt.”

Mr. Market is pricing in the risk in the usual way: dispensing price haircuts that err on the side of caution by assuming the worst.