Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

The Health Care Select Sector SPDR ETF (NYSE:XLV) has lagged the S&P 500 (NYSE:SPY) for the past few years. Is that trend about to end? It sure could and we should find out very soon.

The above chart looks at the Health Care/S&P Ratio (XLV/SPY), which shows that it has created a series of lower highs and lower lows inside of falling channel (1). Over the past 6 months, the ratio has seen a series of higher lows, reflecting out-performance of XLV relative to the broader markets.

The ratio is testing a support/resistance line at (2). If the ratio breaks out at (2), it would suggest that health-care stocks will continue to outperform the broad markets.

Are any stocks in the health-care field creating a bullish pattern? Absolutely.

Merck

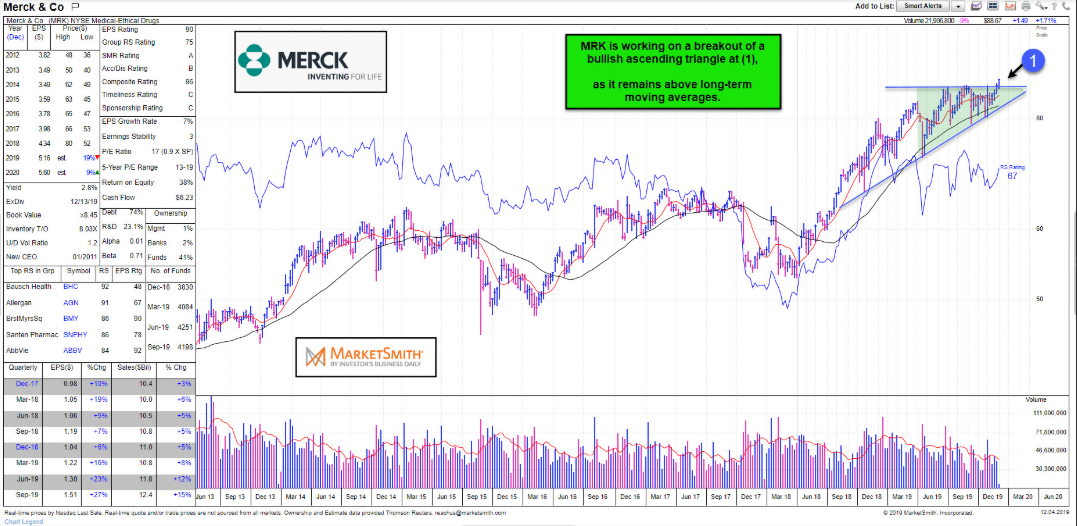

The trend for Merck & Company (NYSE:MRK) remains up. The company has, over the past few months, been looking to create a bullish ascending triangle. Two-thirds of the time, this pattern leads to higher price.

Merck is attempting a bullish breakout at (1). If successful, expect it to do very well in the weeks to come.