S&P 500 Futures: Headline News Algos Win Again

The ES popped up to 2967.00 on Globex after the headline about the U.S. and China setting up new tariff talks for October. The first print of the 8:30 CT futures open 2966.50, down ticked and then the ES went right into a big buy program that pushed the futures all the way up to 2986.75, up 20 handles at 9:20 am CT. After the high, the ES ‘stutter stepped’ down to 2973.50 at 11:23 am. After the low, the ES rallied back up to 2978.50 and then sold back off to a new afternoon low at 2972.00, 1 handle above the vwap.

After 2:00 the ES was trading 2981.00 and dropped 10 handles down to 2971.90 as the MiM started to show 1.2B to sell. At 2:45 the ES traded 2976.50 as the cash imbalance showed 1.1 billion to sell. On the 3:00 pm cash close the ES traded 2973.75, a sell off in line with the large sell imbalance, from 2:34 high of 2981. A 7 handle short opportunity. ES and settled at 2972 on the 3:15 futures close.

In the end it was all about the headline news. In terms of the ESs overall tone, the markets remain firm. In terms of the days overall volume, 1.6 million futures traded which is on par for what we call “Crazy Thursday”.

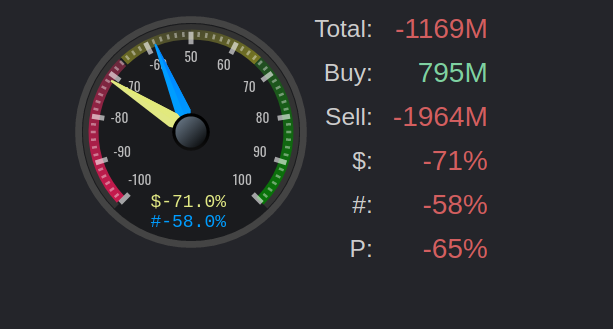

(MiM) MrTopStep Meter:

The MiM reveal at 3:50pm ET, when the MOC orders become real, was about 1.2B to the sell side. A pretty strong bias in both symbols and dollars committed sent the ES futures down about 8 points from that 3:30pm ET high to the close.

Jobs Friday Meets The Week One Options Expo

Our View:

This week has been packed with economic reports and today is the jobs number. Many think the August jobs number may come in lower than expected due to an end of the summer lull and the ongoing trade wars. The non-farm is expected to be 158,000 jobs, down from July’s 164,000 but still above the 140,000 three-month average. The unemployment rate is expected to remain steady at 3.7% and under 4% for the last 17 months.

Our view, the ES rallied above 2980 late in the day and sold off x handles going into the close to close at a six dollar discount to the S&P 500 cash. One has to wonder if the selling was some type of jobs Friday front run. Our lean is for lower prices early and a rally. I do not think all the shorts have covered yet.

Today’s Economic Calendar:

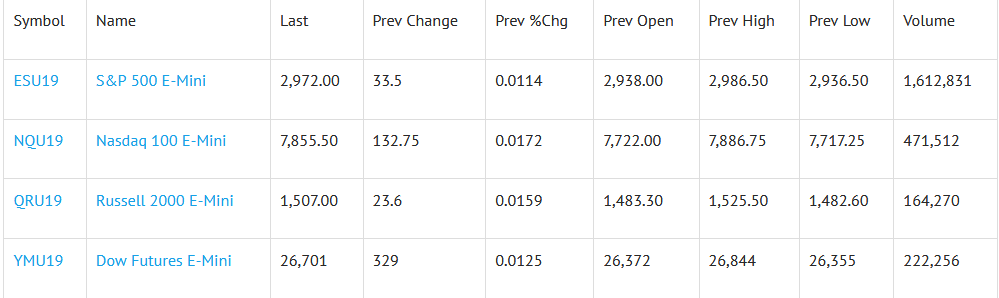

Index Futures Net Changes and Settlements:

Future Fair Values: