Headline Havoc

“Hedge Funds Decline in June as Uncertainty Rises” – HFR, Inc.

“Hedge Funds Outperform S&P 500” – FIN alternatives

“Hedge Funds Severely Underperforming This Year” – The Wall Street Journal

“Hedge Funds Trail Stocks by the Widest Margin Since 2005” – Bloomberg

These are but a small sample of headlines we’ve seen over the last couple of years informing investors about the performance of hedge funds. It strikes us as odd that even publications dedicated to alternative investments fall into this trap of comparing “hedge funds” to the stock market. Of what value is it to compare the collective performance of an amorphous group of strategies—ranging from distressed debt to emerging markets to convertible arbitrage to fixed income arbitrage to discretionary commodity trading, and so forth—to U.S. equities?

Answer: none.

There is absolutely no value in making such an observation. We don’t compare “mutual funds” as a group to the S&P 500, and with good reason, as there are approximately 8,050 distinct funds, spread across 113 categories, covering virtually all asset classes, according to Morningstar.

Why do we care? We care because these comparisons set incorrect expectations for investors. Most alternative strategies attempt to generate unique sources of alpha; they try to manufacture returns with low correlations to traditional asset classes and with less volatility; they aim to provide downside protection when markets take a turn for the worse. Few alternative strategies explicitly attempt to outperform the S&P 500 outright.

We’ve observed that investors think in relative terms when equities are rising and in absolute terms when equities are falling, which is a bar that is all but impossible to reach, let alone exceed. If collectively our job is to help educate investors, step one is to convey information that properly establishes expectations.

The Data

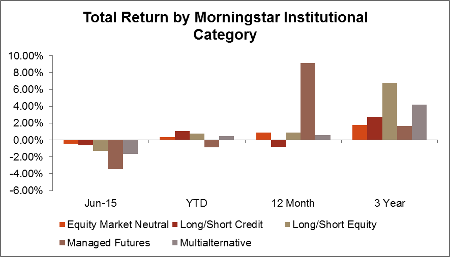

Data as of June 30, 2015

All major alternative categories posted negative returns during the month of June. Managed Futures took the brunt, though it still has the best 12 month return of just over 9%. With equity markets taking a hit during June, it is no surprise that Long/Short Equity funds were down, losing roughly 1.3%. But importantly, these strategies did protect capital, capturing only 56% of the decline experienced by the MSCI All Country World FX Hedge Index. The Long/Short Equity category remains slightly positive for 2015 and the trailing 12 months, earning just under 1% for both timeframes.

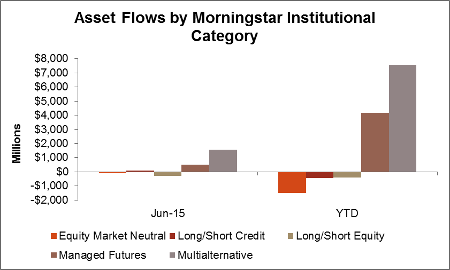

Data as of June 30, 2015

Multialternative and Managed Futures funds continued to drive the majority of flows in alternative mutual funds for the month, raising $1.6 and $0.5 billion, respectively. The other major categories had relatively flat flows during June and remain negative for the year. However, outflows for Long/Short Equity and Market Neutral have been dominated by relatively few funds. All said, the first half of 2015 has been a relatively slow year for asset-raising within alternative mutual fund categories.

Citi Sees Growth Ahead for Liquid Alternatives

Despite the above mentioned ebb in asset raising thus far in 2015, a recent Citigroup Survey showed that liquid alternative AUM could more than double in the next five years, while they see the overall “alternative” universe (including liquid alternatives) increasing by about 50%. This will lead to liquid offerings making up 15% of the total alternative universe, up from 10% at the end of 2014. The report is filled with more interesting data points and observations, definitely worth finding the time to read through.

Language Matters…

Some very interesting results from a recent Invesco study regarding language used when discussing “alternative investments”:

- According to the The Power of Alternatives, a new, year-long study from Invesco and Maslansky + Partners, a research-driven language strategy firm, nearly eight in ten investors (77%) would rather invest in, “alternative mutual funds that are bought and sold like any other fund” than, “liquid alternatives” (23%).

- When asked which phrase best describes an investment that does not rise and fall with the markets, just 18% selected the often-used phrase, “non-correlated” while the majority (59%) preferred, “behaves independently”; and

- Almost two-thirds (64%) of investors would rather invest in, “funds that focus on more consistent returns,” while 25% preferred, “equity funds that give up a little on the upside to get more protection on the downside,” and just 11% selected the industry label, “long-short equity funds.”

Hedge Funds In The News

The Next Big Short

The Wall Street Journal recently featured an informative article highlighting the risks associated with the proliferation of junk bonds and bank loans held by many retail friendly funds. They astutely point out that many hedge funds are looking for ways to profit from what many believe is the inevitable panic that will ensue in these instruments during the next market downturn.

The hedge funds are taking aim at what is regarded by many on Wall Street as a weak spot in the markets. “Liquid alternative” funds have emerged as one of the hottest products in finance, fueled by a promise to deliver hedge-fund-style investing to the masses. They use many of the same strategies as hedge funds, with wagers both on and against markets, but are open to less-wealthy investors with fees closer to mutual-fund standards.

What we find interesting is the shot at “liquid alternatives” that they meld into the story, when in fact it is much more “traditional” funds and fund structures that tend to hold these potentially toxic assets. We do agree, however, that the liquidity mismatch in many high yield bond and bank loan funds may make for some interesting opportunities in the future; we just fail to see what this has to do with liquid alternatives.

Hedge Fund Replication Made Simple(r)

Is it really this easy?

Mr. Edwards said his simple replication strategy invested half in U.S. bonds, via the S&P U.S. Aggregate Bond index, and half in stocks, via the S&P Global 1200 index. If the fund is rebalanced every month, and after allowing for a management fee of 1.5% a year and a performance fee of 15%, then its performance starts to look pretty similar to the HFRI Fund Weighted Composite Index of hedge fund performance. Even monthly swings in performance both up and down are mirrored in the replicator.

We’ve done a lot of research in this area and have come to roughly the same conclusion, replicating the entire hedge fund universe is just about as simple as having a 50% equity/50% bond portfolio. The key quote from the article is “The average hedge fund looks like a fixed blend of cheap investments, at high cost.” Here’s the problem, do investors really want the “average” hedge fund return? If so, then they clearly should just go buy a couple of ETFs and be done. However, an investor in alternative strategies is typically looking for more than the “average” hedge fund return; they want (or at least should want) some form of uncorrelated alpha, which this 50/50 portfolio will fail to deliver.

Education

Why Your Best Long Term Strategy Might Be Short Term

The folks at RCM/Attain Capital wrote an interesting piece regarding short-term trading strategies within the Managed Futures category. For anyone who knows 361 Capital, you know we couldn’t resist referencing lines such as “one man’s noise is another’s treasure.” We would highly recommend reading to learn about non trend-following strategies within the managed futures space.

And Lastly…

The end of an era.

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, 361 Capital is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of 361 Capital.