Into the Heart of Q3 Earning Season

The Finance sector gave us a decent start to the Q3 earnings season, with improved investment banking revenues (both trading as well as advisory services) helping offset some of the challenges in the core business. There weren’t many surprises on the net interest margin, mortgage lending and loan growth fronts – these have been weak spots for a while and we saw more of the same in Q3 as well.

What came as a pleasant surprise were signs of modest improvement in advisory and trading revenues, with the latter benefiting from the increased market volatility towards the end of the quarter. This has raised hopes that the steady decline in trading volumes and revenues over the last few years isn’t reflective of an enduring shift in the industry’s dynamics as a result of regulatory changes, but rather a function of the extremely subdued levels of market volatility. Given the extreme volatility in the current period, it will be interesting to see if Q4 trading results will show a similar improving trend.

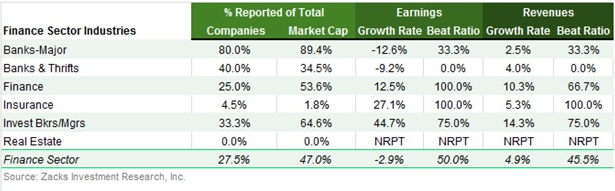

Total earnings for the 22 Finance sector companies that have reported results already (out of 80 total in the S&P 500 index) are down -2.9% on +4.9% higher revenues, with a weak 50% beating earnings estimates and 45.5% coming ahead of top-line expectations. Please note that these 22 Finance sector companies combined account for 47% of the sector’s total market capitalization and include all of the major banks and brokers.

The table below gives the sector’s scorecard at the constituent industry level. As you can see, the earnings season is quite further along for the two major industries in the sector – Major Banks and Investment Brokers/Managers.

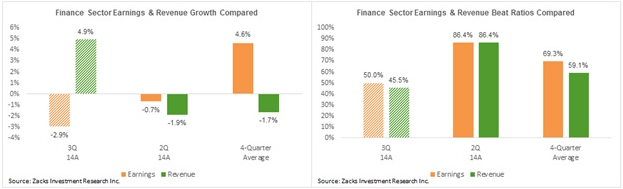

This is weak growth and beat ratios in Q3 relative to what we have been seeing from the same group of 22 companies in other recent quarters, as the charts below show.

The lower ratio of positive surprises for the Finance sector in Q3 thus far is worrisome, though the sub-par earnings growth pace in the quarter is solely due to the huge Bank of America (NYSE:BAC)) charge. The comparative growth picture improves materially once Bank of America is excluded from the data, as the chart below shows

The market’s negative response to otherwise decent banking results likely reflects the recent sharp slide in treasury yields, which makes the operating environment extremely difficult for the group to navigate. Low interest rates squeeze net interest margins that forces banks to make their earnings numbers primarily through cost cuts. Consensus estimates for the current and coming quarters reflect steady improvement in the ‘core’ business.

It wouldn’t be much of a problem if the current downtrend in yields turns out to be a temporary phenomenon. But if rates remain low for longer or start moving even lower (with some calling for the U.S. 10-Year Treasury yield to go to 1.5% in the not-too-distant future), the forward estimates for the sector remain at risk of significant negative revisions. The reason for that is current consensus estimates for the sector reflect a fair amount of improvement in the ‘core’ banking business, which can only happen if net interest margins start expanding as a result of rising interest rates.

The chart below shows consensus earnings growth expectations for the Finance sector as a whole in the coming quarters. Please note that the +4.2% earnings growth expected in Q3 is the composite growth rate for the sector, meaning a blend of the 22 sector companies that have reported results and estimates for the still-to-come 58 companies.

Earnings Calendar (week of October 20th)

We get into the heart of the Q3 reporting season this week, with more than 500 companies releasing results, including 127 S&P 500 members. This week’s line-up of reports spans the entire breadth of the U.S. economy – from Apple (NASDAQ:AAPL) and IBM (NYSE:IBM) to Coke (NYSE:KO), Caterpillar (NYSE:CAT) and a lot more in the middle.

Notable earnings report this week include –

- Apple (AAPL), IBM (IBM) and Chipotle Mexican Grill (NYSE:CMG) after the close on Monday.

- Coke (KO), McDonald’s (NYSE:MCD) and Verizon (NYSE:VZ) before the open on Tuesday

- Boeing (NYSE:BA) and Dow Chemicals (NYSE:DOW) before the open and AT&T (NYSE:T) after the close on Wednesday.

- Caterpillar (CAT), Comcast (NASDAQ:CMCSA), 3M (NYSE:MMM) and General Motors (NYSE:GM) before the open and Microsoft (NASDAQ:MSFT) after the close on Thursday.

- Ford (NYSE:F), Proctor & Gamble (NYSE:PG), and UPS (NYSE:UPS) on Friday, all before the open.

By the end of this week, we will have seen Q3 results from more the 200 S&P 500 members and will have perfect sense of how this earnings season was unfolding.

The Scorecard Thus Far (as of October 17th)

We have seen Q3 results from 82 S&P 500 members that combined account for 24.9% of the index’s total market capitalization. Total earnings for these 82 companies are up +4.2% from the same period last year, with 63.4% of the companies beating earnings estimates. Total revenues are up a much better +5% and an above-average 56.1% have come ahead of top-line estimates.

The growth picture improves once Finance is excluded from the aggregate data. As stated earlier, Finance’s growth has been dragged down by tough comparisons for Bank of America. The last row of the Scorecard table gives the aggregate picture on an ex-Finance basis.

As you can see, Autos and Utilities are the only sector where we haven’t seen any results thus far. Finance has the most results (47% of the sector’s market cap), as has Conglomerates (64.1% of the market cap).

Weak Start for Tech Results

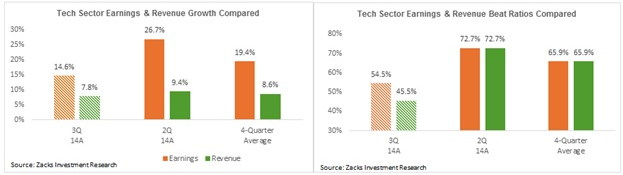

The Tech sector where we have seen results from 29.1% of the sector’s market cap has been a laggard thus far. Total earnings for the 11 Tech sector companies (out of 65 in the S&P 500 index) are up +14.6% on +7.8% higher revenues. But as we saw with Google (NASDAQ:GOOGL), very few companies are coming out with positive surprises – 54.5% of the companies have beat earnings and only 45.5% of the companies have beat revenues.

This is notably weaker than what we have seen from the cohort of 11 companies in other recent quarters, as the chart below shows.

The Composite Picture

The table below shows a composite (or blended) summary picture of Q3 that combines actual results from the 82 S&P 500 members that have reported with estimates for the remaining 418 index members. As you can see, total earnings are expected to be up +3.1% from the same period last year on +2.9% higher revenues and modest margin gains. The expected growth rate for Q3 has been steadily improving in recent days as companies report results and beat estimates.

Total earnings for the S&P 500 reached an all-time quarterly record in 2014 Q2 and current estimates for Q3 put the quarterly total as the second highest ever. But given the historical trend of roughly two-thirds of the companies beating earnings estimates, the final Q3 tally will likely be right in the preceding quarter’s record vicinity. The chart below shows that current consensus estimates reflect record tallies in the following quarters.

For these estimates to hold, we need an improvement on the guidance front, which has persistently been weak for almost two years now. There was modest improvement in tone of management guidance on the Q2 earnings calls, but the majority of companies providing guidance still guided lower. Given the ongoing global growth worries, it is likely that the quality and quantity of guidance will deteriorate even further this earnings season.

Importantly, continued negative guidance will effectively guarantee that we will see a repeat of negative estimate revisions, with estimates for Q4 coming down as earnings season unfolds.

Here is a list of the 535 companies reporting this week, including 127 S&P 500 members.

| Company | Ticker | Current Qtr | Year-Ago Qtr | Last EPS Surprise % | Report Day | Time |

| APPLE INC | AAPL | 1.3 | 1.18 | 4.92 | Monday | AMC |

| CHIPOTLE MEXICN | CMG | 3.86 | 2.66 | 14.75 | Monday | AMC |

| GANNETT INC | GCI | 0.55 | 0.43 | 6.35 | Monday | BTO |

| GENUINE PARTS | GPC | 1.23 | 1.12 | 2.4 | Monday | BTO |

| HALLIBURTON CO | HAL | 1.1 | 0.83 | -1.09 | Monday | BTO |

| HASBRO INC | HAS | 1.47 | 1.31 | -2.7 | Monday | BTO |

| INTL BUS MACH | IBM | 4.3 | 3.99 | 0.23 | Monday | AMC |

| TEXAS INSTRS | TXN | 0.71 | 0.56 | 5.08 | Monday | AMC |

| V F CORP | VFC | 1.09 | 0.98 | 2.86 | Monday | BTO |

| ZIONS BANCORP | ZION | 0.45 | 0.44 | 21.74 | Monday | AMC |

| ATLAS COP-ADR A | ATLKY | 0.37 | 0.4 | 5.41 | Monday | N/A |

| BBCN BANCORP | BBCN | 0.29 | 0.3 | -3.45 | Monday | AMC |

| BANK OF MARIN | BMRC | 0.85 | 0.72 | 6.17 | Monday | BTO |

| BROOKFLD CDA OP | BOXC | 0.37 | 0.35 | 3.24 | Monday | AMC |

| BROWN & BROWN | BRO | 0.47 | 0.39 | 2.44 | Monday | AMC |

| PEABODY ENERGY | BTU | -0.66 | 0.05 | 0 | Monday | BTO |

| BANCORPSOUTH | BXS | 0.33 | 0.26 | 0 | Monday | AMC |

| COMMNTY BK SYS | CBU | 0.56 | 0.54 | 5.56 | Monday | BTO |

| CADENCE DESIGN | CDNS | 0.15 | 0.18 | 41.67 | Monday | AMC |

| CELANESE CP-A | CE | 1.44 | 1.2 | 19.51 | Monday | AMC |

| CYS INVESTMENTS | CYS | 0.32 | 0.23 | -2.94 | Monday | AMC |

| EQUITY LIFESTYL | ELS | 0.66 | 0.65 | 3.28 | Monday | AMC |

| AB ELECTROLUX | ELUXY | N/A | 0.72 | N/A | Monday | N/A |

| EAST WEST BC | EWBC | 0.6 | 0.53 | 0 | Monday | AMC |

| FIRST DEFIANCE | FDEF | 0.53 | 0.54 | 11.76 | Monday | AMC |

| GULFMARK OFFSHR | GLF | 0.81 | 1 | -5.21 | Monday | AMC |

| HELIX EGY SOLUT | HLX | 0.5 | 0.38 | 30.95 | Monday | AMC |

| HEALTHSTREAM | HSTM | 0.08 | 0.08 | 12.5 | Monday | AMC |

| HEXCEL CORP | HXL | 0.54 | 0.48 | 0 | Monday | AMC |

| IDEX CORP | IEX | 0.84 | 0.75 | 2.33 | Monday | AMC |

| ILLUMINA INC | ILMN | 0.56 | 0.45 | 11.76 | Monday | AMC |

| KAISER ALUMINUM | KALU | 1.01 | 0.9 | 19.32 | Monday | AMC |

| LENNOX INTL INC | LII | 1.44 | 1.3 | 0 | Monday | BTO |

| POTLATCH CORP | PCH | 0.86 | 0.56 | -4.76 | Monday | AMC |

| PETMED EXPRESS | PETS | 0.21 | 0.21 | 0 | Monday | BTO |

| KONINKLIJKE PHL | PHG | N/A | 0.47 | N/A | Monday | BTO |

| PACKAGING CORP | PKG | 1.26 | 0.91 | 5.45 | Monday | AMC |

| RENT-A-CENTER | RCII | 0.46 | 0.51 | 0 | Monday | AMC |

| RAMBUS INC | RMBS | 0.05 | 0.14 | 160 | Monday | AMC |

| SAP AG ADR | SAP | 0.94 | 1 | 14.77 | Monday | BTO |

| SERVISFIRST BCS | SFBS | 0.52 | 0.49 | -1.92 | Monday | AMC |

| STEEL DYNAMICS | STLD | 0.44 | 0.25 | 3.33 | Monday | AMC |

| ULTRA CLEAN HLD | UCTT | 0.15 | 0.12 | 5.26 | Monday | AMC |

| VALEANT PHARMA | VRX | 0.61 | 1.41 | 1.05 | Monday | BTO |

| WASH TR BANCORP | WASH | 0.59 | 0.59 | -3.33 | Monday | AMC |

| WILSHIRE BCP | WIBC | 0.2 | 0.16 | -5 | Monday | AMC |

| ACE LIMITED | ACE | 2.33 | 2.49 | 7.08 | Tuesday | AMC |

| ALLEGHENY TECH | ATI | -0.05 | -0.27 | 250 | Tuesday | BTO |

| BROADCOM CORP-A | BRCM | 0.66 | 0.55 | 9.52 | Tuesday | AMC |

| DISCOVER FIN SV | DFS | 1.34 | 1.2 | 3.85 | Tuesday | AMC |

| E TRADE FINL CP | ETFC | 0.22 | 0.16 | 4.35 | Tuesday | AMC |

| FMC TECH INC | FTI | 0.74 | 0.49 | 14.29 | Tuesday | AMC |

| HARLEY-DAVIDSON | HOG | 0.6 | 0.73 | 10.96 | Tuesday | BTO |

| INTUITIVE SURG | ISRG | 2.67 | 3.99 | 0.36 | Tuesday | AMC |

| ILL TOOL WORKS | ITW | 1.23 | 0.99 | 0.83 | Tuesday | BTO |

| KIMBERLY CLARK | KMB | 1.54 | 1.44 | 0 | Tuesday | BTO |

| COCA COLA CO | KO | 0.52 | 0.53 | 1.59 | Tuesday | BTO |

| LOCKHEED MARTIN | LMT | 2.74 | 2.57 | 3.76 | Tuesday | BTO |

| MCDONALDS CORP | MCD | 1.37 | 1.52 | -2.1 | Tuesday | BTO |

| NABORS IND | NBR | 0.37 | 0.2 | 4.35 | Tuesday | AMC |

| OMNICOM GRP | OMC | 0.91 | 0.82 | 5.13 | Tuesday | BTO |

| PENTAIR PLC | PNR | 0.94 | 0.86 | 0 | Tuesday | BTO |

| REYNOLDS AMER | RAI | 0.91 | 0.86 | 2.3 | Tuesday | BTO |

| REGIONS FINL CP | RF | 0.21 | 0.2 | 0 | Tuesday | BTO |

| ROBT HALF INTL | RHI | 0.58 | 0.48 | 5.77 | Tuesday | AMC |

| TRAVELERS COS | TRV | 2.15 | 2.35 | -6.31 | Tuesday | BTO |

| UTD TECHS CORP | UTX | 1.81 | 1.63 | 2.79 | Tuesday | BTO |

| VERIZON COMM | VZ | 0.92 | 0.77 | 1.11 | Tuesday | BTO |

| WATERS CORP | WAT | 1.28 | 1.19 | 0.83 | Tuesday | BTO |

| YAHOO! INC | YHOO | 0.2 | 0.28 | 0 | Tuesday | AMC |

| ABAXIS INC | ABAX | 0.22 | 0.18 | 10.53 | Tuesday | AMC |

| ASBURY AUTO GRP | ABG | 1.08 | 0.91 | 8.18 | Tuesday | BTO |

| AMER CAMPUS CTY | ACC | 0.44 | 0.39 | 3.57 | Tuesday | AMC |

| AKZO NOBEL NV | AKZOY | N/A | 0.43 | N/A | Tuesday | N/A |

| ACTELION LTD | ALIOF | 1.5 | 0.98 | 45.99 | Tuesday | BTO |

| SMITH (AO) CORP | AOS | 0.57 | 0.54 | 10 | Tuesday | BTO |

| APOLLO GROUP | APOL | 0.27 | 0.55 | 16.92 | Tuesday | BTO |

| ARM HOLDNGS ADR | ARMH | 0.24 | 0.18 | 4.55 | Tuesday | BTO |

| ASTEC INDS INC | ASTE | 0.41 | 0.28 | 1.61 | Tuesday | BTO |

| B&G FOODS CL-A | BGS | 0.4 | 0.35 | -15.38 | Tuesday | AMC |

| CATHAY GENL BCP | CATY | 0.45 | 0.38 | 7.32 | Tuesday | AMC |

| CUBIST PHARM | CBST | 0.36 | 0.41 | -37.84 | Tuesday | AMC |

| CELESTICA INC | CLS | 0.2 | 0.19 | 16.67 | Tuesday | AMC |

| CDN NATL RY CO | CNI | 0.95 | 0.86 | 4.35 | Tuesday | AMC |

| CDN PAC RLWY | CP | 2.23 | 1.82 | -0.51 | Tuesday | BTO |

| CREE INC | CREE | 0.24 | 0.3 | 6.45 | Tuesday | AMC |

| CARLISLE COS IN | CSL | 1.22 | 1.18 | -1.71 | Tuesday | BTO |

| COMP TASK | CTG | 0.17 | 0.23 | 0 | Tuesday | BTO |

| CUSTOMERS BANCP | CUBI | 0.41 | 0.3 | 2.78 | Tuesday | BTO |

| COVENANT TRANS | CVTI | 0.36 | 0.13 | 47.06 | Tuesday | AMC |

| DATALINK CORP | DTLK | 0.12 | 0.08 | 171.43 | Tuesday | AMC |

| BRINKER INTL | EAT | 0.5 | 0.43 | -1.16 | Tuesday | BTO |

| ETHAN ALLEN INT | ETH | 0.35 | 0.33 | 19.05 | Tuesday | AMC |

| EXACTECH INC | EXAC | 0.25 | 0.23 | 0 | Tuesday | AMC |

| FLAGSTAR BANCP | FBC | 0.03 | 0.16 | 50 | Tuesday | AMC |

| FIRST MIDWST BK | FMBI | 0.26 | 0.39 | 0 | Tuesday | AMC |

| FULTON FINL | FULT | 0.2 | 0.21 | -4.55 | Tuesday | AMC |

| GRAPHIC PKG HLD | GPK | 0.2 | 0.12 | 17.65 | Tuesday | BTO |

| GREAT SOUTH BCP | GSBC | 0.55 | 0.61 | 41.07 | Tuesday | AMC |

| HAWAIIAN HLDGS | HA | 0.74 | 0.69 | 6.06 | Tuesday | AMC |

| INTERACTIVE BRK | IBKR | 0.23 | 0.32 | -10.34 | Tuesday | AMC |

| INTERCONTL HTLS | IHG | N/A | N/A | N/A | Tuesday | N/A |

| IROBOT CORP | IRBT | 0.33 | 0.26 | 0 | Tuesday | AMC |

| KEPPEL LTD ADR | KPELY | N/A | 0.4 | N/A | Tuesday | N/A |

| LIBERTY PPTY TR | LPT | 0.62 | 0.57 | -3.28 | Tuesday | BTO |

| LEXMARK INTL | LXK | 0.93 | 1.04 | 7.61 | Tuesday | BTO |

| MANPOWER INC WI | MAN | 1.5 | 1.26 | 2.27 | Tuesday | BTO |

| MANHATTAN ASOC | MANH | 0.27 | 0.25 | 8 | Tuesday | AMC |

| MERCHANTS BANCS | MBVT | 0.49 | 0.58 | 1.89 | Tuesday | AMC |

| MERCANTILE BANK | MBWM | 0.41 | 0.48 | -17.07 | Tuesday | BTO |

| SOUTHWEST BC-OK | OKSB | 0.2 | 0.19 | 55 | Tuesday | AMC |

| PEOPL BNCP-OHIO | PEBO | 0.38 | 0.45 | -13.51 | Tuesday | N/A |

| PINNACLE FIN PT | PNFP | 0.51 | 0.42 | 2.08 | Tuesday | AMC |

| PZENA INVESTMNT | PZN | 0.14 | 0.11 | 0 | Tuesday | AMC |

| QUIDEL CORP | QDEL | -0.12 | -0.05 | 40 | Tuesday | AMC |

| RENASANT CORP | RNST | 0.48 | 0.24 | 6.82 | Tuesday | AMC |

| RAMCO-GERSHENSN | RPT | 0.32 | 0.29 | 3.33 | Tuesday | AMC |

| RUSH ENTRPRS-A | RUSHA | 0.51 | 0.37 | 23.81 | Tuesday | AMC |

| SONIC AUTOMOTVE | SAH | 0.48 | 0.46 | -15.38 | Tuesday | BTO |

| SIGNATURE BANK | SBNY | 1.45 | 1.23 | 4.23 | Tuesday | BTO |

| SIX FLAGS ENTMT | SIX | 1.51 | 1.22 | 0 | Tuesday | AMC |

| SUPER MICRO COM | SMCI | 0.34 | 0.17 | -5.56 | Tuesday | AMC |

| SYNOVUS FINL CP | SNV | 0.37 | 0.28 | -2.78 | Tuesday | BTO |

| SONIC CORP | SONC | 0.33 | 0.3 | 3.45 | Tuesday | AMC |

| TRUSTCO BK -NY | TRST | 0.1 | 0.11 | 9.09 | Tuesday | AMC |

| UNISYS | UIS | 0.7 | 0.25 | -72.5 | Tuesday | AMC |

| VASCULAR SOLUTN | VASC | 0.2 | 0.19 | 11.11 | Tuesday | AMC |

| VMWARE INC-A | VMW | 0.54 | 0.64 | 1.89 | Tuesday | AMC |

| VIEWPOINT FINL | VPFG | 0.27 | 0.21 | 30 | Tuesday | AMC |

| WASTE CONNCTION | WCN | 0.54 | 0.51 | 3.92 | Tuesday | AMC |

| WESBANCO INC | WSBC | 0.6 | 0.53 | 14.29 | Tuesday | AMC |

| TAL EDUCATN-ADR | XRS | 0.34 | 0.29 | 30.77 | Tuesday | BTO |

| ZIX CORP | ZIXI | 0.03 | 0.05 | 0 | Tuesday | AMC |

| ABBOTT LABS | ABT | 0.6 | 0.55 | 5.88 | Wednesday | BTO |

| AMPHENOL CORP-A | APH | 0.57 | 0.49 | 3.81 | Wednesday | BTO |

| BOEING CO | BA | 1.97 | 1.8 | 19.8 | Wednesday | BTO |

| BARD C R INC | BCR | 2.1 | 1.5 | 3 | Wednesday | AMC |

| BIOGEN IDEC INC | BIIB | 3.22 | 2.34 | 24.64 | Wednesday | BTO |

| BOSTON SCIENTIF | BSX | 0.2 | 0.17 | 5 | Wednesday | BTO |

| CA INC | CA | 0.59 | 0.83 | 8.77 | Wednesday | AMC |

| CITRIX SYS INC | CTXS | 0.51 | 0.53 | 53.66 | Wednesday | AMC |

| DOW CHEMICAL | DOW | 0.67 | 0.5 | 2.78 | Wednesday | BTO |

| EQUIFAX INC | EFX | 0.99 | 0.9 | 2.13 | Wednesday | AMC |

| EMC CORP -MASS | EMC | 0.37 | 0.32 | -5.71 | Wednesday | BTO |

| GENL DYNAMICS | GD | 1.91 | 1.84 | 6.82 | Wednesday | BTO |

| HUDSON CITY BCP | HCBK | 0.06 | 0.09 | 14.29 | Wednesday | BTO |

| INTERPUBLIC GRP | IPG | 0.21 | 0.17 | 0 | Wednesday | BTO |

| INGERSOLL RAND | IR | 1.04 | 1.16 | 1.8 | Wednesday | BTO |

| LEGGETT & PLATT | LEG | 0.5 | 0.43 | 2.13 | Wednesday | AMC |

| LAM RESEARCH | LRCX | 0.94 | 0.81 | 2.46 | Wednesday | AMC |

| NORTHROP GRUMMN | NOC | 2.17 | 1.97 | -7.27 | Wednesday | BTO |

| NORFOLK SOUTHRN | NSC | 1.81 | 1.53 | 2.87 | Wednesday | BTO |

| NORTHERN TRUST | NTRS | 0.87 | 0.76 | 3.57 | Wednesday | BTO |

| O REILLY AUTO | ORLY | 1.96 | 1.69 | 3.24 | Wednesday | AMC |

| RYDER SYS | R | 1.63 | 1.46 | 3.6 | Wednesday | BTO |

| SIMON PROPERTY | SPG | 2.02 | 2.21 | 0.93 | Wednesday | BTO |

| STANLEY B&D INC | SWK | 1.44 | 1.39 | 4.38 | Wednesday | BTO |

| AT&T INC | T | 0.64 | 0.66 | -1.59 | Wednesday | AMC |

| TORCHMARK CORP | TMK | 1.02 | 0.95 | -0.97 | Wednesday | AMC |

| THERMO FISHER | TMO | 1.69 | 1.3 | 6.17 | Wednesday | BTO |

| TRACTOR SUPPLY | TSCO | 0.51 | 0.46 | 0 | Wednesday | AMC |

| US BANCORP | USB | 0.78 | 0.76 | 1.3 | Wednesday | BTO |

| VARIAN MEDICAL | VAR | 1.21 | 1.08 | 0 | Wednesday | AMC |

| XEROX CORP | XRX | 0.26 | 0.26 | 3.85 | Wednesday | BTO |

| ABB LTD-ADR | ABB | 0.31 | 0.36 | -6.67 | Wednesday | BTO |

| ACACIA RESEARCH | ACTG | -0.02 | -0.08 | -2200 | Wednesday | AMC |

| ALBEMARLE CORP | ALB | 1.02 | 1.09 | 0.92 | Wednesday | AMC |

| ALLEGIANT TRAVL | ALGT | 0.97 | 0.91 | 8.14 | Wednesday | AMC |

| ANGIES LIST INC | ANGI | -0.05 | -0.23 | -34.78 | Wednesday | BTO |

| ALLIED WORLD AS | AWH | 0.52 | 0.98 | -14.77 | Wednesday | AMC |

| NATUS MEDICAL | BABY | 0.31 | 0.3 | 7.69 | Wednesday | BTO |

| BANNER CORP | BANR | 0.61 | 0.6 | 1.56 | Wednesday | AMC |

| BRANDYWINE RT | BDN | 0.37 | 0.4 | 2.86 | Wednesday | AMC |

| B/E AEROSPACE | BEAV | 1.15 | 0.89 | 4.63 | Wednesday | BTO |

| POPULAR INC | BPOP | 0.6 | 0.59 | 23.53 | Wednesday | BTO |

| CHEESECAKE FACT | CAKE | 0.57 | 0.52 | -3.28 | Wednesday | AMC |

| CHEMICAL FINL | CHFC | 0.44 | 0.53 | 10.2 | Wednesday | AMC |

| CORE LABS NV | CLB | 1.51 | 1.35 | 0 | Wednesday | AMC |

| CORELOGIC INC | CLGX | 0.35 | 0.46 | -6.06 | Wednesday | AMC |

| CLEARWATER PAPR | CLW | 1.16 | 0.28 | 8.82 | Wednesday | AMC |

| COVANTA HOLDING | CVA | 0.2 | 0.28 | 500 | Wednesday | AMC |

| CVB FINL | CVBF | 0.23 | 0.23 | 9.09 | Wednesday | AMC |

| EURONET WORLDWD | EEFT | 0.68 | 0.58 | -4 | Wednesday | AMC |

| 8X8 INC | EGHT | 0.01 | 0.05 | 0 | Wednesday | AMC |

| EVERCORE PARTNR | EVR | 0.68 | 0.53 | 8.2 | Wednesday | BTO |

| EXPONENT INC | EXPO | 0.7 | 0.79 | 12.5 | Wednesday | AMC |

| FIBRIA CELULOSE | FBR | -0.09 | 0.04 | 10 | Wednesday | N/A |

| FEDERAL MOGUL-A | FDML | 0.24 | 0.21 | -5.71 | Wednesday | BTO |

| FINANCIAL INST | FISI | 0.47 | 0.42 | 2.13 | Wednesday | AMC |

| FNB CORP | FNB | 0.21 | 0.22 | 0 | Wednesday | BTO |

| FLOTEK INDU INC | FTK | 0.25 | 0.16 | -16.67 | Wednesday | AMC |

| FORTINET INC | FTNT | 0.05 | 0.07 | -16.67 | Wednesday | AMC |

| GRACO INC | GGG | 0.93 | 0.89 | 9.18 | Wednesday | AMC |

| GENTEX CORP | GNTX | 0.48 | 0.38 | 0 | Wednesday | BTO |

| GRACE (WR) NEW | GRA | 0.99 | 1.07 | 6.09 | Wednesday | BTO |

| GLAXOSMITHKLINE | GSK | 0.79 | 0.92 | -8.45 | Wednesday | N/A |

| HORACE MANN EDS | HMN | 0.55 | 0.59 | -14 | Wednesday | AMC |

| IBERIABANK CORP | IBKC | 0.97 | 0.83 | 7.87 | Wednesday | AMC |

| ICON PLC | ICLR | 0.7 | 0.45 | 10.34 | Wednesday | BTO |

| INFINERA CORP | INFN | 0.02 | 0.04 | 400 | Wednesday | AMC |

| IPC THE HOSPITL | IPCM | 0.6 | 0.53 | 1.75 | Wednesday | AMC |

| KNIGHT TRANSN | KNX | 0.27 | 0.19 | 14.81 | Wednesday | BTO |

| COCA-COLA FEMSA | KOF | 1.01 | 1.11 | -0.99 | Wednesday | BTO |

| LASALLE HTL PRP | LHO | 0.79 | 0.72 | 1.23 | Wednesday | AMC |

| LUMBER LIQUIDAT | LL | 0.68 | 0.73 | 0 | Wednesday | BTO |

| LOGITECH INTL | LOGI | 0.18 | 0.17 | 216.67 | Wednesday | AMC |

| LG DISPLAY-ADR | LPL | 0.44 | 0.31 | 105.88 | Wednesday | AMC |

| LA QUINTA HLDGS | LQ | 0.17 | N/A | 0 | Wednesday | AMC |

| MEDICINES CO | MDCO | -0.1 | 0.38 | 414.29 | Wednesday | BTO |

| MILLICOM INTL | MIICF | N/A | -0.37 | -42.99 | Wednesday | N/A |

| MKS INSTRUMENTS | MKSI | 0.37 | 0.25 | 50 | Wednesday | AMC |

| MERKETO INC | MKTO | -0.41 | -0.27 | 30.43 | Wednesday | AMC |

| MARKETAXESS HLD | MKTX | 0.46 | 0.48 | 4.35 | Wednesday | BTO |

| MELLANOX TECH | MLNX | -0.01 | 0.02 | 35.29 | Wednesday | AMC |

| MORNINGSTAR INC | MORN | 0.69 | 0.68 | 3.08 | Wednesday | AMC |

| MSA SAFETY INC | MSA | 0.55 | 0.57 | 3.39 | Wednesday | AMC |

| NORSK HYDRO ADR | NHYDY | N/A | 0.02 | N/A | Wednesday | N/A |

| SERVICENOW INC | NOW | -0.19 | -0.11 | -34.62 | Wednesday | AMC |

| NVE CORP | NVEC | 0.75 | 0.66 | 43.1 | Wednesday | AMC |

| NXP SEMICONDUCT | NXPI | 1.18 | 0.77 | 0 | Wednesday | AMC |

| NEW YORK CMNTY | NYCB | 0.26 | 0.26 | 11.54 | Wednesday | BTO |

| OWENS CORNING | OC | 0.5 | 0.53 | -19.15 | Wednesday | BTO |

| OPEN TEXT CORP | OTEX | 0.86 | 0.65 | 11.96 | Wednesday | AMC |

| PACIFIC CONTL | PCBK | 0.24 | 0.22 | 4.55 | Wednesday | AMC |

| POLARIS INDUS | PII | 2.01 | 1.64 | 1.43 | Wednesday | BTO |

| POLYCOM INC | PLCM | 0.12 | 0.02 | -7.14 | Wednesday | AMC |

| PLEXUS CORP | PLXS | 0.78 | 0.67 | 2.78 | Wednesday | AMC |

| PAC PREMIER BCP | PPBI | 0.29 | 0.18 | 0 | Wednesday | N/A |

| ROCKY BRANDS | RCKY | 0.54 | 0.39 | 5.26 | Wednesday | AMC |

| EVEREST RE LTD | RE | 4.6 | 4.2 | -5.91 | Wednesday | AMC |

| RAYMOND JAS FIN | RJF | 0.85 | 0.93 | 11.84 | Wednesday | AMC |

| STEPAN CO | SCL | 0.89 | 0.92 | 1.1 | Wednesday | BTO |

| SELECT COMFORT | SCSS | 0.4 | 0.36 | 14.29 | Wednesday | AMC |

| SEI INVESTMENTS | SEIC | 0.46 | 0.38 | 14.29 | Wednesday | BTO |

| STORA ENSO -ADR | SEOAY | N/A | 0.18 | N/A | Wednesday | N/A |

| STANCORP FNL CP | SFG | 1.32 | 1.45 | -19.17 | Wednesday | AMC |

| SANGAMO BIOSCI | SGMO | -0.12 | -0.11 | 33.33 | Wednesday | AMC |

| SCHULMAN(A) INC | SHLM | 0.66 | 0.55 | 13.85 | Wednesday | AMC |

| SKECHERS USA-A | SKX | 0.91 | 0.53 | 65.85 | Wednesday | AMC |

| SL GREEN REALTY | SLG | 1.44 | 1.34 | 14.08 | Wednesday | AMC |

| SILGAN HOLDINGS | SLGN | 1.34 | 1.23 | 8.96 | Wednesday | BTO |

| SLM CORP | SLM | 0.17 | 0.6 | 11.11 | Wednesday | AMC |

| SUSQUEHANNA BSH | SUSQ | 0.2 | 0.24 | 15 | Wednesday | AMC |

| TAL INTL GRP | TAL | 0.97 | 1.03 | -2.06 | Wednesday | AMC |

| TEXAS CAP BCSHS | TCBI | 0.75 | 0.74 | 2.9 | Wednesday | AMC |

| TERADYNE INC | TER | 0.4 | 0.46 | 31.71 | Wednesday | AMC |

| INTERFACE INC A | TILE | 0.13 | 0.23 | -4.76 | Wednesday | AMC |

| TRISTATE CP HLD | TSC | 0.17 | 0.05 | -88.24 | Wednesday | AMC |

| TUPPERWARE BRND | TUP | 0.93 | 1 | 0 | Wednesday | BTO |

| TYLER TECH INC | TYL | 0.44 | 0.36 | 9.76 | Wednesday | AMC |

| UNITED FIN BCP | UBNK | 0.22 | 0.18 | 316.67 | Wednesday | AMC |

| UNION BANKSHARS | UBSH | 0.43 | 0.34 | -2.56 | Wednesday | BTO |

| UNIFIRST CORP | UNF | 1.3 | 1.52 | 6.99 | Wednesday | BTO |

| UTD STATIONERS | USTR | 0.99 | 1.01 | 2.41 | Wednesday | AMC |

| WEATHERFORD INT | WFT | 0.33 | 0.23 | 14.29 | Wednesday | AMC |

| WIPRO LTD-ADR | WIT | 0.14 | 0.13 | 7.69 | Wednesday | BTO |

| WORLD ACCEPTANC | WRLD | 2.17 | 1.8 | -0.45 | Wednesday | BTO |

| YARA INTL-ADR | YARIY | 1.11 | 0.94 | 17.92 | Wednesday | N/A |

| YELP INC | YELP | 0.03 | -0.04 | 233.33 | Wednesday | AMC |

| AMER ELEC PWR | AEP | 1.04 | 1.1 | 6.67 | Thursday | BTO |

| ALTERA CORP | ALTR | 0.37 | 0.37 | 10.81 | Thursday | AMC |

| ALEXION PHARMA | ALXN | 1.05 | 0.73 | 0 | Thursday | BTO |

| AMAZON.COM INC | AMZN | -0.74 | -0.09 | -107.69 | Thursday | AMC |

| AIRGAS INC | ARG | 1.29 | 1.25 | 0 | Thursday | BTO |

| BEMIS | BMS | 0.67 | 0.6 | 1.56 | Thursday | BTO |

| CAMERON INTL | CAM | 1.11 | 0.81 | 13.64 | Thursday | BTO |

| CATERPILLAR INC | CAT | 1.33 | 1.45 | 11.92 | Thursday | BTO |

| CHUBB CORP | CB | 1.93 | 2.06 | -10.53 | Thursday | AMC |

| COCA-COLA ENTRP | CCE | 0.88 | 0.82 | 2.27 | Thursday | BTO |

| CELGENE CORP | CELG | 0.82 | 0.69 | 3.9 | Thursday | BTO |

| CERNER CORP | CERN | 0.39 | 0.33 | 2.78 | Thursday | AMC |

| COMCAST CORP A | CMCSA | 0.71 | 0.65 | 4.17 | Thursday | BTO |

| CMS ENERGY | CMS | 0.43 | 0.46 | 15.38 | Thursday | BTO |

| QUEST DIAGNOSTC | DGX | 1.08 | 1.02 | 1.89 | Thursday | BTO |

| DIAMOND OFFSHOR | DO | 0.77 | 1.22 | 13.79 | Thursday | BTO |

| DR PEPPER SNAPL | DPS | 0.88 | 0.88 | 15.22 | Thursday | BTO |

| EQT CORP | EQT | 0.71 | 0.58 | 1.25 | Thursday | BTO |

| EDWARDS LIFESCI | EW | 0.72 | 0.68 | 14.29 | Thursday | AMC |

| FLOWSERVE CORP | FLS | 1 | 0.9 | -2.17 | Thursday | AMC |

| GENERAL MOTORS | GM | 0.96 | 0.96 | -25.64 | Thursday | BTO |

| JUNIPER NETWRKS | JNPR | 0.26 | 0.22 | -3.57 | Thursday | AMC |

| KLA-TENCOR CORP | KLAC | 0.46 | 0.68 | -11.11 | Thursday | AMC |

| LILLY ELI & CO | LLY | 0.67 | 1.11 | 3.03 | Thursday | BTO |

| LORILLARD CO | LO | 0.9 | 0.83 | -4.55 | Thursday | BTO |

| SOUTHWEST AIR | LUV | 0.52 | 0.34 | 14.75 | Thursday | BTO |

| MEAD JOHNSON NU | MJN | 0.91 | 0.91 | -1.12 | Thursday | BTO |

| 3M CO | MMM | 1.96 | 1.78 | 0 | Thursday | BTO |

| MICROSOFT CORP | MSFT | 0.48 | 0.62 | -3.33 | Thursday | AMC |

| NIELSEN NV | NLSN | 0.62 | 0.48 | 1.72 | Thursday | BTO |

| NUCOR CORP | NUE | 0.75 | 0.49 | 17.95 | Thursday | BTO |

| OCCIDENTAL PET | OXY | 1.73 | 1.97 | 2.29 | Thursday | BTO |

| PRECISION CASTP | PCP | 3.29 | 2.9 | -9.85 | Thursday | BTO |

| PRINCIPAL FINL | PFG | 1.05 | 0.9 | 6.93 | Thursday | AMC |

| PULTE GROUP ONC | PHM | 0.36 | 0.45 | -3.85 | Thursday | BTO |

| PROLOGIS INC | PLD | 0.46 | 0.41 | 4.35 | Thursday | BTO |

| RAYTHEON CO | RTN | 1.61 | 1.51 | -11.32 | Thursday | BTO |

| STERICYCLE INC | SRCL | 1.06 | 0.96 | 0 | Thursday | AMC |

| SOUTHWESTRN ENE | SWN | 0.52 | 0.51 | 1.72 | Thursday | AMC |

| T ROWE PRICE | TROW | 1.15 | 1 | 0.89 | Thursday | BTO |

| UNDER ARMOUR-A | UA | 0.4 | 0.34 | 0 | Thursday | BTO |

| UNION PAC CORP | UNP | 1.51 | 1.24 | 0.7 | Thursday | BTO |

| VERISIGN INC | VRSN | N/A | 0.55 | 0 | Thursday | AMC |

| Wynn Resrts Ltd | WYNN | 1.81 | 1.64 | 1.44 | Thursday | N/A |

| ZIMMER HOLDINGS | ZMH | 1.3 | 1.25 | 0.68 | Thursday | BTO |

| AMER AIRLINES | AAL | 1.68 | N/A | 2.06 | Thursday | BTO |

| ALLIANCEBERNSTN | AB | 0.45 | 0.4 | 7.14 | Thursday | BTO |

| ARCTIC CAT INC | ACAT | 1.2 | 1.7 | 12.9 | Thursday | BTO |

| ALAMOS GOLD INC | AGI | 0.01 | 0.07 | 0 | Thursday | BTO |

| ALIGN TECH INC | ALGN | 0.43 | 0.4 | 10.26 | Thursday | AMC |

| ALASKA AIR GRP | ALK | 1.39 | 1.11 | 3.67 | Thursday | BTO |

| AUTOLIV INC | ALV | 1.41 | 1.29 | -5.84 | Thursday | BTO |

| ALTISOURCE PORT | ASPS | 2.37 | 1.42 | 20.43 | Thursday | BTO |

| AVNET | AVT | 0.97 | 0.9 | 3.64 | Thursday | BTO |

| BASIC EGY SVCS | BAS | 0.24 | -0.12 | 30 | Thursday | AMC |

| BUILD-A-BEAR WK | BBW | 0.05 | -0.05 | -108.33 | Thursday | BTO |

| BRUNSWICK CORP | BC | 0.57 | 0.59 | 9.2 | Thursday | BTO |

| BOISE CASCADE | BCC | 0.65 | 0.39 | 52.27 | Thursday | BTO |

| BENCHMARK ELETR | BHE | 0.41 | 0.44 | 16.22 | Thursday | BTO |

| BJ'S RESTAURANT | BJRI | 0.13 | 0.13 | 25 | Thursday | AMC |

| BANKINTER SA | BKNIY | N/A | 0.08 | N/A | Thursday | N/A |

| BANKUNITED INC | BKU | 0.44 | 0.52 | 4.55 | Thursday | BTO |

| BUILDERS FIRSTS | BLDR | 0.11 | 0.09 | -50 | Thursday | AMC |

| BIOMARIN PHARMA | BMRN | -0.19 | -0.38 | 54.76 | Thursday | AMC |

| BRYN MAWR BK CP | BMTC | 0.51 | 0.49 | 12.24 | Thursday | AMC |

| CABELAS INC | CAB | 0.86 | 0.7 | 19.61 | Thursday | BTO |

| CHICAGO BRIDGE | CBI | 1.39 | 1.12 | 7.09 | Thursday | AMC |

| CABOT MICROELEC | CCMP | 0.61 | 0.7 | -14.52 | Thursday | BTO |

| COLFAX CORP | CFX | 0.62 | 0.56 | -27.27 | Thursday | BTO |

| CHECK PT SOFTW | CHKP | 0.83 | 0.8 | 1.25 | Thursday | BTO |

| CHINA UNICOM | CHU | N/A | 0.2 | -16.67 | Thursday | N/A |

| MACK CALI CORP | CLI | 0.47 | 0.57 | 6.38 | Thursday | BTO |

| CALAMOS ASSET-A | CLMS | 0.13 | 0.2 | 69.23 | Thursday | AMC |

| CLEAN EGY FUELS | CLNE | -0.3 | -0.21 | 13.89 | Thursday | AMC |

| COMCAST CLA SPL | CMCSK | 0.71 | 0.65 | 2.74 | Thursday | BTO |

| CONMED CORP | CNMD | N/A | 0.4 | -2.08 | Thursday | AMC |

| COLUMBIA BK SYS | COLB | 0.42 | 0.4 | -6.98 | Thursday | BTO |

| CRA INTL INC | CRAI | 0.33 | 0.31 | 3.23 | Thursday | BTO |

| CARTERS INC | CRI | 1.24 | 1.12 | 29.79 | Thursday | BTO |

| CARPENTER TECH | CRS | 0.45 | 0.65 | -7.79 | Thursday | BTO |

| CREDIT SUISSE | CS | N/A | 0.19 | -174.63 | Thursday | BTO |

| CASH AM INTL | CSH | 0.78 | 0.85 | 25.84 | Thursday | BTO |

| CONSTANT CONTAC | CTCT | 0.21 | 0.17 | 50 | Thursday | AMC |

| CENOVUS ENERGY | CVE | 0.46 | 0.46 | 68.18 | Thursday | BTO |

| WILLIAMS(C)ENGY | CWEI | 1.43 | 1.54 | -44.2 | Thursday | BTO |

| CEMEX SA ADR | CX | 0.02 | -0.13 | 500 | Thursday | BTO |

| CITY NATIONAL | CYN | 1.07 | 1.1 | 14.43 | Thursday | AMC |

| DANA HOLDING CP | DAN | 0.5 | 0.47 | 11.54 | Thursday | BTO |

| DASSAULT SY-ADR | DASTY | 0.55 | 0.56 | 119.23 | Thursday | N/A |

| DIME COMM BNCSH | DCOM | 0.27 | 0.3 | 7.41 | Thursday | AMC |

| DAIMLER AG | DDAIF | N/A | 2.37 | N/A | Thursday | N/A |

| DECKERS OUTDOOR | DECK | 1.01 | 0.95 | 18.32 | Thursday | AMC |

| DOLBY LAB INC-A | DLB | 0.31 | 0.47 | 57.69 | Thursday | AMC |

| DELUXE CORP | DLX | 0.99 | 0.96 | 8.6 | Thursday | BTO |

| DUNKIN BRANDS | DNKN | 0.47 | 0.41 | 0 | Thursday | BTO |

| DEVRY EDUCATION | DV | 0.31 | 0.22 | 4.29 | Thursday | AMC |

| ECHO GLOBAL LOG | ECHO | 0.22 | 0.19 | 22.22 | Thursday | AMC |

| ENTERPRISE FINL | EFSC | 0.36 | 0.44 | 0 | Thursday | AMC |

| CALLAWAY GOLF | ELY | -0.28 | -0.18 | -33.33 | Thursday | AMC |

| EQT MIDSTRM PTR | EQM | 0.85 | 0.6 | 3.85 | Thursday | BTO |

| FIRST AMER FINL | FAF | 0.59 | 0.63 | -12.24 | Thursday | BTO |

| FIRST CT BANCRP | FBNK | 0.15 | 0.06 | 40 | Thursday | BTO |

| FBR & CO | FBRC | 0.52 | 0.21 | -6.45 | Thursday | AMC |

| FCB FINL HLDGS | FCB | 0.22 | N/A | N/A | Thursday | AMC |

| FORUM ENRG TECH | FET | 0.47 | 0.44 | 2.33 | Thursday | AMC |

| FEDERATED INVST | FII | 0.36 | 0.38 | 0 | Thursday | AMC |

| FIRST POTOMAC | FPO | 0.24 | 0.22 | 0 | Thursday | AMC |

| FIRST MERCHANTS | FRME | 0.43 | 0.35 | 0 | Thursday | BTO |

| FREESCALE SEMI | FSL | 0.39 | 0.15 | 6.45 | Thursday | AMC |

| FORWARD AIR CRP | FWRD | 0.59 | 0.46 | 0 | Thursday | AMC |

| GLACIER BANCORP | GBCI | 0.4 | 0.35 | -2.56 | Thursday | AMC |

| GRUPO FIN BANOR | GBOOY | 0.53 | 0.51 | 0 | Thursday | N/A |

| GREENHILL & CO | GHL | 0.62 | 0.06 | 22.73 | Thursday | AMC |

| GIGAMON INC | GIMO | -0.15 | 0.04 | -29.41 | Thursday | AMC |

| GATX CORP | GMT | 1.16 | 1.09 | 7.48 | Thursday | BTO |

| GROUP 1 AUTO | GPI | 1.44 | 1.2 | -9.82 | Thursday | BTO |

| GRUBHUB INC | GRUB | 0.04 | N/A | -25 | Thursday | AMC |

| HANCOCK HLDG CO | HBHC | 0.58 | 0.56 | 0 | Thursday | AMC |

| HERCULES OFFSHR | HERO | -0.06 | 0.11 | -500 | Thursday | BTO |

| HERITAGE FIN CP | HFWA | 0.23 | 0.2 | -27.27 | Thursday | AMC |

| HUBBELL INC -B | HUB.B | 1.59 | 1.62 | -0.66 | Thursday | BTO |

| HUB GROUP INC-A | HUBG | 0.54 | 0.5 | 2 | Thursday | AMC |

| HEALTHWAYS INC | HWAY | 0.08 | 0.05 | 36.36 | Thursday | AMC |

| IGI LABORATORYS | IG | -0.01 | 0 | -100 | Thursday | AMC |

| INGRAM MICRO | IM | 0.62 | 0.53 | 1.89 | Thursday | AMC |

| IMAX CORP | IMAX | 0.06 | 0.02 | 5.56 | Thursday | BTO |

| INFORMATICA CRP | INFA | 0.24 | 0.2 | -11.11 | Thursday | AMC |

| INVACARE CORP | IVC | -0.26 | -0.18 | -28.57 | Thursday | BTO |

| JARDEN CORP | JAH | 1.17 | 1.05 | 2.25 | Thursday | BTO |

| JAKKS PACIFIC | JAKK | 1.01 | 1.11 | 42.11 | Thursday | BTO |

| JETBLUE AIRWAYS | JBLU | 0.28 | 0.21 | 0 | Thursday | BTO |

| JANUS CAP GRP | JNS | 0.22 | 0.17 | 5.56 | Thursday | BTO |

| KIMBER-CLRK MEX | KCDMY | N/A | 0.14 | N/A | Thursday | N/A |

| KKR & CO LP | KKR | 0.39 | 0.84 | -3.12 | Thursday | BTO |

| LAZARD LTD | LAZ | 0.65 | 0.46 | 16.36 | Thursday | BTO |

| LOGMEIN INC | LOGM | 0.09 | 0.02 | 22.22 | Thursday | AMC |

| LATTICE SEMICON | LSCC | 0.07 | 0.07 | 11.11 | Thursday | AMC |

| LANDSTAR SYSTEM | LSTR | 0.81 | 0.64 | 2.56 | Thursday | BTO |

| LIFE TIME FITNS | LTM | 0.86 | 0.83 | -6.17 | Thursday | BTO |

| MICREL INC | MCRL | 0.1 | 0.07 | -25 | Thursday | AMC |

| MEREDITH CORP | MDP | 0.63 | 0.53 | 4.76 | Thursday | BTO |

| M/I HOMES INC | MHO | 0.46 | 0.47 | 3.33 | Thursday | BTO |

| MOBILE MINI INC | MINI | 0.32 | 0.28 | 0 | Thursday | BTO |

| MERIT MEDICAL | MMSI | 0.16 | 0.25 | -11.76 | Thursday | AMC |

| MCCLATCHY CO-A | MNI | N/A | 0.08 | N/A |