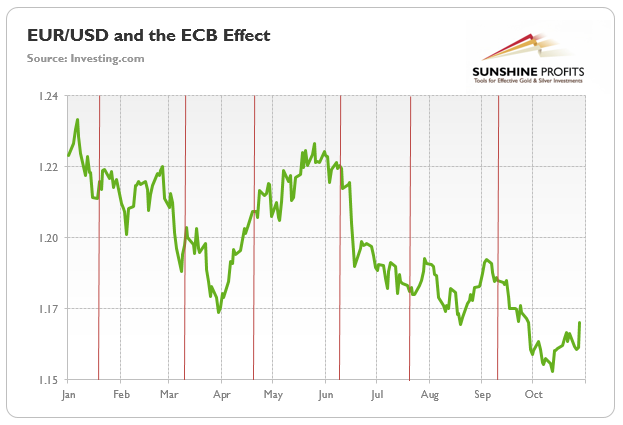

With the ECB holding its next monetary policy meeting on Feb. 3, the EUR/USD is up to its usual shenanigans. Moreover, with the currency pair accounting for nearly 58% of the USD Index’s movement, the sharp rally on Jan. 31 hurt the dollar basket. However, haven’t we seen this movie before? To explain, I wrote on Oct. 29:

"The green line above tracks the EUR/USD’s movement in 2021. If you focus your attention on the vertical red lines, they mark the day before the ECB makes its policy statements. Likewise, if you analyze the performance of the EUR/USD thereafter, you can see that euro bulls often find something to celebrate when Lagarde has her press conferences.

"For context, the EUR/USD has recorded rallies after five of the seven ECB policy meetings in 2021 (including on Oct. 28), declined once, and traded roughly flat after another. However, lower lows have still plagued the currency pair throughout its 2021 journey.

"Thus, is this time really different?"

To that point, while the EUR/USD closed above 1.1680 on Oct. 28, the currency pair has declined materially since; and while euro bulls often buy the EUR/USD in hopes that the ECB will perform a hawkish 180, they’re in front-run mode this time around. However, with disappointment reigning supreme for more than 12 months, another dose of reality should strike sooner rather than later.

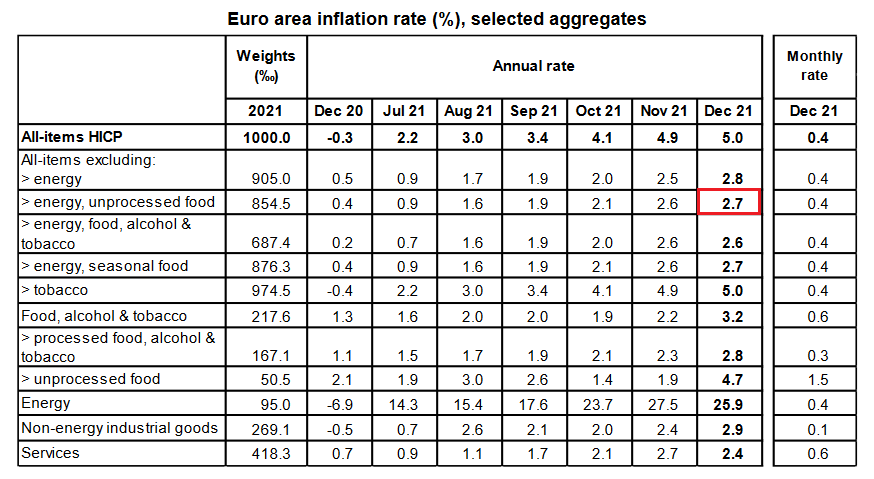

For example, while the Eurozone headline inflation increased by 5% year-over-year (YoY) on Jan. 20, core inflation—which includes the inflationary effects of food and energy prices—only increased by 2.7% YoY (the red box below). As a result, while I’ve highlighted the discrepancy on several occasions, the pricing pressures confronting Europe are mainly a function of oil and gas irregularities. Outside of that, most goods and services are within the ECB’s expected inflation range.

Source: Eurostat

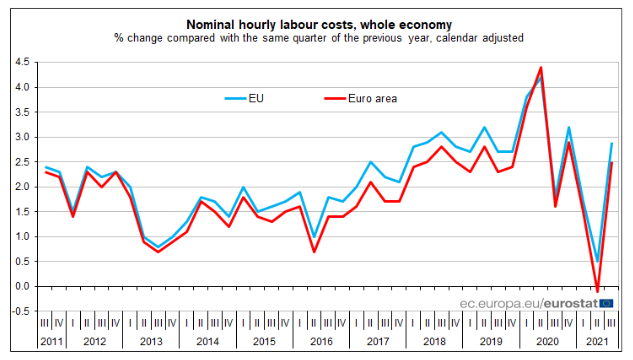

Second, hourly labor costs in the Eurozone rose by 2.5% YoY on Dec. 16 (the latest release). Moreover, the report revealed that “the costs of wages and salaries per hour worked increased by 2.3%, while the non-wage component rose by 3.0% in the third quarter of 2021, compared with the same quarter of the previous year.”

As a result, non-wage labor costs—like insurance, healthcare, unemployment premiums, etc.—did the bulk of the heavy lifting. In contrast, wage and salary inflation are nowhere near the ECB’s danger zone.

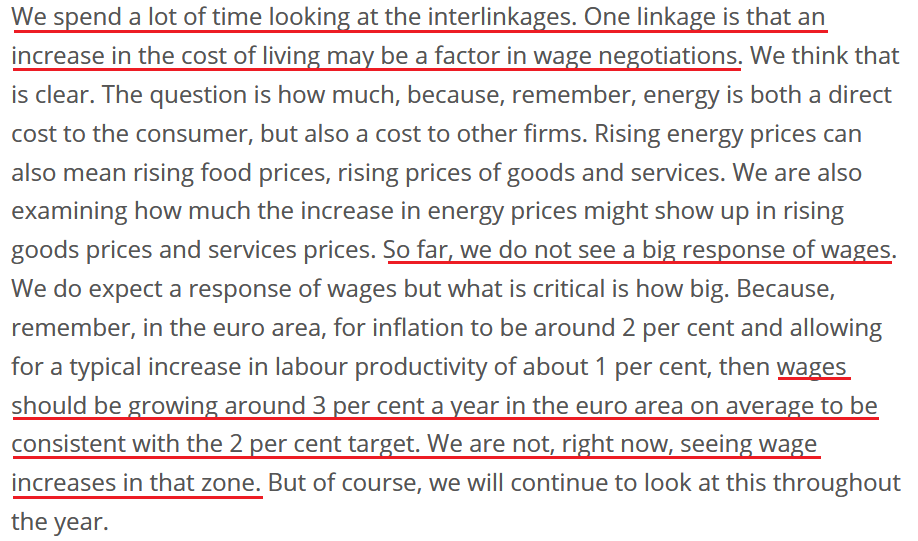

Why is wage inflation so critical? Well, ECB Chief Economist Philip Lane said on Jan. 25:

“We are clear from our December forecast that we expect inflation − in overall terms for this year − to be around 3.2% in the Euro Area, and then to be below 2% in 2023 and 2024 (…). So rather than focus on month by month, we have a clear vision in terms of the overall direction: that the inflation rate will fall later this year.”

More importantly, though:

Source: ECB

As a result, when the ECB’s Chief Economist tells you that wage inflation needs to hit 3% YoY to be “consistent” with the ECB’s 2% overall annual inflation target, a wage print of 2.3% YoY is far from troublesome. Thus, while euro bulls hope that the ECB will mirror the Fed and perform a hawkish 180, the data suggests otherwise.

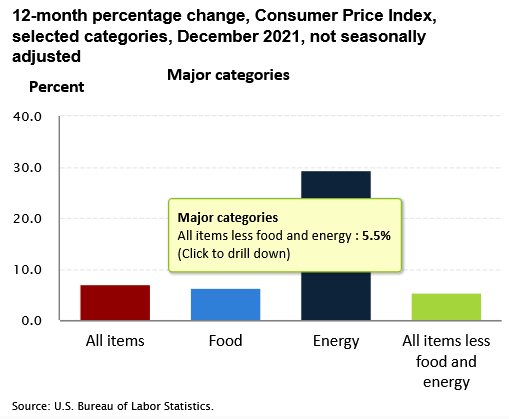

Think about it: why would the ECB raise interest rates when core inflation is at 2.7% YoY and wage inflation is at 2.3% YoY? In stark contrast, U.S. core inflation (the chart below) increased by 5.5% YoY on Jan. 12, and U.S. average hourly earnings increased by 4.7% YoY on Jan. 7. As such, while I’ve stated it on numerous occasions, the Fed and the ECB are worlds apart.

To that point, Giovanni Zanni, Chief Euro Area Economist at NatWest Markets, told clients on Jan. 28:

“markets are increasingly worried that the ECB is behind the curve, but we are less concerned. 18bp of rate hikes priced in by Dec-22 looks too much, we think."

Likewise, Derek Halpenny, Head of Research for EMEA Global Markets at MUFG, stated on Jan. 28:

“there will certainly be more focus on EUR and GBP next week with the ECB and the BoE meeting. The BoE is widely expected to hike but the ECB remains far off that point. We expect EUR to remain under downward pressure over the coming months."

Conversely, with liftoff at the Fed’s March monetary policy meeting likely a done deal, the dove-hawk divergence between the ECB and the Fed remains material.

For context, this is how it started (Nov. 16):

Source: Reuters

And this is how it’s going (Jan. 31):

Source: Reuters

Remember, San Francisco Fed President Mary Daly is a major dove. As a result, she stated on Jan. 31:

"I don't want to predetermine what [the level of interest rates] should be, because I really do see the two-sided risks we're facing, and so I want to be data dependent (...). We have to have our options open, right? And if more is needed, more will be done. If less is needed, less will be done, but we have to have our options open."

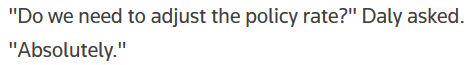

However, when pondering a rate hike in March, Daly said:

Source: Reuters

The bottom line? While the USD Index may come under pressure this week, it’s the same old story: euro bulls bid up the EUR/USD in hopes that the ECB will say or do something hawkish. In the process, dollar weakness spreads to other currency pairs, and the USD Index suffers.

However, once the short-term sentiment highs dissipate, the fundamentals reign supreme. With the Fed all but certain to raise interest rates in March and the ECB poised to disappoint once again, the EUR/USD’s downtrend should continue over the medium term.