With the S&P 500 closing at the lows on Oct. 27 and mining stocks following suit, surging inflation is starting to rattle the financial markets. For example, the Bank of Canada announced on Oct. 27 that it “is ending quantitative easing and moving into the reinvestment phase, during which it will purchase Government of Canada bonds solely to replace maturing bonds.”

And while the hawkish revelation is bullish for the CAD and bearish for the USD/CAD, the latter recovered roughly half of its intraday losses on Oct. 27. Moreover, while the USD/CAD accounts for 9.1% of the USD Index’s movement, the EUR/USD (57.6% of the USD Index’s movement) is the most important currency pair.

To that point, with the European Central Bank poised to reiterate its dovish stance today and the Fed already pre-announcing its taper plans, U.S.-Eurozone inflation differentials should accelerate the Fed’s hawkish outperformance over the next several months.

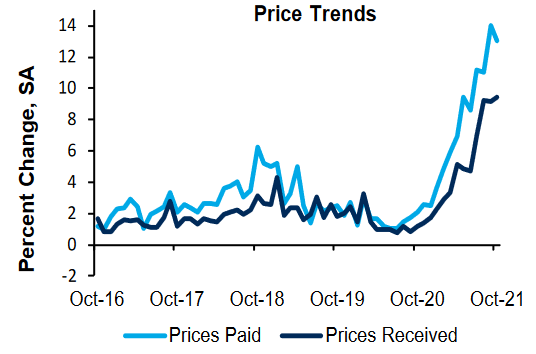

To explain, the Dallas Fed released its Texas Service Sector Outlook Survey on Oct. 26. And while the headline index increased from 14.5 in September to 19.6 in October, the report revealed:

“Wage and price pressures rose in October to extremely high levels. The wages and benefits index increased to 34.7, a record high in the survey’s 14-year history. The selling prices index rose to 22.7, while the input prices index climbed to 47.0 – its highest reading since 2008.”

Likewise, the Dallas Fed’s Texas Retail Outlook Survey (also released on Oct. 26) sang a similar tune:

“Retail price pressures remained highly elevated in October, while wage pressures accelerated. The selling prices index slipped five points to 45.5 – still near a record-high level – while the input prices index rose from 50.1 to 56.3. The wages and benefits index spiked nearly 14 points to 38.3, near the survey’s record high.”

Moreover, the Richmond Fed also released its Fifth District Survey of Manufacturing Activity on Oct. 26. The headline index increased from -3 in September to 12 in October, and the prices received index hit a new all-time high.

Please see below:

Source: Richmond Fed

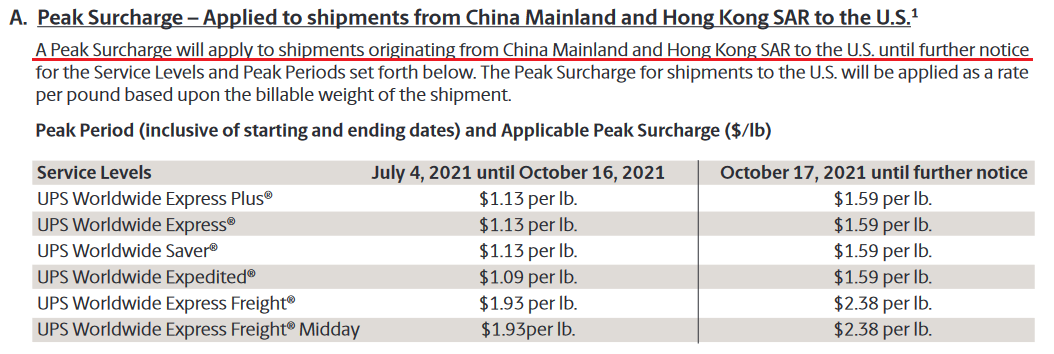

On top of that, the largest U.S. corporations continue to sound the inflationary alarm. For example, United Parcel Service (NYSE:UPS) – a Fortune 500 company and one of the world's largest shipping couriers – released its third-quarter earnings on Oct. 26.

Prior to the print, UPS announced on Oct. 8 that it’s increasing its surcharges on U.S. “shipments originating from China Mainland and Hong Kong SAR” anywhere from 23% to 46% “until further notice.” For context, China accounts for 17.2% of YTD U.S. imports and ranks first among countries where the U.S. imports goods (Mexico is second at 13.8%).

Please see below:

Source: UPS

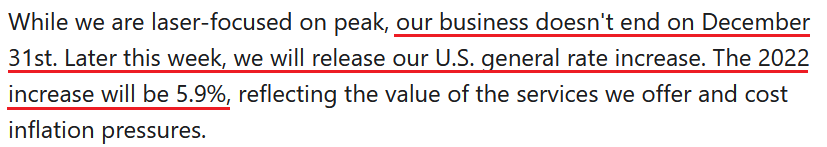

And while UPS also increased its surcharges for several other types of foreign shipments to the U.S., the company announced on Oct. 26 that its domestic rate increases would hit the wire in the coming days:

Source: UPS/The Motley Fool

A Sign Of Things To Come

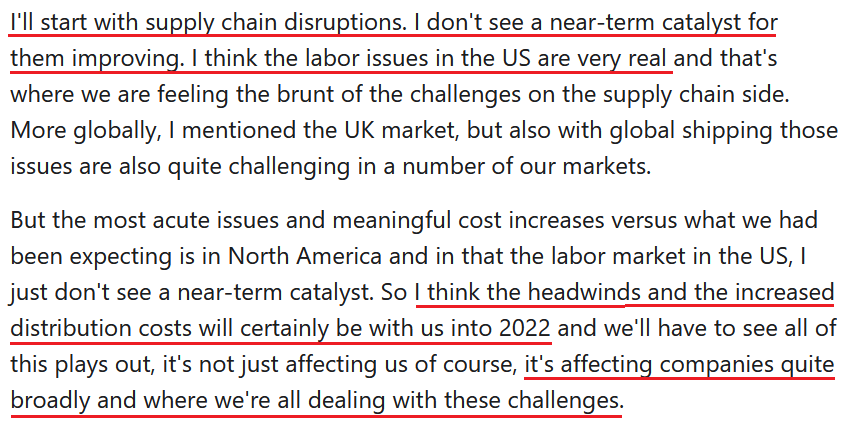

Also sounding the inflationary alarm, Kimberly-Clark (NYSE:KMB) – the maker of Cottonelle, Huggies and Kleenex that has 46,000 employees worldwide – released its third-quarter earnings on Oct. 25. CEO Michael D. Hsu said that “higher inflation and supply chain disruptions increased our costs well beyond the expectation we established just last quarter.”

Moreover, he added that “we had expected commodity prices to ease in the second half of 2021; instead, prices for resin and pulp increased further in the third quarter and are now expected to stabilize at a meaningfully higher level than our prior estimate.”

In addition, while Hsu was light on the specifics, he said that “further pricing actions” are already in the works and CFO Maria Henry said that she expects the cost-push inflationary spiral to continue for the foreseeable future.

Please see below:

Source: Kimberly-Clark/The Motley Fool

Making three of a kind, 3M – which has a market cap of more than $100 billion – released its third-quarter earnings on Oct. 26. CFO Monish Patolawala said that we’re “facing a lot of inflation…. I think the big issue that we have seen as inflation is coming faster than anybody thought…. I would say we don't see the raw material or the inflation environment slowing down in any way. I think you're going to see that volatility.”

As for wage inflation:

“It's a global item, but it's more pronounced right now for us in the U.S. So we are seeing higher cost, whether it is cost driven by some of the items Mike mentioned as well as with the demand that we have, we are spending more money on overtime. And also we are seeing cost of inflation, which is labor cost that comes through us, through outsource manufacturing hard goods that we buy, we're also seeing inflation on that.”

As a result:

Source: 3M/Seeking Alpha

For context, I warned on March 30 that companies wouldn’t sit idly by and watch their profit margins erode.

I wrote:

Didn’t Powell insist that near-term inflation was only “one-time” and “transient?” Well, despite government-issued CPI data failing to capture the effect of the Fed’s liquidity circus, pricing pressures are popping up everywhere. Think about it: with corporations’ decision tree left to raising prices or accepting lower margins, which one do you think they’re likely to choose?

Finally, McDonald’s (NYSE:MCD) – the world's largest fast-food restaurant chain – released its third-quarter earnings on Oct. 27. CEO Chris Kempczinski said the following about wage inflation:

“It's a very challenging staffing environment in the U.S., a little bit less so in Europe, but still challenging in Europe. In the U.S. for us, we are seeing, as I've mentioned a few calls ago that there is wage inflation. Our franchisees are increasing wages over 10% year-to-date [and] our McOpCo restaurants were up over 15% on wages.”

On top of that:

“Pricing and cost pressures are a bigger focus over the last few quarters than they had been previously. Last quarter, I think I talked about how we were seeing roughly a 6% increase year-over-year in the U.S. We are still seeing that and that's pretty much the level we expect for the full-year 2021 over 2020 right around that 6. And that's really to cover both labor cost pressures and commodity cost pressures that we're seeing.”

More importantly, though:

Source: McDonald’s/The Motley Fool

The bottom line?

With inflation surging and the figures coming out of corporate earnings calls nowhere near the Fed’s 2% annual target, the Nov. 2/3 taper announcement will likely be a hawkish appetizer. Right now, investors expect the Fed to hold off on interest rate hikes until well into 2022. Moreover, Fed Chairman Jerome Powell said on Oct. 22 that “I don’t think it is time to raise rates.”

Despite that, though, the Fed remains materially behind the inflation curve. And with commodity inflation, wage inflation and rent inflation creating the perfect storm, the Fed will likely have to accelerate its tightening cycle to calm the pricing pressures. Moreover, with the PMs suffering mightily when the Fed turns hawkish, they’re unlikely to celebrate the inflationary anxiety that should grip the Fed over the next few months.

In conclusion, precious metals were mixed on Oct. 27 and mining stocks continued their underperformance. And after the USD Index shrugged off the intraday volatility, the dollar basket continues to showcase strength when faced with adversity. Moreover, with a taper announcement only cementing the greenback’s fundamental foundation and more hawkish rhetoric from the Fed poised to enhance the U.S. dollar’s uptrend over the medium term, the 2021 theme of ‘USD Index up, precious metals down’ should remain alive and well over the next few months.