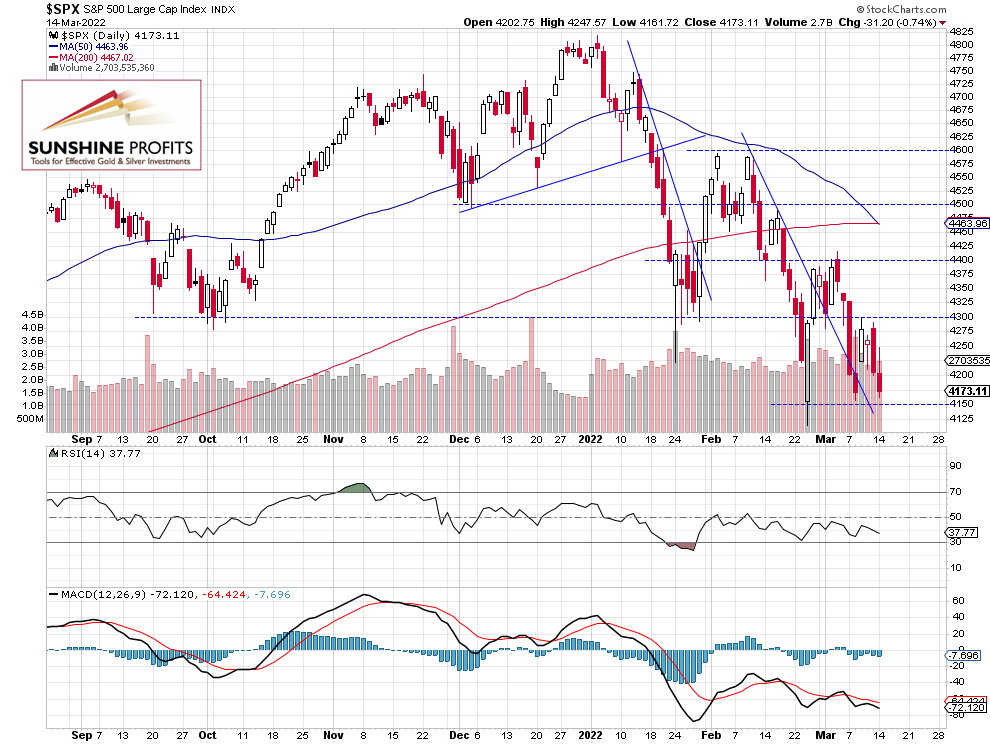

The S&P 500 index yesterday extended the decline from Friday, but it remained within a week-long volatile consolidation. Is this a medium-term bottoming pattern?

The broad stock market index lost 0.74% on Monday, after a decline of 1.3% last Friday. The market bounced from the short-term resistance level of 4,300 and it extended a volatile consolidation following the early March sell-off from the 4,400 level. Last Tuesday, it reached the local low of 4,157.87 and then rebounded to the 4,300 level. Yesterday, the S&P 500 came back below the 4,200 level again.

The market is closer to the Feb. 24 local low of 4,114.65. It was 704 points, or 14.6%, below the Jan. 4 record high of 4,818.62. There’s still a lot of uncertainty concerning the ongoing Ukraine conflict. This Producer Price Index is release this morning, while market awaits the important FOMC Statement release tomorrow, when we may see some further consolidation.

The nearest important resistance level is now at around 4,200. On the other hand, the support level is at 4,100-4,150. The S&P 500 index continues to trade slightly above the recently broken downward trend line, as we can see on the daily chart.

(Xhart by courtesy of http://stockcharts.com)

Futures Contract Trades Along Previous Lows

Let’s take a look at the hourly chart of the S&P 500 futures contract. Today it is bouncing from the 4,140 level. It’s a support level marked by the previous local low. The support level is also at 4,100.

We are still maintaining our long position, as we are expecting an upward correction from the current levels.

(Chart by courtesy of http://tradingview.com)

Conclusion

The S&P 500 index will likely bounce this morning following better-than-expected producers’ inflation data release. The market may extend its volatile consolidation and we may see more uncertainty, as investors will be waiting for Wednesday’s FOMC Statement release.

Here’s the breakdown:

- The S&P 500 index will likely bounce this morning, but we may see some more short-term uncertainty.

- We are maintaining our long position (opened on Feb. 22).

- We are still expecting an upward correction from the current levels.