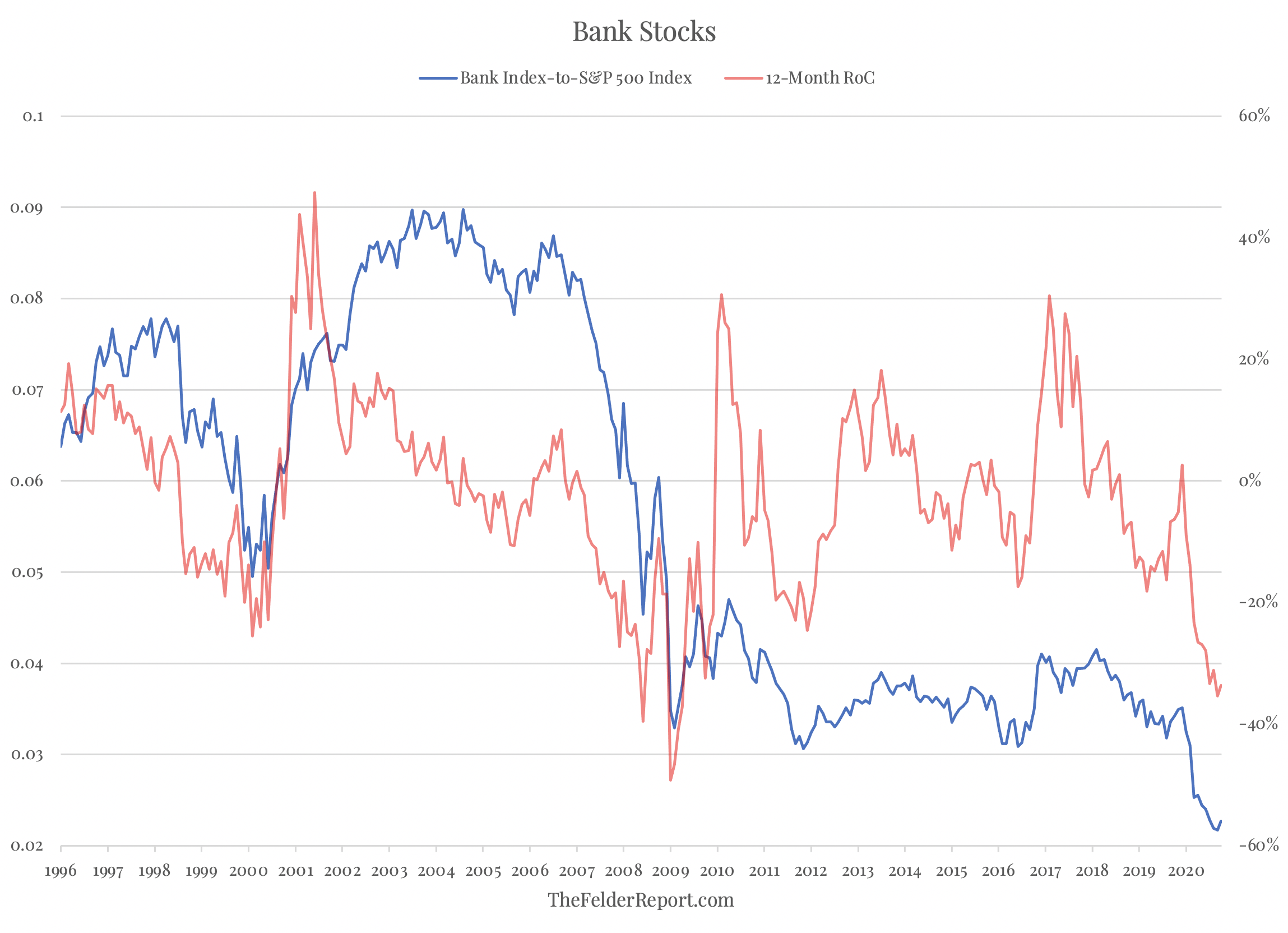

In addition to energy, the banking sector has been one of the worst-performing groups in the market this year (which always gets my attention). The Bank Index is down more than 30% year-to-date while the S&P 500 Index is actually up on the year. Over the past few decades, it was only during the Great Financial Crisis and at the peak of the Dotcom Mania that we saw such a dramatic disparity in the performance of the two.

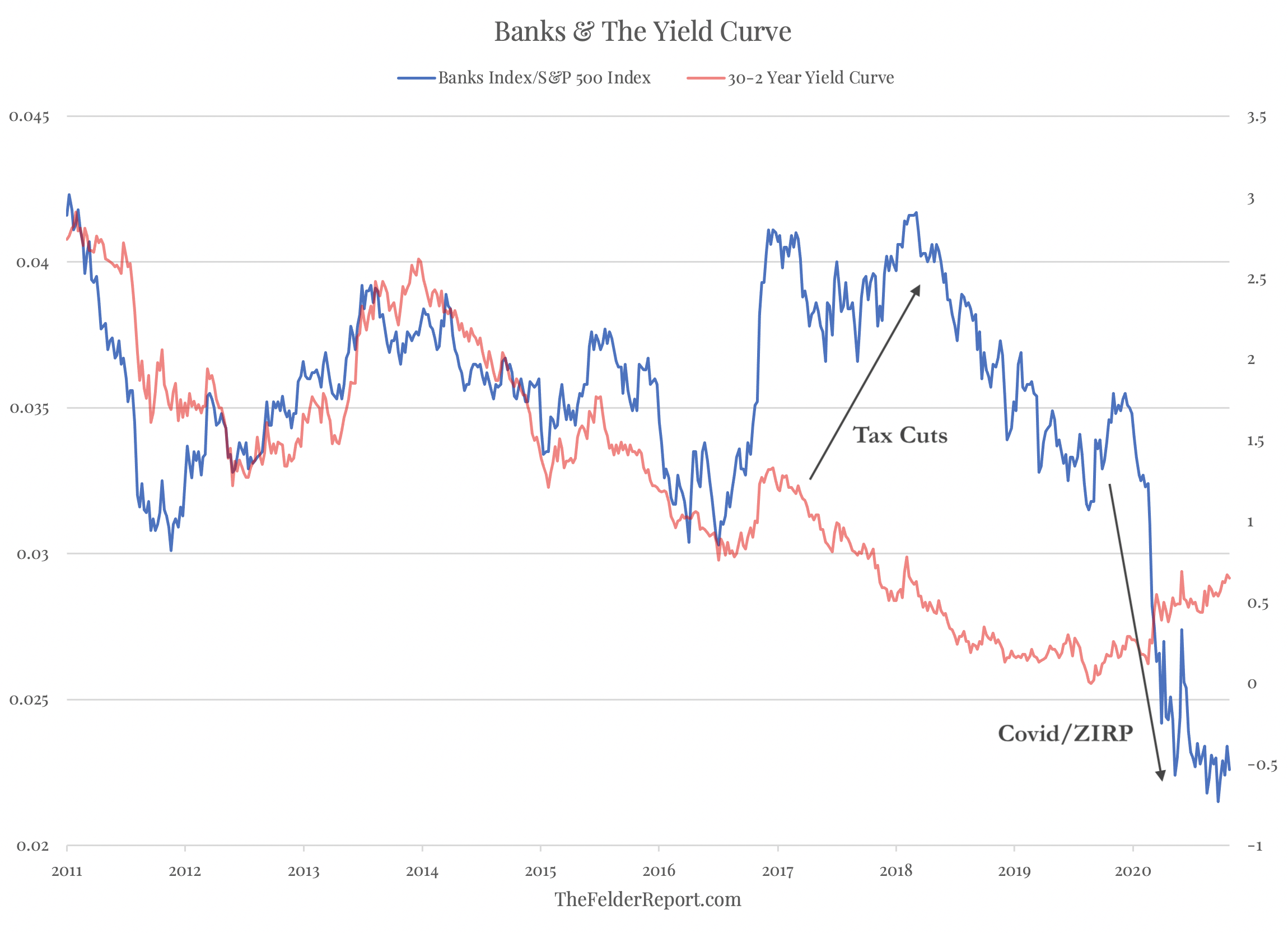

What’s especially interesting about the banks’ underperformance this year is that it has come during a time when the yield curve has been widening. Typically, a flattening yield curve leads to underperformance for the banks and a widening yield curve leads to outperformance. This relationship was upset in a bullish fashion by the tax cuts and other deregulatory efforts which came about as a part of Donald Trump’s election. This year it has been upset in a bearish fashion by investor worries over the default cycle and also over net interest margins amid projections of low interest rates indefinitely into the future.

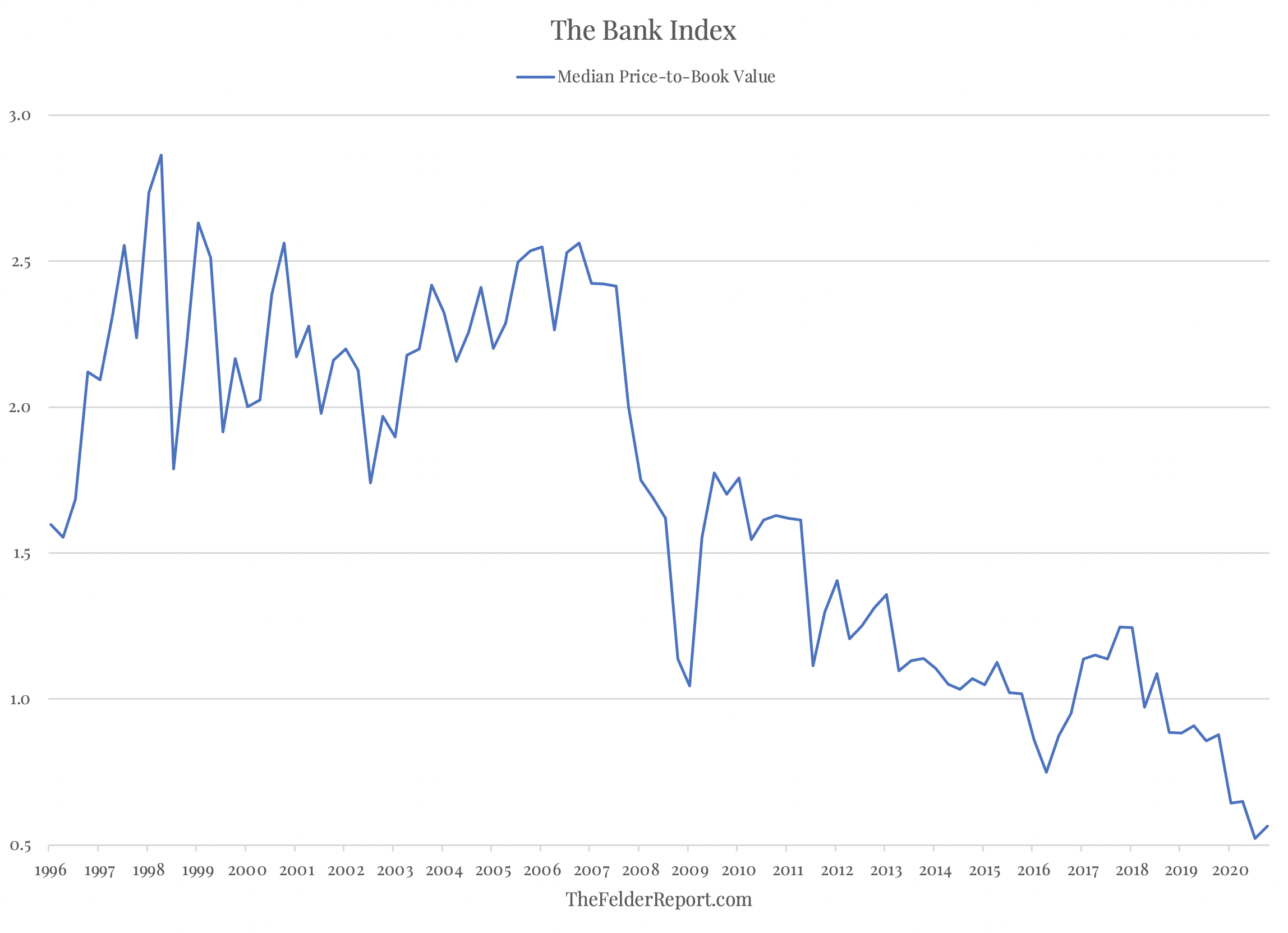

From a valuation standpoint, it’s hard to argue the banks haven’t already priced in a great deal of negative news about both defaults and persistently low rates. The median price-to-book value for the Bank Index is lower than it has been at any time over the past 25 years.

The question investors must answer is whether these concerns that have led to banks’ underperformance despite a widening yield curve are justified, as they were in 2008, or whether this is an opportunity to buy bank stocks on the cheap, as it was back in 2000. As Howard Marks wrote in The Most Important Thing, “to achieve superior investment results, you have to hold nonconsensus views regarding value, and they have to be accurate. That’s not easy.” But that’s where the real money is made.