Hasbro Inc. (NASDAQ:HAS) posted mixed second-quarter 2017 results, wherein earnings surpassed the Zacks Consensus Estimate while revenues slightly lagged the same.

Change in Reporting

Notably, since first-quarter 2017, Hasbro started reporting its revenues by brand portfolios that include Franchise Brands, Partner Brands, Hasbro Gaming and Emerging Brands. The company has ceased providing revenue breakdown by product category: Boys, Games, Girls and Preschool.

Earnings and Revenues Discussion

Adjusted earnings of 53 cents per share beat the Zacks Consensus Estimate of 46 cents by 15.2% and surged 29.3% year over year.

Hasbro's net revenue of $972.5 million also rose 11% over the prior-year quarter. However, revenues lagged the Zacks Consensus Estimate of $973 million by nearly 0.1%. Notably, revenues improved in three out of its four brand portfolios.

While Franchise Brands, Partner Brands and Hasbro Gaming recorded a gain, revenues declined at Emerging Brands.

Hasbro's cost of sales ratio increased 130 basis points (bps) to 37.9%. Meanwhile, selling, distribution and administration expenses declined 80 bps but royalty expense ratio rose 20 bps. Additionally, operating profit improved 17.8% year over year to $100 million.

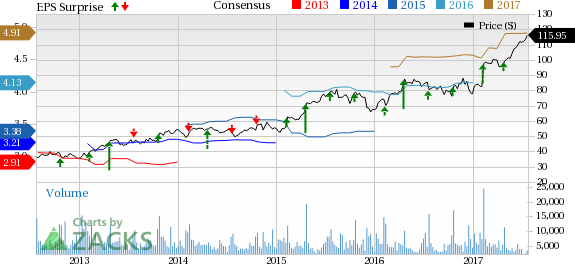

Hasbro, Inc. Price, Consensus and EPS Surprise

Behind the Headline Numbers

The Franchise Brand portfolio posted revenues of $545.7 million, up 21% year over year, driven by revenue growth in Magic: The Gathering, Nerf, Transformers and Monopoly brands.

Partner Brand revenues increased 1% to $230.0 million one the back of growth in Beyblade, Dreamworks’ Trolls, Marvel and Disney Princess brands.

The Hasbro Gaming portfolio recorded a 6% year-over-year rise in revenues to $133.9 million. This uptick reflects Hasbro’s diverse gaming portfolio, including face-to-face gaming, off-the-board gaming and digital gaming. Several new games as well as traditional ones such as Dungeons & Dragons and Operation also aided the momentum.

Meanwhile, Emerging Brands revenues declined 14% to $62.9 million, due to declines in Playskool, Super Soaker and Easy-bake Oven products.

Regionally, net revenue from the U.S. and Canada segment increased 16% to $494.4 million, supported by growth in Franchise Brands, Partner Brands and Hasbro Gaming portfolios. However, the same was partly offset by a dip in Emerging Brands revenues in the region. In fact, this segment reported operating profit of $81.6 million, reflecting a jump of 41% year over year.

International revenues were $426.6 million, up 6% year over year. Revenue growth in Franchise Brands and Hasbro Gaming was offset by a decline in Emerging and Partner Brands. Notably, increased sales were registered across Latin America, Emerging markets, Europe and Asia Pacific regions. However, international operating profit was $16.9 million, down 43% from a year ago.

The Entertainment and licensing segment revenues declined 1% year over year to $51.5 million, as growth in Digital Gaming led by Backflip Studios was offset by declines in entertainment revenues. Furthermore, the segment's operating profit declined 18% to $11.3 million.

Zacks Rank & Upcoming Releases

Currently, Hasbro holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

JAKKS Pacific, Inc. (NASDAQ:JAKK) is scheduled to report second-quarter 2017 numbers on Jul 25. The Zacks Consensus Estimate for the quarter is pegged at a loss of 24 cents per share.

Mattel, Inc. (NASDAQ:MAT) and Electronic Arts, Inc. (NASDAQ:EA) are expected to release their quarterly numbers on Jul 27. The Zacks Consensus Estimate for the quarter is pegged at a loss of 8 cents for Mattel and 14 cents for Electronic Arts.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

JAKKS Pacific, Inc. (JAKK): Free Stock Analysis Report

Hasbro, Inc. (HAS): Free Stock Analysis Report

Mattel, Inc. (MAT): Free Stock Analysis Report

Electronic Arts Inc. (EA): Free Stock Analysis Report

Original post

Zacks Investment Research