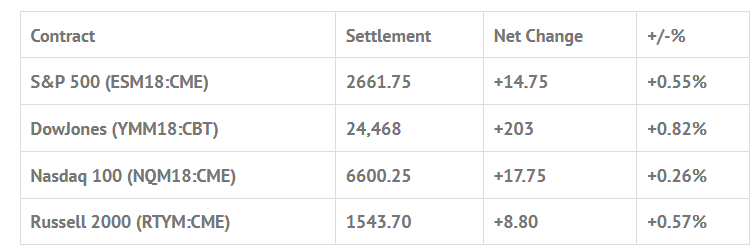

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 6 out of 11 markets closed lower: Shanghai Comp -0.15%, Hang Seng +1.11%, Nikkei -0.36%

- In Europe 12 out of 12 markets are trading lower: CAC -0.32%, DAX -0.58%, FTSE -0.20%

- Fair Value: S&P -0.31, NASDAQ +11.82, Dow -27.19

- Total Volume: 1.6mil ESM, and 666k SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Employment Situation 8:30 AM ET, Charles Evans speaks on Saturday 10:30 AM ET, Baker-Hughes Rig Count 1:00 PM ET, Jerome Powell Speaks 1:30 PM ET, Consumer Credit 3:00 PM ET, and John Williams Speaks 4:00 PM ET.

S&P 500 Futures: #ES Rallies 112.50 Handles In One And A Half Days

Whenever you hear that the S&P 500 futures has not had back to back up days in over a month, you know something has to give. After the Chinese struck back with its tariffs list on Tuesday night, the ES sold off down to 2559.25 on Globex Wednesday morning, and then traded up to 2672.25 Thursday at 11:00 CT, a +112.50 handle rally.

On yesterdays 8:30 open, the ES traded 2660.75, up +13.75 handles. After the open, the ES traded up to 2662.75, sold off down to 2651.00, back and filled a bit, then rallied up to 2672.25, up +25.75 handles on the day. After the high, the futures pulled back to the 2661.25 level, made a lower high at 2669.75, and then sold off down to 2640.00 at 12:45. At 2:20 CT, the ES traded back up 2672.00, one tick off the high of the day, as the MiM showed $700 to buy MOC. The ES then sold off down to 2658.25 at 2:41.

On the 2:45 cash imbalance reveal, the MiM ended up showing $1 billion to buy, and the futures traded 2665.25. On the 3:00 cash close the ES traded 2668.00, and then went on to settle at 2662.75 on the 3:15 futures close, up +15.75 handles or +0.59%.

In the end, one of MrTopStep’s favorite rules applies; it takes days and weeks to knock the ES down and only one to bring it back. Is the decline over? No, but for now there has been a big momentum shift. Will it last? Only until the next bad China tariff headline hits!

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.