Investor sentiment has wobbled recently, but there’s still room for debate on whether the appetite for risk has peaked for this market cycle. Using a set of ETF pairs to gauge conditions shows that the strongest case for optimism resides in a global asset allocation framework. A more granular view of markets, however, paints a mixed picture, based on prices through Wednesday’s close (Oct. 9).

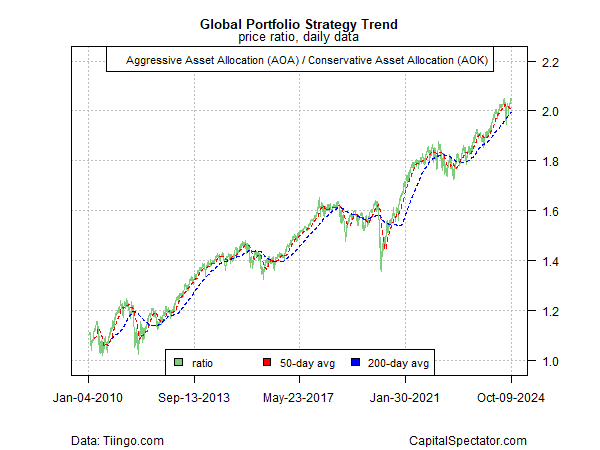

Let’s start with the good news: A big-picture profile of global asset allocation has rebounded sharply. After testing support levels in the past two months (see here and here), but never signaling a clear risk-off signal, the ratio for an aggressive mix of global assets (AOA) vs. a conservative counterpart (AOK) has rallied over the past several weeks and is close to the record high set in mid-July.

The implication: market sentiment remains bullish and prices appear on track to set new highs in the near term. If this ratio takes out its previous peak, the news will strengthen the case for maintaining a risk-on bias in global strategies.

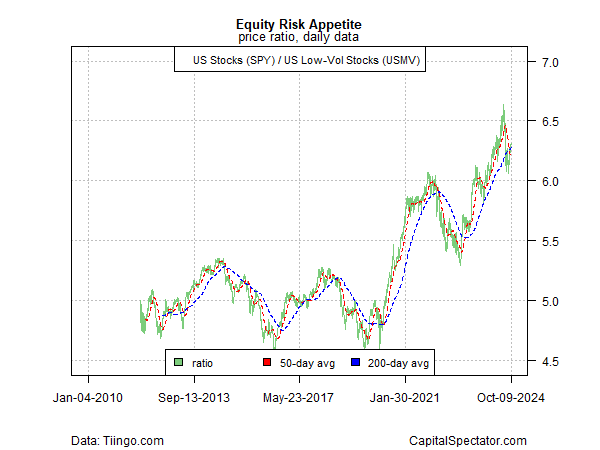

The profile for US equities, however, is a bit more nuanced. Although the S&P 500 Index closed at a new record high yesterday, a sentiment proxy for stocks is still reflecting a more cautious posture, based on the ratio for a broad equities ETF (SPY) vs. a low-volatility portfolio of stocks (USMV).

Although this ratio has recovered some of its upside momentum lately, it remains well below its previous peak, which suggests market momentum in this space is still modest at best.

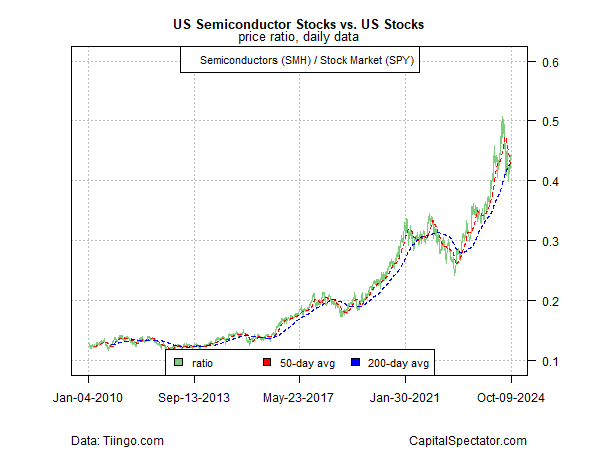

A similar profile applies to the ratio for semiconductor stocks (SMH) vs. the broad US equities market (SPY).

Semis are thought to be a useful proxy for the business cycle and so the modest rebound for these shares in relative terms suggest a degree of caution endures for the near-term outlook.

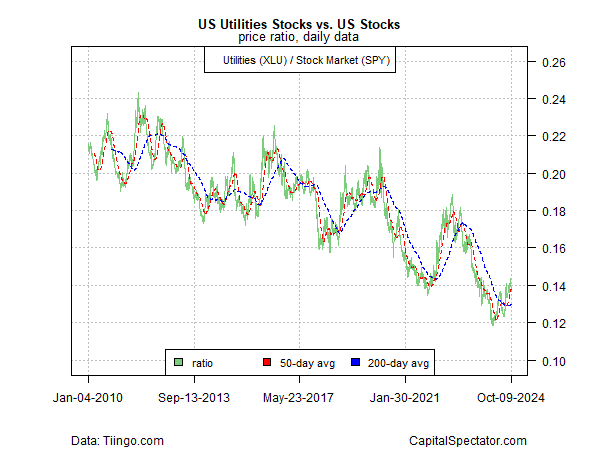

Meanwhile, the safe-haven trade via utilities stocks (XLU) relative to equities overall (SPY) continues to signal a renewed appetite for defensive holdings.

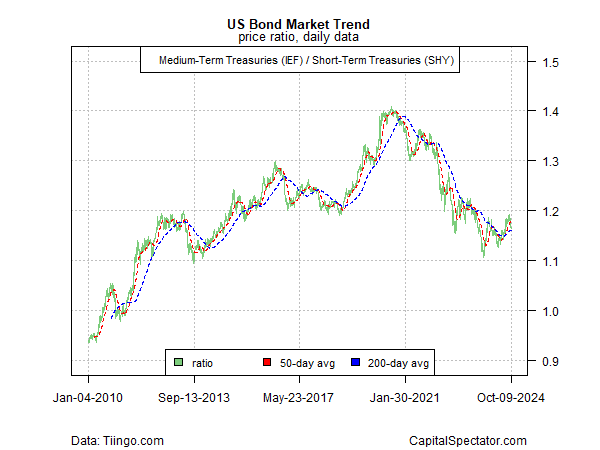

The US bond market has enjoyed renewed strength recently, but a proxy for risk appetite in this space suggests the jury’s still out on whether fixed income is set for an extended bull run, based on a ratio of medium- (IEF) vs. short-term Treasuries (SHY).

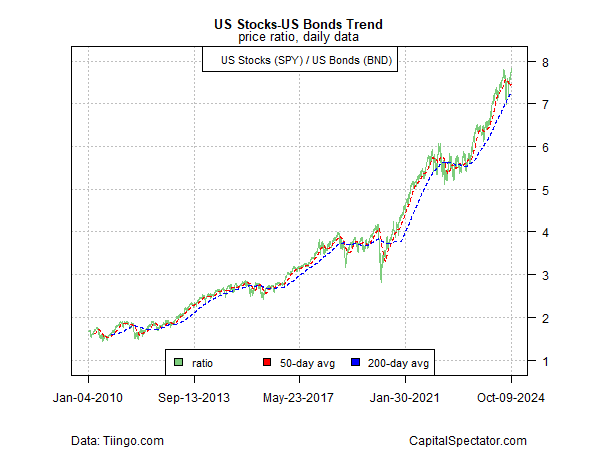

One pushback to the cautious signaling discussed above is the ratio of US stocks (SPY) to US bonds (BND), a proxy that ticked up to a new record high yesterday.

If this ratio continues to push higher in the weeks ahead, the rally will provide support for thinking that there’s still a net-positive skew in favor of risk-on sentiment for the basic US-oriented asset allocation space.