S&P 500 to hit 7,100 by end-2025: Wells Fargo

It turned out that the pronouncements late Tuesday by Kaplan and Kashkari were an opening act in yesterday’s appearance by Jerome Powell. The Fed chair’s realistic and grim assessment just served to put pressure to throw yet another lifeline to the real economy. While this is far from the last Fed’s word, the bulls didn’t really find anything to cheer. We’ve issued an intraday Alert to jump in immediately onto the short side of the market to take advantage of the just unfolding slide! As the Congress is split on the Democrat-proposed $3-trillion bill, how far can it go on?

S&P 500 in the Short-Run

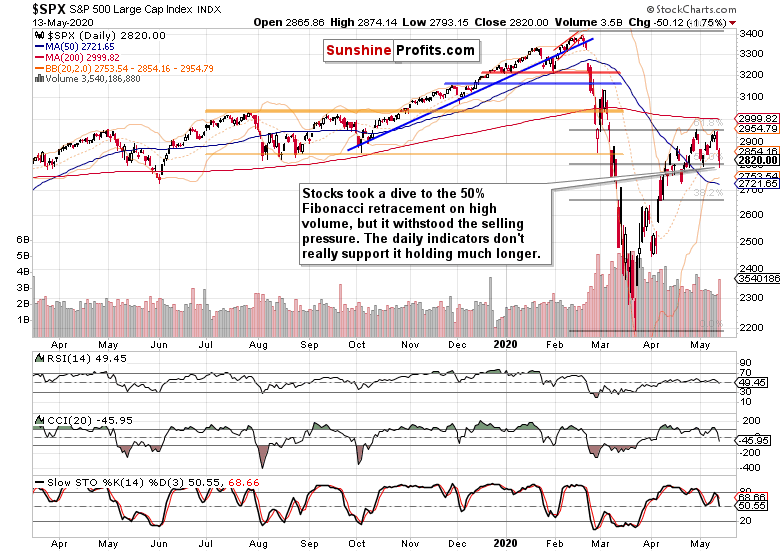

Let’s start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Despite some encouraging signs of overnight stabilization, stocks gave up the gains just as the Powell speech went on. Diving on heavy volume, the 50% Fibonacci retracement provided support to the buyers yesterday. Given the sell signals of the daily indicators, we’re of the opinion that this support won’t likely hold for too long.

This is how we have summarized it in our yesterday’s intraday Stock Trading Alert:

After the back-and-forth trading of recent weeks and all the signals favoring either the bulls or the bears at different junctures, the prevailing direction appears to be down now.

Powell delivered his own version of the Fed has given its best shot and coupled it with a call for more fiscal action. The point that the markets focused on the most, appears to be that despite the swift response and pledge to do more (while ruling out negative interest rates), it’s the admittance of serious downside risks to the real economy and the fragile nature of the much-hyped recovery.

Both stocks and junk corporate bonds gave up on their efforts to reverse the preceding downswings, and stocks as the more vulnerable ones are leading on the way down. After all, should some of the reopening efforts backfire, what state of confidence would that leave the consumers and companies 6 or 8 weeks from now? The valuations would be even more extended than they have been already.

Thus, more twisting of the policy-makers’ arms rules the day, and given the credit markets – S&P (NYSE:SPY) 500 sectors dynamics, won’t likely end all that soon.

Coupled with the testimony by White House adviser Dr. Anthony Fauci, second wave outbreaks around the world and outside the State of New York clusters of domestic infections, those was no good news for the bulls. It appears that similarly to the run-up to the coronavirus plunge during February, stocks are first slowly, then more quickly coming to realization of the serious downside risks. Back then, the credit markets were showing non-confirmation of the stock advance to the all-time highs almost on a daily basis – eventually resolving with a slide, and the rest is history, as they say.

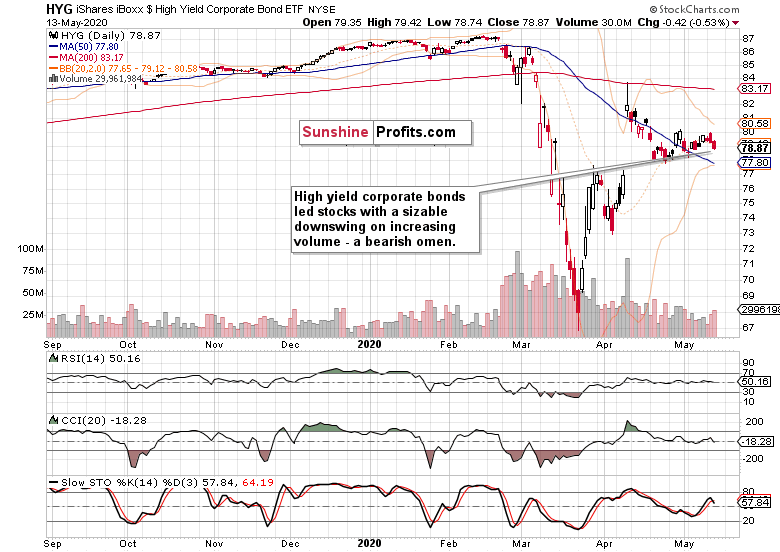

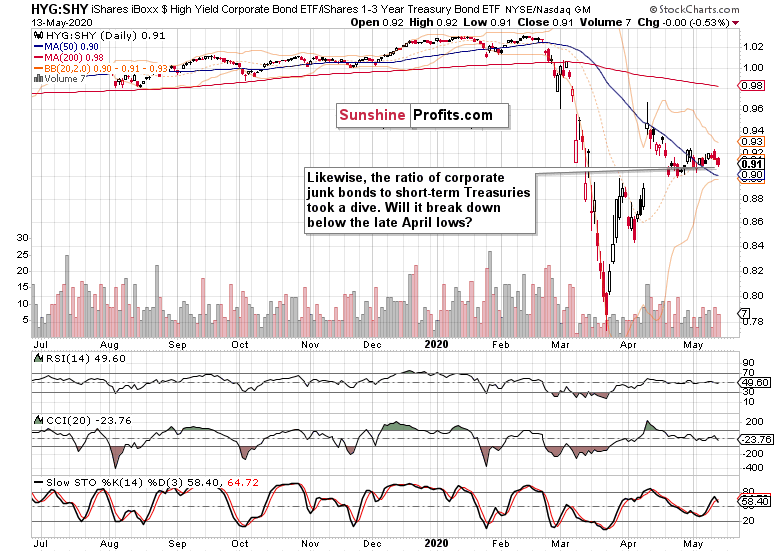

How do the credit markets look after yesterday’s session exactly?

The Credit Markets’ Point of View

High-yield corporate debt (HYG ETF) went slowly but surely deeper into the red as the session progressed. The sizable volume behind the two-day downswing is a warning sign, pointing to more downside ahead. Selling into the Fed’s hands on the acknowledged tough times ahead, anyone?

Importantly, the junk bond ratio to short-dated Treasuries (HYG:SHY) confirms the above assessment. As the next likely step, the challenge of late April lows looms – and for

the HYG ETF as well.

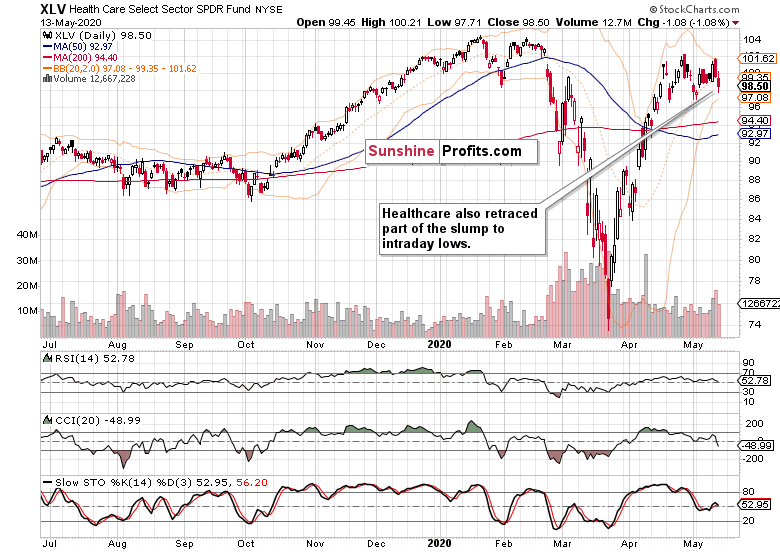

Key S&P 500 Sectors in Focus

Technology declined on heavy volume, but retraced a part of the move lower. The daily indicators though wouldn’t agree that a local bottom is in. As a result, we expect more downside action over the coming sessions, which is supported by volume picking up on the downside.

The healthcare (XLV ETF) bulls didn’t step in as strongly before the closing bell, and yesterday’s volume wasn’t as large as in case of tech, relatively speaking. But these are the two most resilient sectors that have been performing strongest in the race off the March 23 lows – and still, their current price action leans bearish.

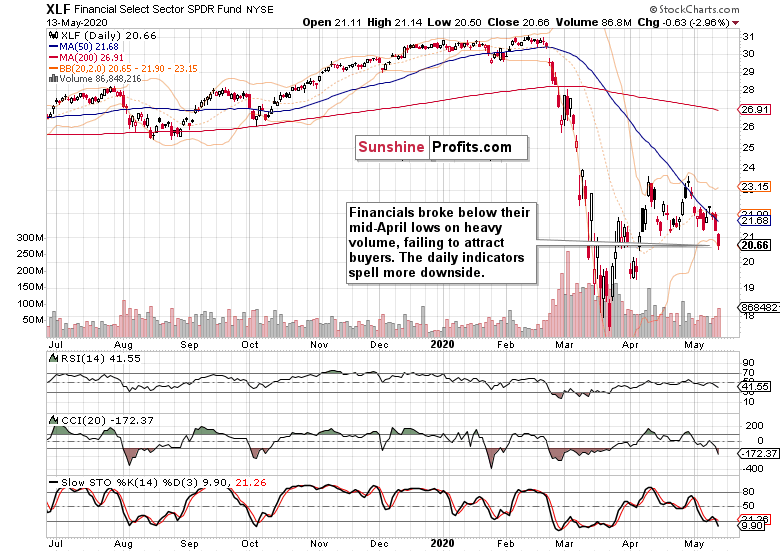

Out of the heavyweight, finance (XLF ETF) has been the weakest – both yesterday and since March 23. With buyers nowhere to be seen and the daily indicators as bearish as they get, downswing continuation is the path of least resistance here.

The early bull market sectors (energy, materials, industrials) also took a beating on highvolume yesterday. Industrials (XLI ETF) are the weakest among them, already trading below their late-April lows. The bearish outlook they give (i.e. the bull market hypothesis being put to this heavy a test), is confirmed by the Russell 2000 (IWM ETF) downswing, again on high volume giving it credibility.

In closing, it appears that stocks won’t shake of another several million new unemployment claims figure as gracefully as last week – and that‘s an understatement.

Summary

Summing up, the bullish case appears increasingly lost as stock attempt to break below the 50% Fibonacci retracement. And given the momentum, credit markets’ performance and sectoral dynamics, it’s likely that the bears will succeed. Should the HYG ETF break below the late April lows, the bearish case would get a new lease of life. Combining the technical and fundamental developments though, the sellers are holding the upper hand currently regardless – the unfolding downswing is well placed to go on lower still. Our open and increasingly profitable short position remains justified.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes dozens of winning stock portfolios chosen by our advanced AI.

Year to date, 3 out of 4 global portfolios are beating their benchmark indexes, with 98% in the green. Our flagship Tech Titans strategy doubled the S&P 500 within 18 months, including notable winners like Super Micro Computer (+185%) and AppLovin (+157%).

Which stock will be the next to soar?