Harris Corporation (NYSE:HRS) — a leading player in the field of technology innovations — recently announced a dividend hike. The move indicates the company’s commitment to create value for shareholders as well as underlines its confidence in business growth.

The company raised quarterly dividend by 8% to 57 cents per share (or $2.28 annually) from 53 cents (or $2.12 annually). Approved by the company’s board of directors, this new payout will be made on Sep 22, 2017, to stockholders of record as on Sep 8. This is the 16th such annual dividend increase by the company.

Meanwhile, William M. Brown, Chairman, President and CEO of the company, anticipates 2018 to be a year of growth at Harris and is also hopeful about its long-term outlook. The company now expects earnings per share (on an adjusted basis) for fiscal 2018 in the band of $5.85 to $6.05. Revenues for the same are projected in the range of $6.02-$6.14 billion.

As investors prefer an income generating stock, a high dividend-yielding one is obviously much coveted. Needless to say that investors are always on the lookout for companies with a track record of consistent and incremental dividend payments to put their money on.

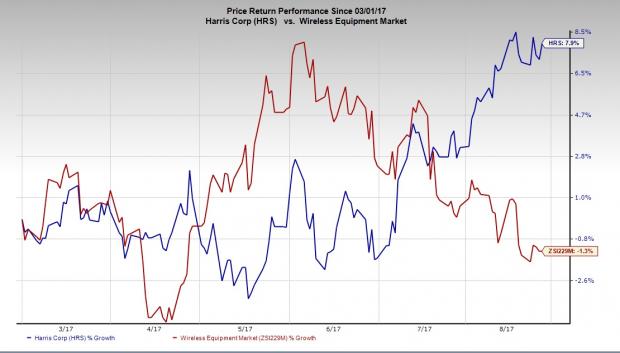

Harris has been performing well of late. Shares of the company have gained 7.9% in the last six months as against the industry’s decline of 1.4% during the period.

The dividend rise is likely to further improve the stock.

Zacks Rank & Key Picks

Harris currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the Computer and Technology sector are InterDigital, Inc. (NASDAQ:IDCC) , Juniper Networks, Inc. (NYSE:JNPR) and Sonus Networks, Inc. (NASDAQ:SONS) . While InterDigital and Juniper Networks sport a Zacks Rank #1 (Strong Buy), Sonus Networks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

InterDigital has an impressive earnings history, surpassing the Zacks Consensus Estimate in three of the last four quarters with an average beat of 15.2%.

On the other hand, Juniper Networks’ shares have rallied 18.8% in a year, while shares of Sonus Networks have climbed 17.1% in the past six months.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Juniper Networks, Inc. (JNPR): Free Stock Analysis Report

Harris Corporation (HRS): Free Stock Analysis Report

InterDigital, Inc. (IDCC): Free Stock Analysis Report

Sonus Networks, Inc. (SONS): Free Stock Analysis Report

Original post

Zacks Investment Research