Harmony Gold Mining Company Limited (NYSE:HMY) posted adjusted earnings of 22 cents per share for fiscal 2017 (ended Jun 30, 2017), compared with adjusted earnings of 15 cents per share recorded a year ago, a 47% year over year increase. The improvement was driven by an increase in gold prices along with gains from Hidden Valley acquisition as well as commodity and currency hedges.

Revenues and Costs

Revenues increased 12% year over year to $1,417 million in fiscal 2017 from $1,264 million registered in fiscal 2016.

Gold production increased by roughly 1% year over year to 1,087,852 ounces (oz) in fiscal 2017 and exceeded guidance of 1.05 million ounces (Moz). Gold ounces sold, rose 2% year over year to 1,097,944 oz in fiscal 2017. Gold prices received was $1,304 per oz in fiscal 2017, up 12% from $1,169 per oz a year ago.

Cost of sales increased 33.2% year over year to $1,449 million in fiscal 2017. Cash operating costs rose by 19% year over year to $1,000 per oz. All-in-sustaining costs (AISC) of $1,182 per oz rose 18% year over year from $1,003.

Financial Overview

Cash and cash equivalents increased 11.8% to $95 million as of Jun 30, 2017 from $85 million as of Jun 30, 2016. Cash flow generated from operating activities was $280 million for the fiscal ended Jun 30, 2017, down 10.3% year over year.

Harmony declared a final dividend of 3 cents per share for fiscal 2017.

Outlook

According to Harmony, its successful hedging strategy enabled the company to generate cash flows, helping it reduce net debt and invest in Hidden Valley. The mine is expected to generate 180,000 ounces of gold per annum by fiscal 2019. In fiscal 2018, Harmony plans to produce roughly 1.1 Moz at AISC of about $ 1,180 per ounce.

Moving ahead, the company plans to focus on exploration activities, unlock value of Golpu, identifying value accretive acquisitions, improving asset quality and reduce costs. It also aims to become a 1.5 Moz gold producer in fiscal 2019.

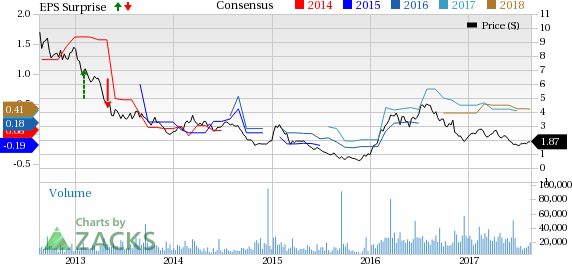

Price Performance

Shares of Harmony have lost 20.1% in the last three months, significantly underperforming the industry’s 1.1% decline.

Zacks Rank & Key Picks

Harmony currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are Akzo Nobel N.V. (OTC:AKZOY) , Arkema S.A. (OTC:ARKAY) and Kronos Worldwide Inc. (NYSE:KRO) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Akzo Nobel has expected long-term earnings growth rate of 11.1%.

Arkema has expected long-term earnings growth rate of 12.8%.

Kronos has expected long-term earnings growth rate of 5%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Arkema SA (ARKAY): Free Stock Analysis Report

Akzo Nobel NV (AKZOY): Free Stock Analysis Report

Harmony Gold Mining Company Limited (HMY): Free Stock Analysis Report

Original post

Zacks Investment Research