Harley-Davidson Inc. (NYSE:HOG) launched 13 new models as part of product-development initiative. Of the 13 vehicles, five are new touring bikes and eight are all-new Softail Big-Twin cruisers. This recent launch is a company’s initiative to roll out 100 new motorcycles in the auto market by 2027.

Per Paul James, manager of Harley-Davidson’s product portfolio, the new versions are for current riders and to attract new customers.

The eight new Softail models include Fat Boy, Heritage Classic, Low Rider, Softail Slim, Deluxe, Breakout, Fat Bob and Street Bob.

Harley-Davidson, Inc. Price and Consensus

All the newly unveiled models consist of the company’s Milwaukee-Eight engine. Other added features are daymaker LED headlamps, a USB charging port, an improved electrical system for charging and fuel tanks.

The company expands product portfolio and engages in long-term investments to increase the customer base. The recently-launched 2017 model of touring motorcycles are also witnessing a steady rise in demand. This upside is driven by strong Milwaukee-Eight touring motorcycle sales, spurting revenue growth both in the United States and abroad.

The motorcycle manufacturer is also developing its first electric motorcycle, Project LiveWire. Good news is that the company aims to create two million new Harley-Davidson riders in the United States and increase its international business to 50% of total annual volume sales.

For growing the riders’ strength, the company continues to invest in Harley-Davidson Riding Academy, which saw a 10% year-over-year rise in students’ footfall in first-quarter 2017.

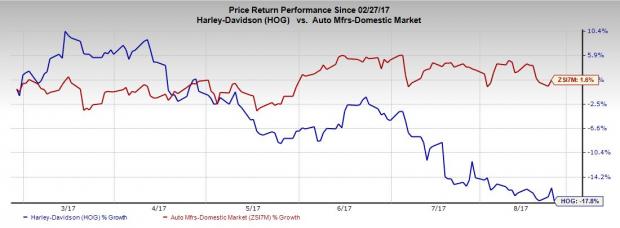

Price Performance

Harley-Davidson’s shares have plunged 17.8% in the last six months, substantially underperforming the 1.6% gain of the industry it belongs to.

Zacks Rank & Key Picks

Harley-Davidson currently carries a Zacks Rank #5 (Strong Sell).

A few better-ranked automobile stocks are Continental AG (OTC:CTTAY) , Cummins Inc. (NYSE:CMI) and Fox Continental Holding Corp. (NASDAQ:FOXF) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Continental has a long-term growth rate of 7.9%.

Cummins has an expected long-term earnings growth rate of 12.1%.

Fox Factory has a long-term growth rate of 16.1%.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

Fox Factory Holding Corp. (FOXF): Free Stock Analysis Report

Cummins Inc. (CMI): Free Stock Analysis Report

Harley-Davidson, Inc. (HOG): Free Stock Analysis Report

Continental AG (CTTAY): Free Stock Analysis Report

Original post

Zacks Investment Research