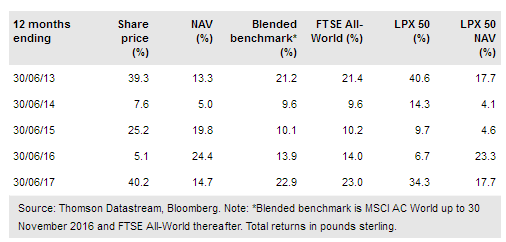

HarbourVest Global Private Equity Ltd (LON:HVPEa) gives investors access to selected private equity (PE) managers globally and a highly diversified portfolio of over 7,000 underlying companies. HVPE will celebrate its 10th anniversary in December 2017 and since inception its shares have outperformed global listed and unlisted equities, represented by the FTSE All-World and LPX 50 indices, by 11% and 36%, respectively. This solid performance is consistent with the mandate to generate long-term capital growth above global equities, and has been achieved with relatively low volatility due to HVPE’s high level of diversification.

Investment strategy: Diversified global exposure

HVPE provides a highly diversified route into the unlisted sector, which is many times larger than the listed sector and difficult for most individual investors to access directly. HarbourVest funds invest in third-party managers’ PE funds globally, using a network of specialists and relationships built up over 35 years. HVPE’s resulting overall portfolio is highly diversified by vintage year, strategy (dominated by buyout plus venture and growth capital), geography and industry, with more than 7,000 underlying companies. The investment mandate is to generate capital growth in excess of listed equities, hence the company does not pay a dividend, instead reinvesting cash proceeds into new opportunities.