To all of our clients and colleagues in the UK Happy Brexitversary.

It's been an entire year since Theresa May triggered Article 50 setting Great Britain on an unalterable path to separate herself from the European Union.

After a year of negotiations, it seems we've managed to nail down the divorce bill. Even though there aren't any specific figures at least there is a framework to decide how much the UK will pay to leave. The state of the Irish border on the other hand remains up in the air.

The pound sterling has completely recovered from the night of the referendum where it lost more than 10% of its value within 24 hours but inflation remains high. We're just getting some more economic data now and will take a look at it below.

Wishing everyone a wonderful holiday and for those in Europe and Australia, enjoy the long weekend.

Today's Highlights

- Volatility Remains

- Brexit Data

- Crypto Watch

Please note: All data, figures and graphs are valid as of March 29th. All trading carries risk. Only risk capital you're prepared to lose.

Traditional Markets

Volatility continues in some places more than others. The tech sector in particular is seeing a mass effort from analysts to re-evaluate what the value of intangible assets should be.

Traders had been piling into Fangs for years already without really giving much thought about what they're buying or what they're paying for it. So a bit of reckoning should be a healthy process.

Indeed, it seems that the fears about a trade war have subsided somewhat as talks between the US and China continue and we look forward to the May 1st deadline for Trump's aluminum and steel tariffs.

In this graph, we can see the difference in yesterday's trading to previous days. The Dow Jones (white) was nearly flat while the Nasdaq (green) sank rather deeply.

Overall, volatility (via NYSE:VXX) is elevated as uncertainty abounds.

There's a lot of data releases scheduled for today including key inflation numbers from the USA so the fun could well continue until the closing bell on Wall Street.

Brexit by the Numbers

The data released Thursday morning held no real surprises. We mentioned a recovery of the pound sterling so I did want to show that.

The dotted blue line shows the current price, which is just at the lows of the normal prices for the six months leading to the referendum (green box). Still, the yearly average price (yellow line) is still trailing behind.

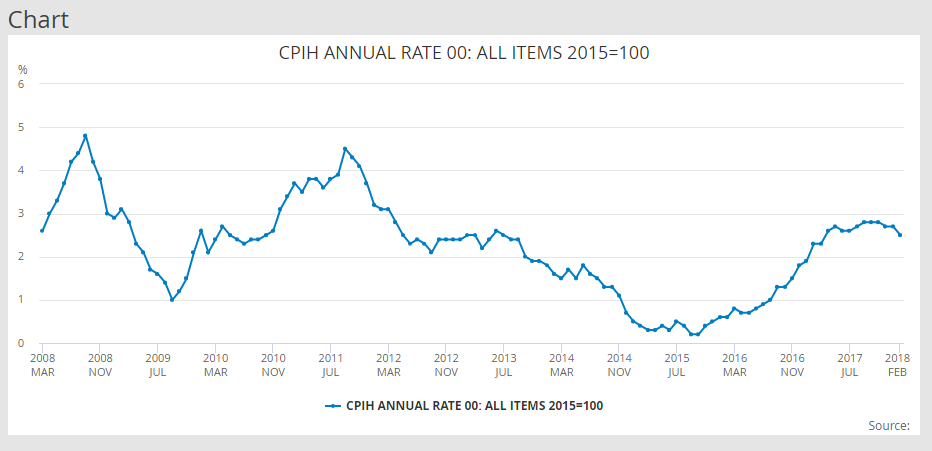

Here we can see the UK's inflation over the last 10 years. As we can see, it's not at historic highs, but it is higher than the comfort level of 2%.

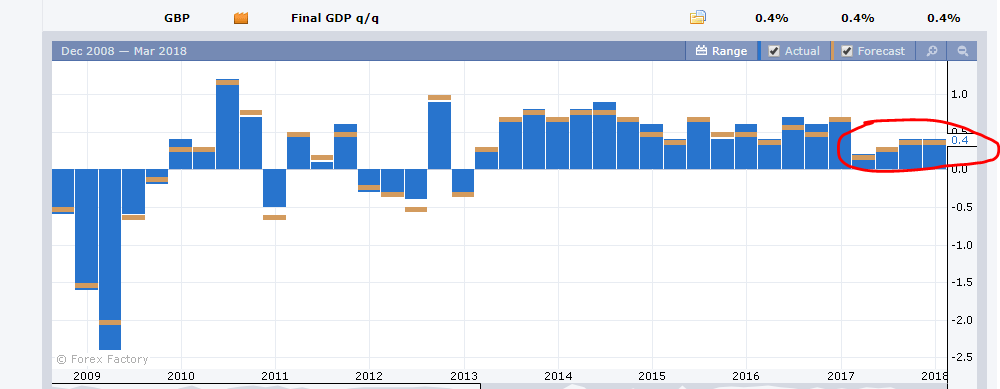

Still, economic output remains low ever since Article 50 was first triggered, as the data today shows.

Crypto Watch

Watch out, prices remain under pressure. At the moment we continue to test key levels of support, which for the time being don't seem to be holding up all that well.

Nothing changes sentiment like price. As long as there is no momentum, there is little reason for zealous traders to jump into the market.

Here we can see Bitcoin testing it's previous low of $7,326 a coin. If it does fall below that, the next level of support isn't until the February 6th low of $5862.

However, a movement in the yen yesterday could provide some indication. The yen has been getting strong these last few weeks, which for Japanese traders is an incentive to hold off on buying Bitcoin.

Now that Prime Minister Shinzo Abe has apologized for the current scandal it seems that the news cycle is shifting and we did see the Yen drop significantly yesterday.

If we see the expectation of yen weakening returning to the market over the next few weeks it could cause some buying pressure from the crypto trading nation.

One thing we can watch are the yen futures on CME that can be found at this link. Notice how each month the settlement price gets stronger. We'll need to see if this starts to turn around.

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.