Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

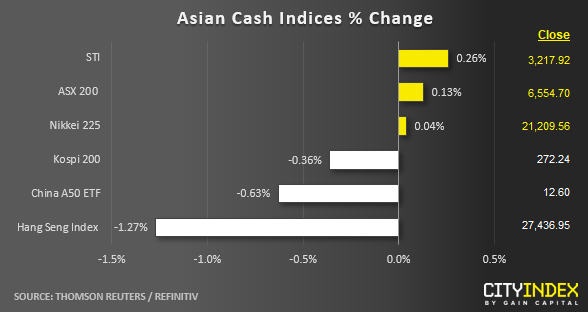

Protests in Honk Kong have seen the Hang Seng Index lead the way lower, after an already weak lead from Wall Street.

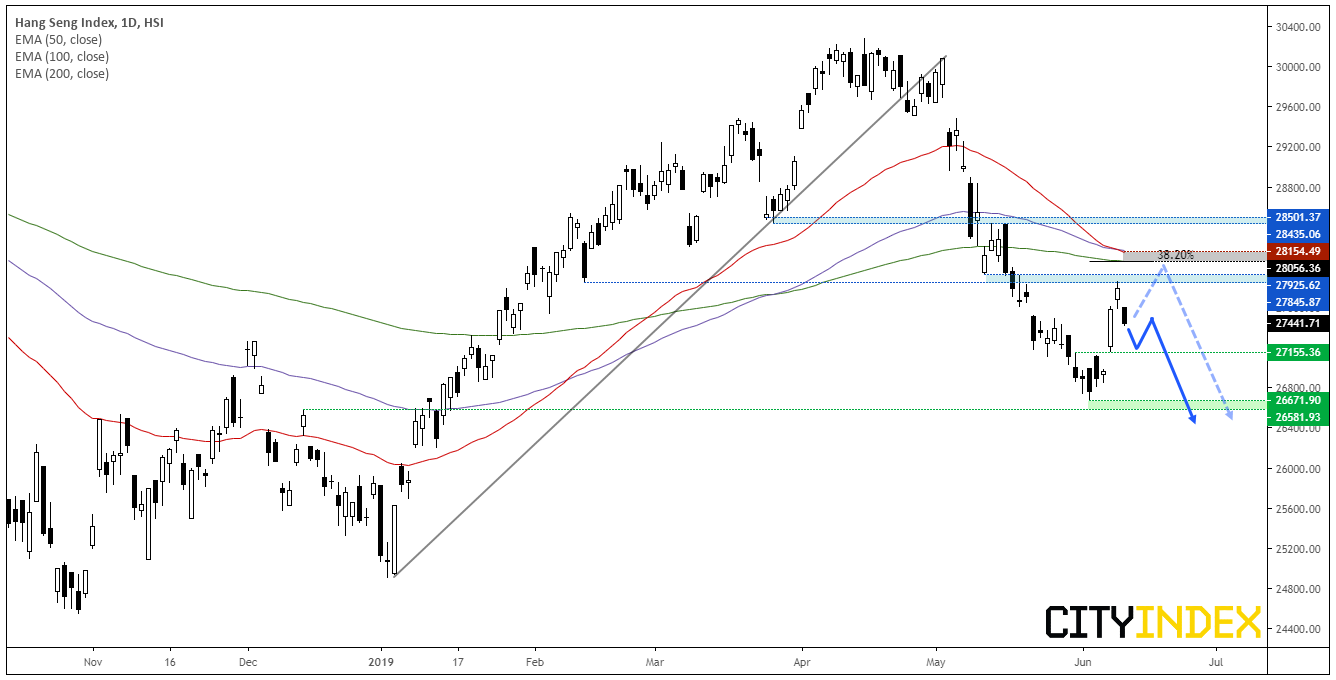

With the Hong Kong government set to vote on the controversial extradition bill, demonstrators have taken to the streets, with organizers claiming over a million people have attended. The city has come to a slowdown which has weighed on the domestic equity market which now leads the way lower in Asia. Technically, it’s correction could be nearing an end after a rebound this month.

The minor rebound has met resistance at the 27,845 low and failed to test a cluster of resistance just above 28,000, which comprises of the 38.2% Fibonacci level, 50, 100 and 200-day eMA. Given a 38.2% retracement is considered as acceptable, its failure to reach this far is a testament to HSI’s weakness whilst other APAC stocks extend their gains.

The market gapped lower and extended losses, meaning today’s open price is currently the daily high. If the index can close beneath 23,790 it confirms an evening star reversal formation and suggests the corrective high is in. Furthermore, global benchmarks such as the S&P 500 appear stretched over the near-term and suggest a retracement could be due and, if global sentiment sours this will provide another headwind for the index and suggests it could break to new lows.

Should the index hold above 27,155 and recycle higher, we’d continue to look for areas of weakness below the resistance cluster just above 28,000. And, as the trend remains bearish below 28,500, we’d only seek bullish setups on the daily following a break of this key level.

Over the near-term, sentiment for HSI is clearly being driven by domestic issues. Therefore it remains vulnerable to updates around the protest. Beyond this, we need to assess global sentiment and the general stock market direction but, ultimately, let price action be our guide.