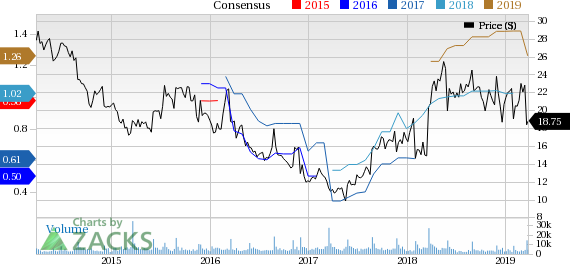

Guess?, Inc. (NYSE:GES) has been losing grounds lately, as it is incurring high costs. High costs also weighed on the company’s bottom line in fourth-quarter fiscal 2019. Its shares have lost more than 9% in the past three months against the industry’s growth of 18.7%. In fact, this Zacks Rank #5 (Strong Sell) stock lost about 15% in just seven days time, following the company’s earnings release..jpg)

Let’s delve deeper into factors pulling down Guess? and see if the renowned textile-apparel player has any scope for revival.

Expenses Weighing on the Stock

Rising distribution and logistics costs in Europe have long been a hurdle for Guess?. Notably, this caused a decline of 480 basis points (bps) in the Europe segment's operating margin in the fourth quarter. Also, gross margin contracted 60 bps, owing to occupancy deleverage, stemming from increased European logistics costs, and adverse impacts of rise in inventory levels in China and Europe.

Additionally, the company’s SG&A expenses have been rising. Together, these factors had an adverse impact on Guess?’s earnings per share in the fourth quarter, which marked the second consecutive bottom-line miss. Although the bottom line in the reported quarter grew year on year, the same was impacted by high costs. In fact, management expects SG&A expenses to increase in the first quarter as well as fiscal 2020 due to higher advertising costs.

Further, operating margin is expected to decline 4-4.5% in the first quarter, primarily due to rise in expenses. Moreover, for the first quarter of 2020, the company expects loss of 25-29 cents. We note that the Zacks Consensus Estimate for the first quarter has deteriorated from loss of 15 cents to loss of 25 cents in the past seven days. Also, the consensus mark for earnings in fiscal 2020 has gone down from $1.42 to $1.26 per share in the same time period.

Apart from this, the company’s solid international presence keeps it exposed to adverse currency fluctuations. In fact, management expects adverse currency impacts of nearly 1 cent on earnings during the first quarter of fiscal 2020. Operating margin is also likely to witness a decline of nearly 10 bps in the quarter.

The Bottom Line

Though currency woes pose threats, strong international presence has been benefitting Guess?’s top line. Evidently, strength in the company’s Europe and Asia businesses have long been driving the company’s revenues. During the fourth quarter of fiscal 2019, revenues in the European region advanced 4.1%, owing to store openings, enhanced wholesale revenues and comps growth. Markedly, comps improved for the 14th straight quarter in Europe on a constant-currency basis. Coming to Asia, revenues rallied 21.7% on the back of improved comps. Going ahead, we expect these regions to continue fueling the company’s performance, courtesy of constant store openings and e-commerce growth.

International strength is a driving factor for many other textile-apparel players like lululemon (NASDAQ:LULU) , Ralph Lauren (NYSE:RL) and Columbia Sportswear (NASDAQ:COLM) , among others. Coming back to Guess?, it is to be seen if strong Europe and Asia sales, and efforts to enhance margins can counter the hurdles and help the company regain momentum.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

lululemon athletica inc. (LULU): Free Stock Analysis Report

Guess?, Inc. (GES): Free Stock Analysis Report

Ralph Lauren Corporation (RL): Free Stock Analysis Report

Columbia Sportswear Company (COLM): Free Stock Analysis Report

Original post

Zacks Investment Research