After posting a loss in the first quarter of fiscal 2018, Guess?, Inc. (NYSE:GES) revived its performance and delivered upbeat second-quarter fiscal 2018 results, wherein both earnings and revenues came ahead of the Zacks Consensus Estimate. Guess? benefited from increased sales in its Europe and Asia segments, which led management to raise its fiscal year guidance. Consequently, shares of the company have increased approximately 13.1% post trading hours on Aug 23.

Guess? delivered earnings of 19 cents per share in the second quarter which came ahead of the Zacks Consensus Estimate of 10 cents. Adjusted earnings had also increased 26.7% from the prior-year quarter and surpassed management’s guided range of 8-11 cents. Earnings benefited from increased margins and revenues across its segments. Currency had negatively impacted earnings during the quarter by approximately 5 cents. The company posted GAAP net earnings of 18 cents in the second quarter, up 52.6% from the year-ago period.

We also note that shares of this Zacks Rank #3 (Hold) company have increased 9.4% in the past three months, almost in line with the industry’s rise of 8%.

Revenues and Margins

Net revenue amounted to $573.7 million in the quarter that improved 5.3% and also outpaced the Zacks Consensus Estimate of $559.1 million. On a constant-currency basis, revenues grew 4.9%. In fact, this quarter marked the fourth straight quarter of revenue improvement. The upside came on the back of solid sales at the Europe, Asia and American Wholesale segments, offset by soft revenues across the Americas Retail and Licensing segments. Moreover, comps in Europe and Asia had also risen, owing to new store openings.

Gross profit increased 6.7% to $198 million during the quarter, as a result of improved revenues. The company’s gross margin also expanded 40 basis points (bps) to 34.5%, owing to improved supply chain initiatives.

Furthermore, the company reported adjusted operating profit of $24.5 million that surged 52.3% in the quarter. Operating profits gained from the strong control over expenses, in addition to top-line growth. Also, adjusted operating margin expanded 130 bps to 4.3%, including negative currency impacts of approximately 20bps.

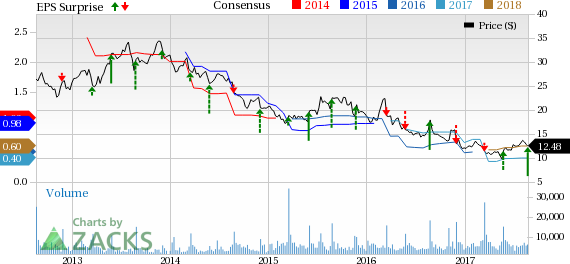

Guess?, Inc. Price, Consensus and EPS Surprise

Segment Results

Revenues of $201.2 million at the Americas Retail segment were down 11.2% (down 10.8% on a constant-currency basis). Revenues had declined owing to lower traffic and rate of conversion. Further, Retail comp sales including e-Commerce declined 10% in both U.S. dollars and constant-currency basis. Also, the operating margin in the segment declined 290 bps to reach -3.6%.

The Europe segment's revenues of $255.2 million were up 20.1% (up 18.8.1% on a constant-currency basis). New store openings and comps growth had aided the regions performance. Retail comp sales including e-Commerce improved 5% in U.S. dollars as well as in constant currency. Operating margin for the segment increased 160 bps to 10.3%.

Revenues of $62.7 million from Asia increased 17.5% (up 17.1% in constant currency), owing to comps growth and store openings. Retail comp sales including e-Commerce grew 7% in U.S. dollars and 6% on a constant-currency basis. Operating margin for the segment surged 870 bps to 2.4%.

Net revenues of $32.7 million at the American Wholesale segment rose 6.6% (up 6.8% on a constant-currency basis). Operating margin for the segment had risen 300 bps to 14.9%.

However, net revenues of $21.9 million at the Licensing segment decreased 0.2% in both U.S. dollars and constant currency. Operating margin for the segment declined 120 bps to 88.7%.

Other Financial Update

Guess? exited the quarter with cash and cash equivalents of $316.5 million compared with $415.5 million in the previous-year quarter. The company had long-term debt of $39.2 million compared with $23.6 million in the year-ago period. Further, the stockholders’ equity as of Jul 29 was $955.8 million.

During the second quarter, the company’s board approved a quarterly cash dividend of 23 cents per share payable on Sep 22 to shareholders of record at the close of business on Sep 6, 2017. It did not repurchase any shares during the quarter.

Moving ahead, capital expenditure is expected in the band of $85–$95 million for fiscal 2018, backed by consistent investment in the retail improvement in European and Asian regions.

Guidance for Fiscal 2018

For fiscal 2018, management expects consolidated net revenues to rise between 6-7.5% versus 3.5-5% guided earlier. On a constant-currency basis, consolidated net revenues are anticipated to grow between 4-5.5%, same as guided previously. As result of the impact of the 53rd week revenues are expected to rise 1%.

Also, the company’s adjusted operating margin is projected in the band of 3.1-3.5% and the GAAP operating margin is expected in the range of 2.4-2.8% for the full year.

Adjusted earnings per share for fiscal 2018 are forecasted in the range of 52-60 cents, up from 34-44 cents expected earlier. GAAP earnings are projected in the band of 34-42 cents. Currency is likely to have a negative impact of 2 cents per share. The Zacks Consensus Estimate for fiscal 2018 is currently pegged below the company’s guided range at 40 cents.

Guess? also plans to remain consistent with its initiative to reduce its footprint in the United States, which is estimated to hold less than 36% of its global sales currently. The company has been experiencing soft retail environment in the U.S and Canada and has resorted to store closures in these regions.

Guidance for Third Quarter 2018

For the third quarter of fiscal 2018, management expects consolidated net revenues to improve between 4-6%. On a constant-currency basis, consolidated net revenues are anticipated to grow between 2-4%.

Moreover, the company’s adjusted operating margin is projected in the band of 2.2-3%, while the GAAP operating margin is projected in the band of 0.1-0.9%.

Adjusted earnings per share for the third quarter are forecasted in the range of 8-11 cents. On a GAAP basis, the company anticipates loss of 4-7 cents for the third quarter.

Currency is not likely to have an impact on earnings during the quarter. The Zacks Consensus Estimate for the third quarter is currently pegged higher at 14 cents.

Do Consumer Discretionary Stocks Interest You? Check These

Better-ranked stocks in the same sector include SodaStream International Ltd. (NASDAQ:SODA) , flaunting a Zacks Rank #1(Strong Buy) as well as Callaway Golf Company (NYSE:ELY) and Gildan Activewear, Inc. (TO:GIL) , both carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

SodaStream has an average positive earnings surprise of 103.9% over the past four quarters. It has a long-term earnings growth rate of 7.5%.

Callaway Golf Company has an average positive earnings surprise of 23.3% over the past four quarters. It has a long-term earnings growth rate of 15%.

Gildan Activewear has an average positive earnings surprise of 5.5% over the past four quarters. It has a long-term earnings growth rate of 13.5%.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Callaway Golf Company (ELY): Free Stock Analysis Report

SodaStream International Ltd. (SODA): Free Stock Analysis Report

Guess?, Inc. (GES): Free Stock Analysis Report

Gildan Activewear, Inc. (GIL): Free Stock Analysis Report

Original post

Zacks Investment Research