While Value stocks were the overall outperformer during the third quarter, the tides began to turn late in the quarter as Growth stocks pulled ahead of Value factors. Strategists at Bank of Bank of America Merrill Lynch report that Growth factors beat the S&P 500 in September, although they lagged for the full third quarter and are also behind year to date.

Risk and distress were favored in September

Strategist Savita Subramanian and team said in their October 5 quantitative research note titled “A PM’s guide to stock picking” that Risk factors led all others. They report that Risk factors were up 1.6% in September, with High EPS Dispersion beating all the others with a 3.1% gain. High Beta factors gained 1.5%.

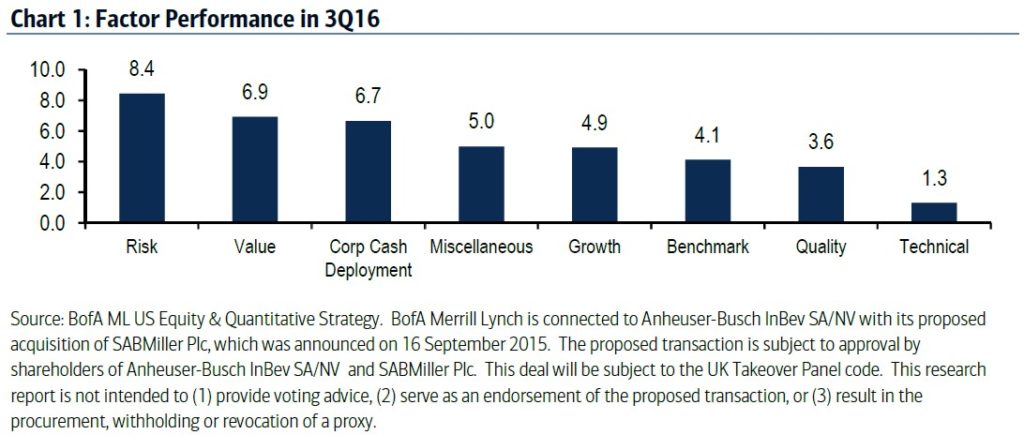

They add that Risk was the best-performing group for the third quarter as well with an 8.4% gain. Risk is also performing very well year to date with a 19.3% gain. The BAML team reports that High Beta gained 11.3%, making it the second-best performing factor, and Low Price, which covers distressed stocks, has been the leader with a 29.2% gain for the year.

Small Size also outperformed in September, beating the S&P 500 for the third quarter with a 7.3% gain and year to date with a 21.5% gain.

Growth factors over value stocks, but only for September

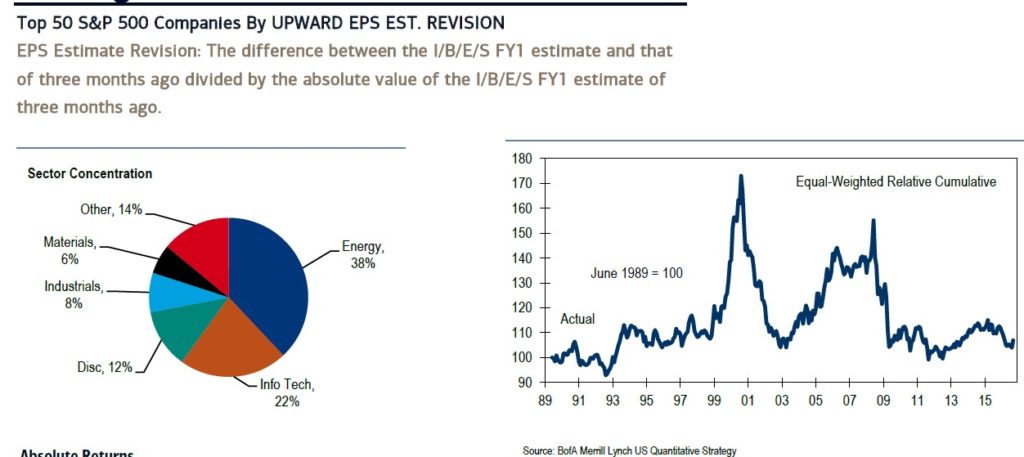

Subramanian and team said that Growth stocks beat the S&P 500 uniformly last month, with the leading factor being Upward EPS Estimate Revisions with a 2.7% gain to make it the second-best overall return.

Despite the strength of Growth stocks in September, Value stocks led for the third quarter with a 6.9% gain, compared to the 4.9% gain logged by the Growth factor. Value stocks are also leading year to date with a 7.9% gain compared to Growth factors’ 5.2% gain for the year thus far.

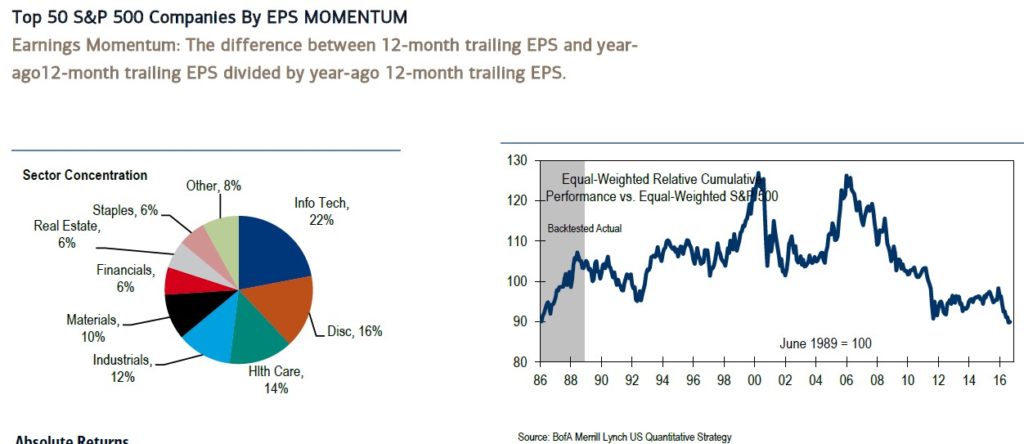

Momentum stocks also did well during the month of September, although they lagged both in the third quarter and year to date.

The BAML team report that most of the Technical and Momentum factors they watch beat the index in September, with the top factors gaining more than 2%. Despite the strong performance of some factors, Momentum stock factors still finished in last place for the third quarter with a 1.3% gain. The factor is also in last place year to date with a 3.7% gain. In fact, Subramanian and team report that four of the bottom five factors during the third quarter were in the Momentum category, with their lags ranging from 0-.4% to -0.9%.