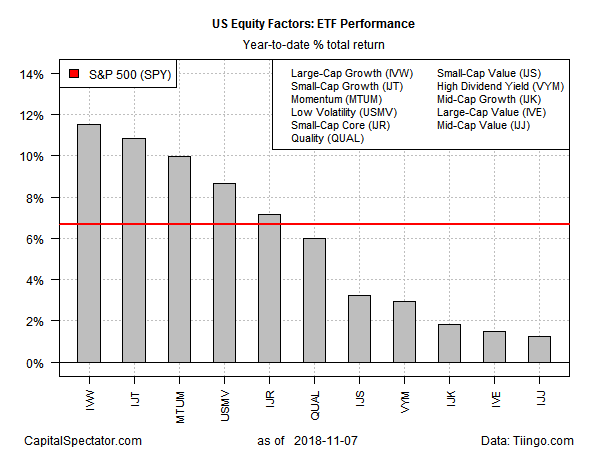

The sharp swings in the stock market in recent weeks haven’t dented the year-to-date performance edge that’s prevailed for large- and small-cap growth stocks in the US over their value counterparts, based on a set of exchange-traded funds through yesterday’s close (Nov. 7).

Large-cap growth still holds the lead for The Capital Spectator’s set of US equity factor ETFs so far in 2018. The iShares S&P 500 Growth (NYSE:IVW) is up a strong 11.5% year to date. Running slightly behind in second place is iShares S&P Small-Cap 600 Growth (NASDAQ:IJT), which is ahead by 10.9% so far in 2018.

Value, by comparison, is far behind in this year’s equity factor horse race. Dead last for year-to-date results at the moment: iShares S&P Mid-Cap 400 Value (NYSE:IJJ), currently posting a slight 1.3 gain. The second-weakest performance this year: iShares S&P 500 Value (NYSE:IVE), which is ahead by 1.5%.

Meanwhile, the broad market this year is up 6.7%, based on the SPDR S&P 500 (NYSE:SPY).

Despite the surge in market volatility over the past month, the growth factor has proven to be resilient in holding an edge over value, at least so far. But note that the latest rebound in equity prices generally has given large-cap value stocks a strong lift. Consider, for instance, that iShares S&P 500 Value (IVE) yesterday extended its rally to close just a hair below its 50-day moving average.

It’s too soon to say if this is an early clue that value’s fortunes vis-à-vis growth are set to rebound. In any case, the latest pop for big-cap value is an encouraging sign for thinking that undervalued stocks may be set to generate firmer performance in the months ahead vs. the track record in recent history.