A few years ago I read a very interesting report. It alleged that the average memory of the non-professional is less than 2 years back. In other words, if you are one of these people who encouraged by fashion or advertised recommendation made a mistake ones by investing in overpriced assets (and lost some money on the way) there is a high probability you are going to repeat your mistakes.

This finds confirmation in the equity market. In 2000 the street was hoarding stocks of internet companies because apparently, we were witnessing a transformation towards the new economy. Seven years later everyone was buying the real estate and stocks of developers. The result is known to all. I am raising this topic as again in the US and Western Europe we see fashion for tech companies returning and consequentially their price is extremely high. In my opinion, it is a great opportunity to short and benefit from falls.

The perfect example of how imagination can disconnect from reality is Netflix (NASDAQ:NFLX). Netflix gives you access to a huge online library of movies. The market is slowly becoming sated. Amazon (NASDAQ:AMZN), Hulu or HBO are stepping up their game and the competition starts to be very aggressive. Nevertheless, Netflix invests madly to increase their reach and they are not paying attention to the cost of this operation. Only this year company binged on 1 bn USD of their capital and their debt is now at 2.4 bn USD. The cost of servicing their obligations classifies them as junk.

Shareholders are still blind to those circumstances even though EV/EBIT equals 170, more than 96% of other companies in this sector. I used EV/EBIT on purpose. It is a better indicator than traditional P/E when it comes to expanding firms with a high cost of maintenance of their library. Recap: simply put the EV (enterprise value) is firm’s market capitalisation + debt – cash. EBIT is firm’s earnings before any taxes and interest payments.

P/BV (Price/Book Value) is very high at soaring 18 (more than 98% of the sector).

Pricing like this demonstrates one of two things. Either investors have no idea why they buy Netflix or they assume that the firm will decisively dominate the market and squeeze miraculous profits out of nowhere. I believe Netflix is one of the most overpriced companies from its segment which in itself is very expensive.

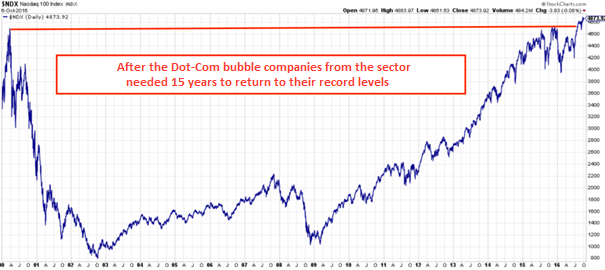

Netflix is now one of the most expensive NASDAQ companies – index of tech firms. Over the past few years investors again found faith in high-tech. Since 2009 bottom index of tech firms quadrupled reaching speculative bubble levels. Notably, not as extreme as in 2000. Worth mentioning is the fact that share price took 15 years to return to its records.

Will this time be different and overpriced stocks are not going to plummet? It is very unlikely although no one will give you any guarantee. In the US we see the economy doing very poorly and political uncertainty only adds to the mix. With Janet Yellen attempting to raise interest rates all year long she may actually pull the trigger in December. Raising interest rates by another symbolic 0.25% is much more likely at the end of 2016 than ever before. Also, this is the first time that I believe in this possibility.

Today, almost 70% of investors believe that a rate hike is due in December. This means that less than 30% will be surprised. The lower percentage of ‘surprised’ public the smoother reaction of the market. We still have to acknowledge that even a move of minuscule 0.25% makes the stock market plunge. The more overpriced industry/shares the more violent their nosedive.

Summary

All I want you to remember from this article is this: do not invest in fashionable, costly assets getting even more expensive thanks to the influx of capital from unaware investors. From Everest heights, the price can, of course, reach higher but the market eventually is reminded of common sense and it verifies stock prices in an unapologetically brutal way.

The Simon Property Group (NYSE:SPG) is an enormously expensive REIT invests in retail real estate. The drop of their price was so massive that I closed my short position with profit in anticipation of a temporary bounce. I will open my short position again (earning money if the stock goes down) when price stabilizes a bit higher. This is a pure speculation and I am not encouraging this unless you are an experienced investor.

If you accept a higher risk and still want to short I would recommend using a 1-year put option. Looking at how blindly optimistic the stock prices are those options are not pricey and what is more important you risk only the money you buy the option with and not the bulk of your capital.