Groupon Inc. (NASDAQ:GRPN) recently announced the layoff of 130 employees from its customer service unit in Chicago as part of its restructuring activities.

This group consisted of remote workers. Chicago Business quoted a spokesperson from the company who said that the step will ensure centralization of the customer service roles, training and resolution process, which will ultimately improve customer service.

There was no confirmation whether these positions will be filled any time soon. However, the company does not anticipate this move to be a headwind for customer service quality.

Shares of Groupon have gained 24.7% year to date, underperforming the industry’s 47.8% rally.

Groupon’s Restructuring Timeline

Groupon has been concentrating on streamlining its operations by reducing international presence to focus on its core profit area. To this end, it cut 1100 jobs in September 2015 and ceased operating in seven countries namely Morocco, Panama, the Philippines, Puerto Rico, Taiwan, Thailand, and Uruguay.

In March 2017, the company terminated the services of employees of LivingSocial, which it had acquired in October 2016. Groupon also closed the Washington D.C. office of Living Social as part of the same strategy.

In first-quarter 2017, the company reduced its presence from 27 to 15 countries.

Impact of the Restructuring Processes

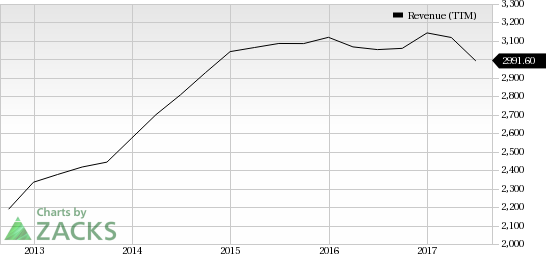

We believe the company’s streamlining activities have positively impacted margins. Groupon’s focus on the domestic market is helping it to accelerate gross profit. In second-quarter 2017, gross margin increased 590 basis points (bps) on a year-over-year basis to 49.5% in the quarter.

Operating loss (excepting one-time items) was $2.77 million compared with a loss of $32.54 million in the year-ago quarter. This led to a sequential improvement in the bottom-line results in the last quarter.

Despite reduced international presence and intensifying competition, we expect the restructuring will positively impact Groupon’s overall results going forward.

Zacks Rank & Key Picks

Groupon currently has a Zacks Rank #3 (Hold).

Better-ranked stocks in the broader technology space are Activision Blizzard, Inc (NASDAQ:ATVI) Applied Optoelectronics, Inc. (NASDAQ:AAOI) and Applied Materials, Inc. (NASDAQ:AMAT) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Activision Blizzard, Applied Optoelectronics and Applied Materials is projected to be 13.63%, 17.50% and 17.11%, respectively.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Groupon, Inc. (GRPN): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Activision Blizzard, Inc (ATVI): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post

Zacks Investment Research