On Sep 11, we issued an updated research report on Group 1 Automotive, Inc. (NYSE:GPI) .

In second-quarter fiscal 2017 (ended Jun 30, 2017), Group 1 Automotive reported adjusted earnings per share of $1.87, missing the Zacks Consensus Estimate of $1.99. However, the top line was almost in line with the Zacks Consensus Estimate.

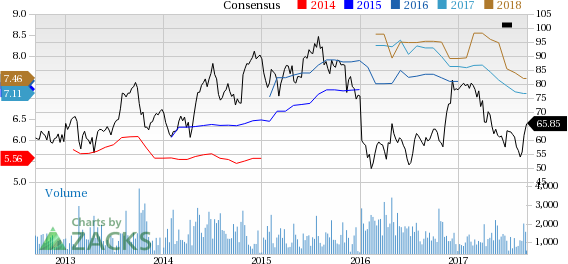

Earnings estimates for Group 1 Automotive have been going down of late. In the last seven days, estimates for fiscal third quarter have slid 0.5% to $1.92.

Group 1 Automotive, Inc. Price and Consensus

In order to expand business, the company engages in frequent acquisition and divestments of dealerships and franchises. In August, Group 1 Automotive acquired Audi dealership in Forth Worth, TX. The dealership’s expected annualized revenue is $55 million.

Previously in June, the company acquired Beadles Group Ltd., a U.K.-based automotive retailer, enabling it to expand operations in the United Kingdom.

However, the company has been witnessing a decline in new vehicle unit sales, which dropped by 6.3% in the second quarter from the year-ago level. It also has been observing weak volume sales across the oil-dependent markets of United States and Brazil.

Price Performance

Group 1 Automotive’s stock has plunged 15.5% year to date, substantially outperforming the 4.4% fall of the industry it belongs to.

Zacks Rank & Key Picks

Group 1 Automotive currently carries a Zacks Rank #3 (Hold).

A few better-ranked automobile stocks are Toyota Motor Corporation (NYSE:TM) , Allison Transmission Holdings, Inc. (NYSE:ALSN) and Ferrari N.V. (NYSE:RACE) , all currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Toyota has a long-term growth rate of 7%.

Allison Transmission has a long-term growth rate of 10%.

Ferrari has an expected long-term earnings growth rate of 14.1%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Group 1 Automotive, Inc. (GPI): Free Stock Analysis Report

Toyota Motor Corp Ltd Ord (TM): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Ferrari N.V. (RACE): Free Stock Analysis Report

Original post

Zacks Investment Research