Trend Model signal summary

Trend Model signal: Neutral

Trading model: Bullish

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. In essence, it seeks to answer the question, "Is the trend in the global economy expansion (bullish) or contraction (bearish)?"

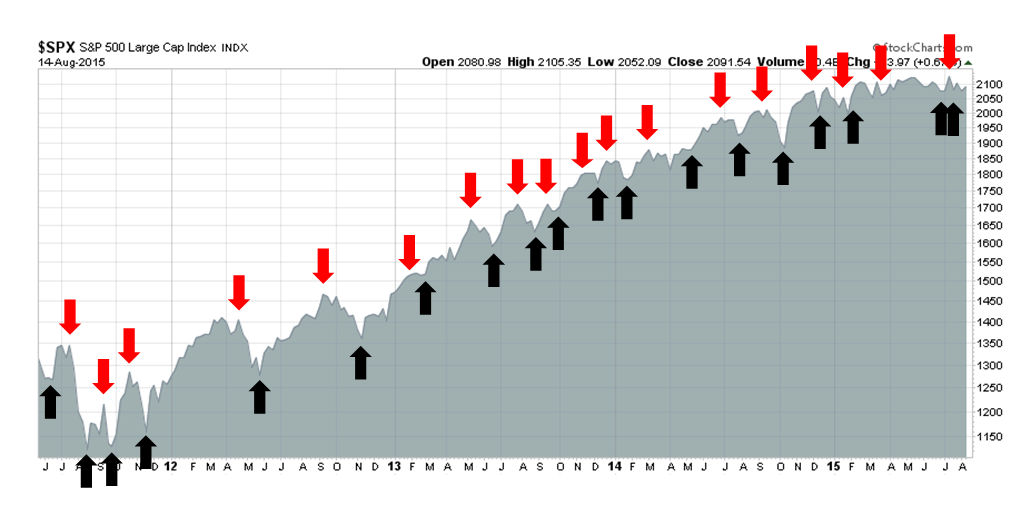

My inner trader uses the trading model component of the Trend Model seeks to answer the question, "Is the trend getting better (bullish) or worse (bearish)?" The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. In addition, I have a trading account which uses the signals of the Trend Model. The last report card of that account can be found here.

Trend Model signal history

Update schedule: I generally update Trend Model readings on weekends and tweet any changes during the week at @humblestudent.

Waiting for the rally

I feel like I've been caught in the movie "Groundhog Day", where a weatherman played by Bill Murray had to repeat the same day over and over again. Last week, I wrote that while I remained intermediate term cautious, I was short-term bullish and I was waiting for an oversold rally (see You can`t hurry tops!).

The US equity market did rally last Monday and I looked like a genius for all of a single day. Tuesday saw the PBoC devalue the RMB 1.9% and global markets sold off in response. On Wednesday, the PBoC devalued again and the SPX successfully tested the 200 day moving average (dma) and reversed itself on the day. However, we saw little upside follow-through on Thursday and Friday.

At the beginning of the new week, here we are waiting for the oversold rally again.

Still intermediate term cautious

Last week, I wrote about the technical reasons for intermediate term caution over the next few months so I am not going to repeat myself. Instead, I will focus on the fundamental and macro reasons why I am worried and not worried about the stock market for the next few months.

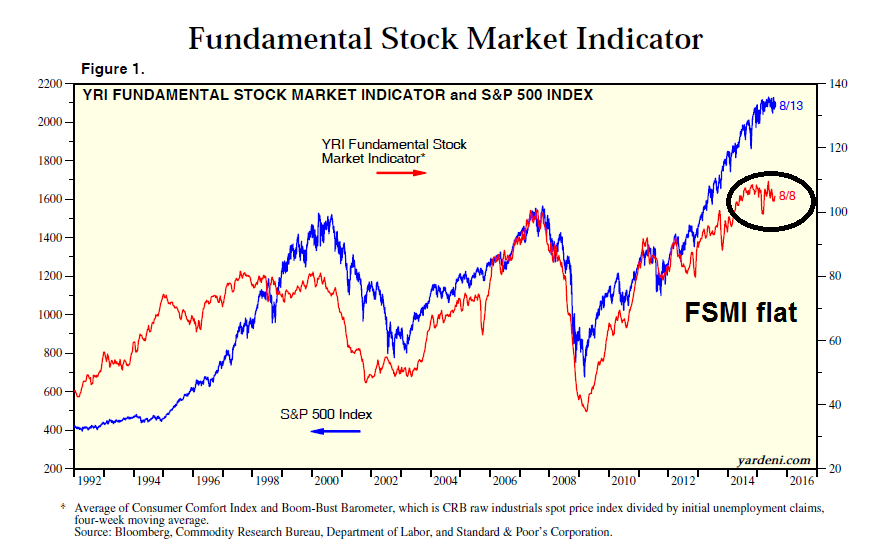

John Butters of Factset took the week off, so there is no earnings update. With most of earning season over, there is little to report on in any case. However, I would point out that Ed Yardeni maintains a Fundamental Stock Market Indicator (FSMI), which is a coincidental indicator of the fundamental strength of stock prices. As the chart below shows, FSMI has gone nowhere for most of 2015 while stock prices have rallied - a negative divergence (annotations in black are mine).

Looking across the Pacific, I do have some concerns about China, though none of them are of immediate importance. There were two key "tells" that indicated to me that the market freak-out over the RMB devaluation was unwarranted. First, I noticed that as the news broke about the RMB getting devalued against the USD, the USD was weak against major currencies like EUR.

In addition, EM paper wasn't getting sold like it might have been if the market had truly panicked. The chart below shows the relative performance of US HY and EM bonds against equivalent duration Treasuries (via iShares iBoxx $ High Yield Corporate Bond Fund (ARCA:HYG), iShares 3-7 Year Treasury Bond Fund (NYSE:IEI) and iShares JPMorgan (NYSE:JPM) USD Emerging Markets Bond Fund (NYSE:EMB)).

Note that even as the markets went risk-off, EM bonds outperformed HY bonds. That was a signal from the credit markets that they were not overly concerned about the immediate effects of a Chinese currency war.

Longer term, however, the poor relative performance of HY and EM credits remains a concern as they are signals of rising risk aversion from the fixed income markets.

The "soft-boiled egg landing"

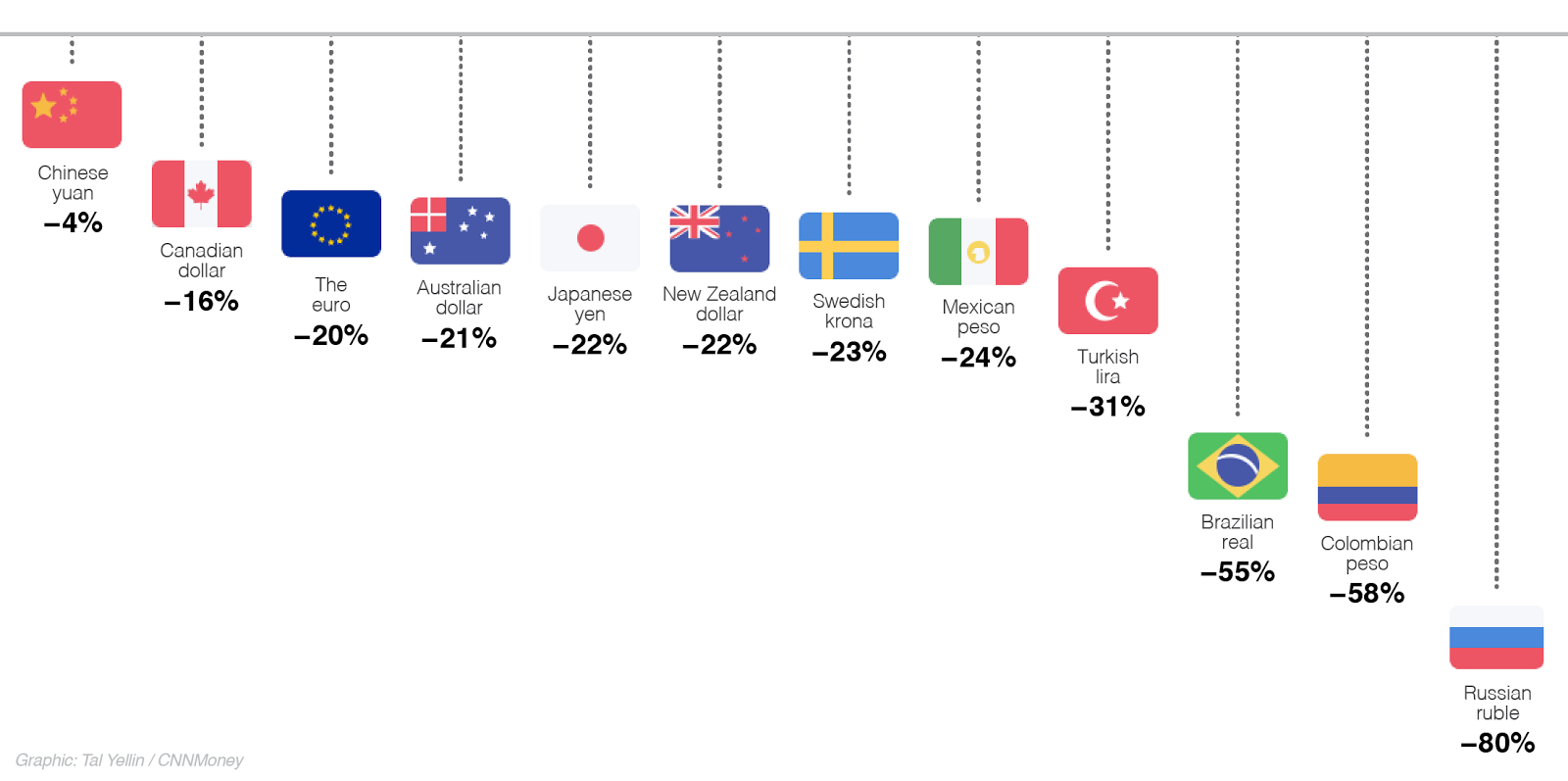

Here is what I learned from the PBoC devaluation affair. First, there is no need to panic over minor currency fluctuations. Here is a chart of how much other currencies have depreciated against the USD in the last year (via CNN):

1 year currency depreciation against US Dollar

Did the market freak out when the Brazilian real tanked 9% against the dollar last month? What about the news that the Turkish lira hit all time lows? OK, Brazil and Turkey aren't major economies. What about Japan? How did the market react when one of the stated aims of Abenomics was to weaken the Japanese yen? What about the euro? The euro peaked in 2009 and it has been steadily weakening against the USD. Did the markets tank? Um, not really. Instead, American investors poured money into currency-hedged European stock funds and ETFs.

Longer term, however, I am concerned that the scenario of Chinese weakness outlined by Ray Dalio of Bridgewater Associates is in play (see Is China getting hit with THE BIG ONE?). Remember the quaint old days when we were just concerned about the bubble in Chinese real estate? Now we have added the Chinese stock market and their currency to the list of worries. This latest move by the PBoC to weaken its currency is therefore confirmation that Chinese economic growth is weakening. Indeed, a research report from Citi indicated that five Chinese provinces are in recession. Economies growing at 7% do not behave this way.

A research note from Citi published earlier this week forecast further stimulus measures from Chinese authorities, with five provinces believed to have shrinking economies.

"There is a widespread acknowledgement of the economy's weakness, and three resource-oriented provinces in north-east China - Liaoning, Jilin and Helongjiang – are thought to be in recession already, along with north China's Hebei and Shanxi provinces," the analysts wrote.

I had postulated one fallout of the Ray Dalio scenario of a China slowdown would be a "soft boiled egg" landing for China and Asia. The landing would be soft on the inside (China), but hard on the outside (for anyone doing business with China). An article in the Sydney Morning Herald quoted analysts from Lombard Street Research and ANZ expressing precisely these concerns, Shweta Singh of LSR brought up the spectre of another Asian Crisis:

Lombard Street Research senior economist Shweta Singh said the sharp yuan devaluation in 1994 was now recognised as leading to the emerging financial market crisis in 1997 and described the current situation as the "perfect storm"."The start of the Fed's rate rise cycle during the same year was the straw that broke the camel's back. No wonder that the repercussions for emerging markets of a similar change in the direction of Fed policy have been an issue of lively debate among investors," Mr Singh said.

While emerging markets could benefit from greater US private consumption and greater competitiveness, Mr Singh said the worst-hit economics would be those that are fairly uncompetitive with similar export programs and structures to China, such as South Korea, Malaysia, Vietnam, Thailand and Taiwan.

The concerns expressed by ANZ were less alarmist, but nevertheless worrisome for regional trade:

ANZ chief economist of Asia Glenn Maguire has revised Asian forecasts down until 2018 due to a "trade recession" that is likely to endure."The surprise renminbi devaluation announced by China yesterday and the Vietnamese dong band widening announced by Vietnam this morning speaks of the economic stresses that are arising from this unusually depressed period of global trade and a global economic backdrop that remains tepid and uneven rather than synchronised and ascending," Mr Maguire said.

Describing the "de-correlated and weak" Asian market response to a strengthening US economy as a "relay baton drop", Mr Maguire said it was a remarkable every Asian nation is experiencing negative year-on-year export growth given the regions trade history.

"It is suggestive of further 'breaks' in the traditional determinants of the Asian trade multiplier. Structurally lower potential growth rates among major economies, unfavourable demographic trends and under-investment in capacity are not sufficient explanations for this breakdown."

The ratio of Asian trade export growth to global GDP growth prior to the global financial crisis averaged around 2.9 per cent but has dropped to 1.5 per cent since then. Mr Maguire said it may have actually fallen even lower towards 1:1 since the commodity prices crunch in June.

Now add into the mix the expectation that the Federal Reserve will raise interest rates sometime this year, probably at its September meeting, and you have the makings of a financial Molotov cocktail. Will fragile EM economies be able to withstand the shock of rising US rates when there are USD 9 trillion in offshore loans (see The key tail-risk that the FOMC missed (and you should pay attention to))?

Independent of those risks, Tim Duy penned a Bloomberg View article stating that he believed that the Fed may be tightening prematurely. The disagreement between market expectations, which believes that the US economy remains anemic, and the FOMC`s expectations, which are more hawkish, is leading to trouble (emphasis added):

The Fed...doesn't believe it has engineered the soft landing just yet. It expects that interest rates will need to rise farther to tame inflationary pressures. In fact, the Fed believes that the economy will evolve in such a way that it can raise short-term rates back to levels comparable to the old normal.

Financial markets participants, however, are not on the same page. They see the Fed staying persistently lower than Federal Open Market Committee meeting participants anticipate.

I would argue that financial markets are signaling that a soft landing has already been achieved and that much additional tightening will risk tipping the economy back into recession. The Fed staff is stuck in between; at least that is the story told by the accidental release of staff forecasts. The staff envisions a near-term policy path that better resembles what is expected by financial markets, although the staff, like FOMC participants, can't shake its faith that eventually rates will return to something more like the historical norm.

He thinks that the Fed is on thin ice because the economy remains too fragile for a rate hike:

My concern now is that the FOMC is on thinner ice than members realize because they don't believe they have already tightened policy. The soft landing may already be upon us. They just don't know it, or won't admit it.

That's a recipe for recession.

You don`t necessarily have to buy Duy`s argument that Fed tightening will lead to a recession. The combination of the fragility of China-dependent EM economies, the possibility raised by a respected Fed watcher like Tim Duy of a US recession and a somewhat "unexpected" September rate hike (which is only priced at roughly 50% right now) could be the catalyst that spooks the markets.

The bears need a wash-out

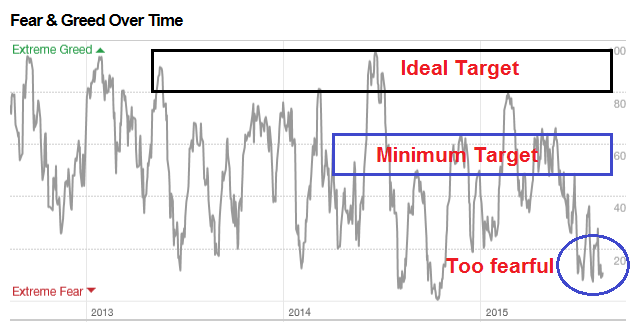

Despite these concerns, I am not overly worried about a nasty sell-off in stocks right now. That's because bearish sentiment is still overdone. The Fear and Greed Index remains in fear territory. In order for the market to meaningfully decline, we need the bears to capitulate and get washed out. In order for a meaningful correction to begin, the Fear and Greed Index needs get to at least neutral and preferably into the greed zone. That implies a market rally to test and make new highs.

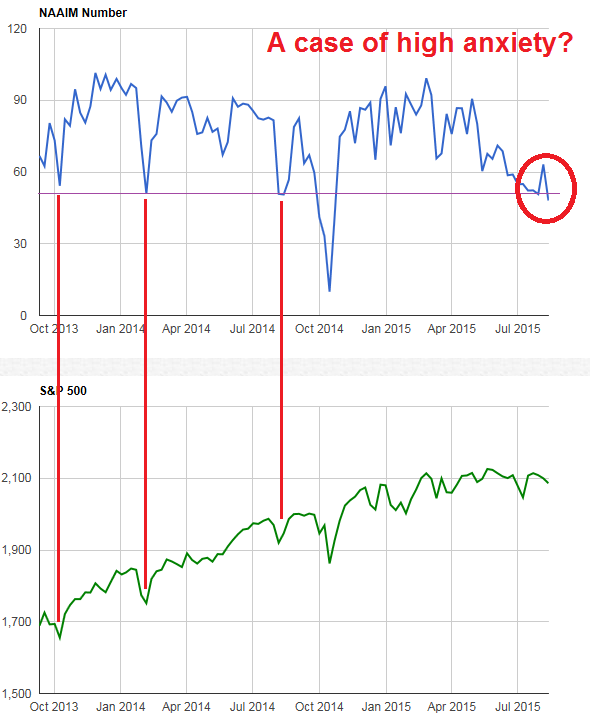

As well, the NAAIM Exposure Index shows that RIAs registering a level of bearishness that is consistent with past short-term market bottoms. Bear markets or major corrections simply do not start with sentiment readings at these levels.

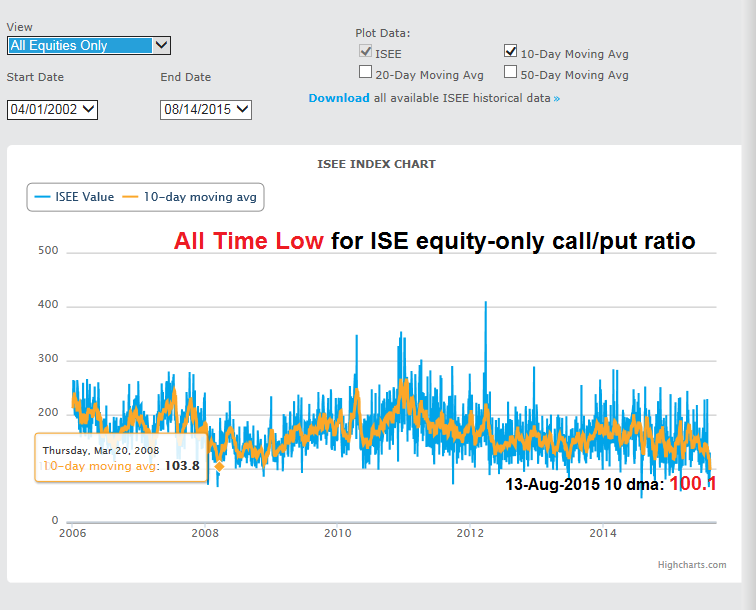

In fact, sentiment readings got so bad that on Thursday, the ISE equity-only call/put ratio, which is a measure of client-only opening transaction option orders, reached an all-time-low.

The next lowest reading that I found in the ISE history was on March 20, 2008. As a reminder of what was happening then, the SPX had peaked in October, 2007 and was already in decline. March 20, 2008 represented a sentiment extreme and the market proceeded to rally by 10.8% in the next two months and the rally was halted at the downtrend line. The market then fell into its Lehman Crisis low later that year.

While this is not a forecast, an equivalent gain today would take SPX up to 2307. Even if it were to fall short of 2300 and reach, say 2200, such a rally would likely flip market sentiment from excessively bearish to wildly bullish - which would set up the conditions for the intermediate term top that I had been postulating.

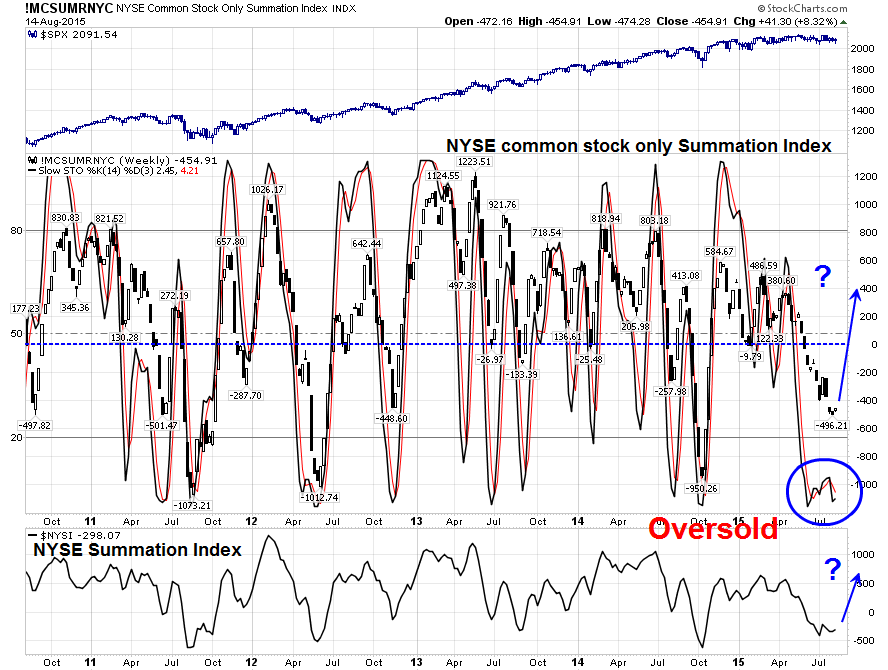

In addition to the crowded short sentiment readings, a number of breadth indicators are flashing oversold readings. The chart below shows the NYSE common stock only Summation Index (middle panel) and the more familiar NYSE Summation Index (bottom panel). I have overlaid a slow stochastic overbought/oversold indicator on the common stock only indicator. These indices are oversold and appear to be poised for an advance over the next few weeks of unknown magnitude.

So far, I have mainly focused on the contrarian crowded trade. The flip side of the coin is the "smart money" - namely insiders. Barron's reported that insider transactions are back flashing a "buy" signal after ticking back into "neutral" for one week last week.

To summarize, we have multiple cases of "dumb money" sentiment showing a crowded short and, in one cases, readings are at a historical extreme. On the other hand, the "smart money" insiders have been buying for the last several weeks. How can you not be bullish for the next few weeks?

The week ahead

I began last week with the expectation that an oversold rally would begin. I'm starting this week the same way, in a replay of Groundhog Day. Let's recap last week's market action.

The market rallied on Monday, but as the market opened on Tuesday morning, My inner trader tweeted that he was moving cash on the RMB devaluation reaction. Near the bottom on Wednesday, I tweeted that we were nearing a bottom and my inner trader began to edge back into the market on the long side.

As of the close on Friday, I believe that the stock market has further room to rise. Stock prices had become severely oversold Wednesday and undergone a successful test of their 200 dma. None of the RSI momentum indicators are overbought and the VIX Index was slightly above the mid Bollinger® Band, or 20 dma.

These charts from IndexIndicators confirm my views. This chart, of stocks above their 50 dma show that the indicator has been experiencing an uptrend of higher lows and higher highs, just like the SPX. The lows seen in late June and early July may have represented an oversold condition where breadth could be seen as a bounce, with potential to rise to the target zone shown.

This chart of net 52-week highs vs. lows tell a similar story. Breadth is improving and readings re not overbought. They could advance, at the very least, to the first target, with the potential to rise further to the higher target zone, which would likely represent SPX new all-time-highs.

My inner investor remains roughly at investment policy target weight on his asset allocation. My inner trader is long equities in anticipation of an oversold rally that is likely to test the old highs and possibly make new highs in the weeks to come. Undoubtedly the ride will be bumpy, but hopefully we won`t get a Groundhog Day repeat this coming week, where the market declines to test the lows again.

Disclosure: Long SPXL

Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.