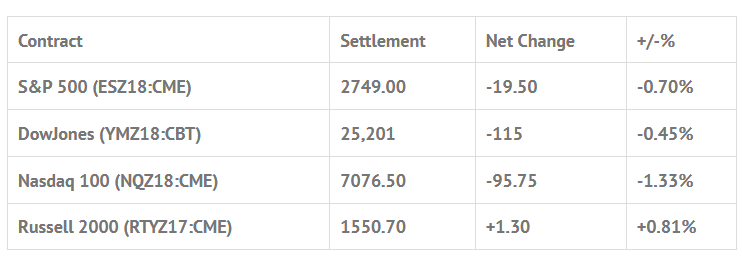

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed higher: Shanghai Comp -0.85%, Hang Seng +0.07%, Nikkei +1.25%

- In Europe 12 out of 13 markets are trading higher: CAC +0.56%, DAX +0.68%, FTSE -0.14%

- Fair Value: S&P +2.28, NASDAQ +15.38, Dow -12.96

- Total Volume: 1.75mil ESZ & 436 SPZ traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Redbook 8:55 AM ET, Industrial Production 9:15 AM ET, Housing Market Index 10:00 AM ET, JOLTS 10:00 AM ET, and Treasury International Capital 4:00 PM ET.

S&P 500 Futures: Any Good News Out There?

In a world of good and bad news, recently it’s all been bad. From the disappearance of Washington Post columnist Jamal Khashoggi, to Riyadh’s response to use oil as a political weapon, which is something unheard of since the 1973 Arab embargo that triggered the first oil crisis, It really seems like the world community is becoming unraveled. Yesterday, Sears filed bankruptcy, and the negotiations over Britain’s departure from the EU suffered a blow as the two sides failed to resolve differences… These were just a few of the nonstop negative headlines.

After Germany’s old political guard suffered another setback in the elections over the weekend, the S&P 500 futures sold off down to 2745.25 during Sunday nights Globex session, and then traded up to a 2768.75 high. The first print off of Monday mornings 8:30 CT futures opening bell was 2769.75, followed by a MrTopStep 10 handle rule selloff down to 2759.25. From there, the ES rallied up to a lower high and double top at 2768.00, then flunked down to a new daily low at 2751.25. After that, the futures traded up to 2765.00, pulled back a little, then traded up to 2774.75 at 10:30 am, before selling back off down to 2754.24 at 11:15 as the NQ sold off following an upside run of the buy stops.

The afternoon saw more pops and drops, as the ES rallied up to a new high of day at 2776.75 at 12:40, but then dropped to 2761.00 at 1:30, before rallying back up to a new high of day of 2778.75 just before the 1:00 hour ended. The final hour saw the MiM build up to $652 million to sell, and as the reveal at 2:45 showed $1.5 billion to sell, the selling intensified in the S&P’s, dropping down to a late day low of 2752.50. The benchmark futures went on to print 2753.00 on the 3:00 cash close, before trading down to a new low of day at 2748.50, and then settling the day at 2748.75, down -19.75 handles, or -0.71%.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.