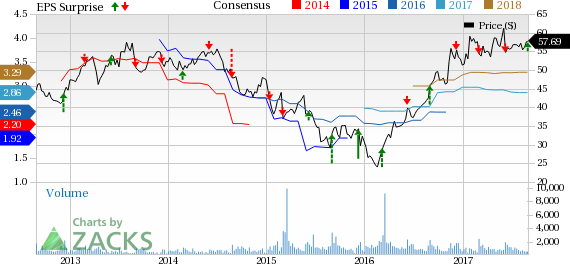

Greif, Inc. (NYSE:GEF) reported adjusted earnings of 85 cents per share for third-quarter fiscal 2017 (ended Jul 31, 2017), down roughly 6.6% year over year. Earnings, however, beat the Zacks Consensus Estimate of 84 cents.

Including one-time items, the company posted earnings of 74 cents per share compared to 78 cents per share recorded in the year-ago quarter.

Operational Update

Revenues jumped 13.8% year over year to $962 million from $845 million generated in the prior-year quarter. In addition, revenues surpassed the Zacks Consensus Estimate of $895 million.

Cost of sales increased 15.9% year over year to $774.7 million. Gross profit grew 6% year over year to $187.1 million. Gross margin contracted 140 basis points (bps) to 19.5% in the quarter. Selling, general and administrative (SG&A) expenses remained flat year over year at $92.6 million. Adjusted operating profit climbed 12.6% year over year to $94.5 million. Adjusted operating margin descended 10 bps to 9.8% in the reported quarter.

Segmental Performance

Rigid Industrial Packaging & Services: This segment reported sales of $674.4 million, up 13% from $596.8 million recorded in the year-ago quarter. Divestitures and foreign currency translation negatively impacted net sales by $5.5 million and $2.1 million, respectively. Adjusted operating profit climbed 10.6% year over year to $70.2 million from $63.5 million.

Paper Packaging: Sales were up 19.6% year over year to $206.3 million, on the back of rise in volumes in mills and corrugator facilities, and increased sales of specialty products. The segment reported operating profit of $19 million, down 5% year over year, due to significant escalation of input costs, and selling, general and administrative expenses.

Flexible Products & Services: Sales from this segment increased 5.7% year over year to $73.9 million. Divestitures and foreign currency translation negatively impacted net sales by $1.5 million and $1.4 million, respectively. The segment reported adjusted operating profit of $2.6 million compared to an operating loss of $1 million in the year-earlier quarter.

Land Management: The segment’s sales jumped 24% year over year to $7.2 million, on the back of growth in timber sales. Operating income surged 58.8 % year over year to $2.7 million.

Financial Position

Greif ended the reported quarter with cash and cash equivalents of $94.6 million compared with $103.7 million as of Oct 31, 2016. Cash provided by operating activities decreased to $89.6 million in the fiscal third quarter compared with $100.3 million in the year-ago quarter, due to an increase in operating working capital. Long-term debt was $1033.7 million as of Jul 31, 2017, compared with $974.6 million as of Oct 31, 2016.

On Aug 29, Greif announced a quarterly dividend of 42 cents per share of Class A Common Stock and 63 cents per share of Class B Common Stock. The dividends are payable on Oct 1 to stockholders of record at the close of business as of Sep 18, 2017.

Guidance

Greif slashed its fiscal 2017 adjusted earnings per share guidance to the range of $2.81-$2.95 from the prior band of $2.84-$3.02, due to the ongoing competitive pressure in Asia Pacific, timing of raw material price adjustment mechanisms in customer contracts and current assessment of a $2.5-million headwind impact related to Hurricane Harvey. The company reaffirmed its fiscal 2017 free cash flow guidance range to $180-$200 million.

The company announced its long-term financial targets. Greif guided 2020 adjusted operating profit to be in the range of $425-$465 million. It also expects 2020 free cash flow to be between $230 million and $270 million.

Greif remains on track to attain 2017 transformation commitments and remains confident about the consistent execution of strategy.

Share price Performance

Over the past year, Greif has outperformed the industry with respect to price performance. The stock gained around 32.7%, while the industry recorded growth of 5.6% over the same time frame.

Zacks Rank & Stocks to Consider

Greif currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the same sector are AGCO Corporation (NYSE:AGCO) , Altra Industrial Motion Corp. (NASDAQ:AIMC) and Caterpillar Inc. (NYSE:CAT) . All three stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AGCO has an average positive earnings surprise of 39.70% for the trailing four quarters. Altra Industrial Motion generated an average positive earnings surprise of 16.95% over the past four quarters, while Caterpillar has an average positive earnings surprise of 41.43% during the same time frame.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Greif Bros. Corporation (GEF): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC): Free Stock Analysis Report

Original post

Zacks Investment Research