Investing.com’s stocks of the week

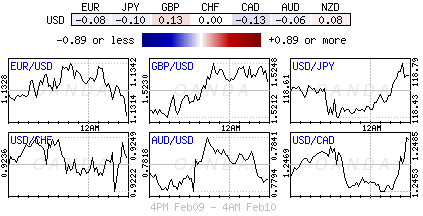

- Profit taking continues to dominate dollar

- No incentive to push dollar higher

- Norges Bank cannot afford to be misread

- Greeks dominated by euro timetable

The forex market becomes more difficult to endure when “the” obvious trade is the only trade and when the appetite for that particular currency is no more, at lest temporarily. Currently, the market has its full for the U.S dollar, or at least until investors can make room for their appetite.

Over the past 24-hours renewed uncertainty regarding the impact of a potential Grexit has wounded risk-on sentiment, leading to losses across global bourses. The exception being the Shanghai Composite, but only because a five-year low in China’s CPI (+0.8%) and the biggest drop in six for PPI (-4.3% – 35th consecutive decline) has further fueled expectations of continued easing by the People’s Bank of China.

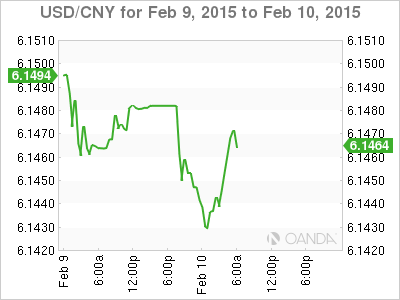

Weak consumer demand in China

China’s overnight price reports certainly rationalizes last week’s target RRR (reserve requirement ratio) cut by the PBoC and further proof that the global “deflation” phenomena is gaining momentum. Even the world’s second largest economy is not immune to the effects of lower prices as it moves towards the brink of a deflationary spiral. The data strengthens the prospect for further policy action likely before the end of Q1 in the format of a further -50bps cut to the RRR. For now, the excessive market CNY weakness seems to have subsided a tad as the market continues to focus on what Chinese policy makers are saying.

PBoC comments in their Q4 monetary policy report indicate that the authorities are expected to keep national policy not too tight, not too loose. Basically, fine-tune their economy in a timely manner with prudent monetary policy by using quantitative and pricing tools. The PBoC is probably under more strain than most central bankers as they are doing a lot of juggling, albeit, weaker growth, hot money flows and shadow banking. The authorities have to keep the wheels greased and prevent an extreme slid in economic growth while avoiding an excessive credit stimulus. When China sneezes all of us catch a cold.

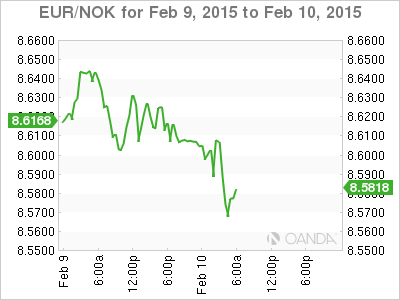

Is Norway to cut again?

Interest rate recalibration by Central Banks is now in full force. It is a capital markets objective to accurately price and telegraph rate moves to investors. Nevertheless, forex and fixed income speculators are always looking for that “extra” clue so they can anticipate the next currency move.

Norway’s CPI declined by just -0.1% in January against market expectations of a -0.3% fall. The headline rate eased to +2% from +2.1% YoY, while core-inflation was unchanged at +2.4%. The market consensus feels that despite Norway’s inflation holding up for now, the probability that the impact of lower oil prices affecting growth negatively will eventually lead to lower inflation. A percentage of the bond market is beginning to price in another possible move by the Norges bank as early as next month. The NOK level is now key (€8.57). The NOK is much higher than when the central bank cut rates in December. Norwegian policy makers assumed a much lower NOK in its December outlook. With crude's price bounce only being slight when compared to the most recent falls, the market should be anticipating at the very least a “super dovish” Norges bank or an interest rate cut.

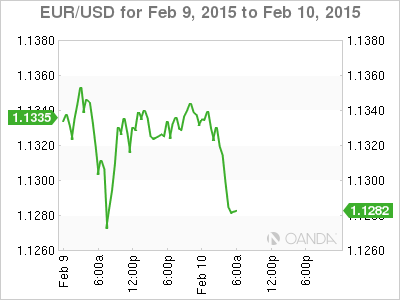

Euro dictated by timetable

The current prospects for the single currency will continue to be driven by the very tight timetable to negotiate a new support package for Greece. The market is not willing to throw “all in” at current price levels (€1.1290). The risk/reward does nothing for the current odds.

The EU continues to take a tough line with Greece ahead of key meetings. Eurogroup Finance Ministers meet tomorrow before the EU Leaders’ summit on Thursday. It does not end there; further Eurogroup's meeting next week will follow these. Spillover effects to the eurozone as a whole have been limited with some tension already having been alleviated after independent Greeks Party Kammenos (part of ruling coalition) stated that the government has a plan “B” if the EU remained rigid on any agreement.

Nevertheless, if Greece were to leave the eurozone it would materially increase the downside risks for the EUR in the near term and threaten financial stability in the union. The single currency is again retesting below the psychological €1.1300 handle, not with conviction, just trepidation with stellar momentum as the market heads stateside.