It’s getting awfully difficult to remember the last time the US government was NOT on the brink of a shutdown, but the most recent deadline for “disaster,” this coming Friday, January 19, is fast approaching. The last threat, near the end of December, was once again avoided when Congress stepped in to kick the can down the road with an agreement on short-term funding. For the upcoming “deadline,” politicians on both sides of the aisle are threatening to play hardball.

The truth is that the mid-December Democrat victory in Alabama—with Doug Jones wresting the Senate seat from the Republican Party—trimmed the latter’s majority in the Senate to just 51 versus 49. Given the need for 60 votes, Republicans will have to do something to entice nine Democrats to back any legislation and avoid a shutdown. Yet right now, with the necessary spending bill tied to ongoing negotiations regarding immigration legislation, coupled with President Trump's recent, unfortunate remarks about countries from which he finds immigration undesirable, it appears the probably of convincing any Democrat to vote with the GOP is unlikely. And that means that the probability of a government shutdown this time has likely increased. Should investors be concerned about market exuberance collapsing as a result?

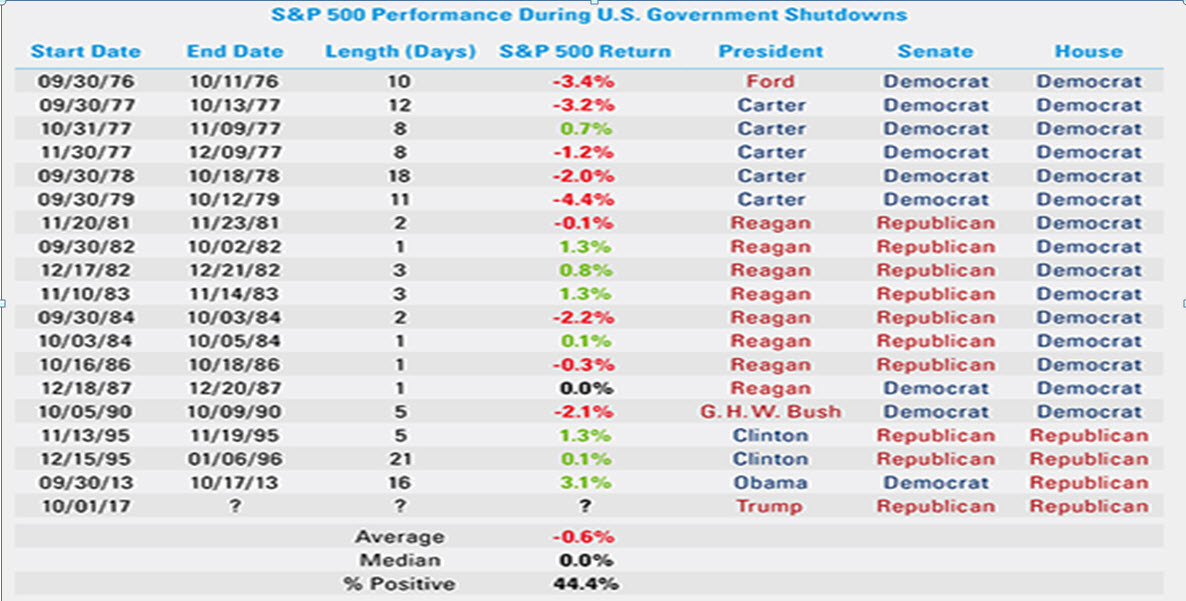

Although “government shutdown” sounds a lot like some type of end-all apocalyptic disaster, history shows us that it may not be as dire as financial media tends to portray it. As we mentioned when we took a look at the issue back in September of last year (see chart below), government shutdowns have occurred on 18 occasions in the past and resulted in negative returns for the S&P 500 on only half of those occasions with an overall average drop of just 0.6% in the S&P 500, according to data from LPL Research. In fact, the last instance was in 2013 and the benchmark index actually chalked up a 3.1% gain.

On the political scale, both sides are weighing their stance with a view on the impact for November’s mid-term elections and their options for blaming the other side for an actual shutdown “if” it occurs.

In fact, as recently as last Friday, U.S. President Donald Trump suggested that it was the Democrats that were threatening a shutdown over their insistence on the Deferred Action for Childhood Arrivals, known as DACA, program which gave legal protection against deportation to roughly 2 million undocumented immigrants, known as “dreamers”, who came to the United States as children.

Beyond the Shutdown: What Markets Are Actually Interested In

In the shadow of this impasse, the first since Trump’s victory in pushing through new tax legislation, markets are more interested in the results as an indicator for future spending programs that should truly have an impact on stocks. While Republicans are clamoring for increased defense spending, Democrats are insisting on a dollar-for-dollar match in non-defense spending, which covers areas like education, science, and government.

Beyond that, markets are still awaiting Trump’s promise to embark on what will be, in his words, a “very big infrastructure plan”, estimated to be tagged at $1 trillion. The first step for Congress will be to “deal with” the government shutdown, whatever that means. We think the odds are slightly higher that it won’t be avoided in this round, although politicians have proven to be capable of constantly kicking the can yet further down the road.

Markets may well prefer the situation to be resolved so politicians can begin to fight it out over greener pastures. “Greener” in the sense of showing the money to firms in infrastructure. In no case, however are we suggesting that the political hostility across the aisles will subside.