Alphabet Inc. (NASDAQ:GOOGL) owned search engine giant Google is gradually expanding its cloud services in Europe.

The company recently opened a new data center in London. This is in-line with the company’s initiative to extend its cloud footprint worldwide.Google is also trying to cope with Amazon.com, Inc.’s (NASDAQ:AMZN) cloud platform Amazon Web Services (AWS).

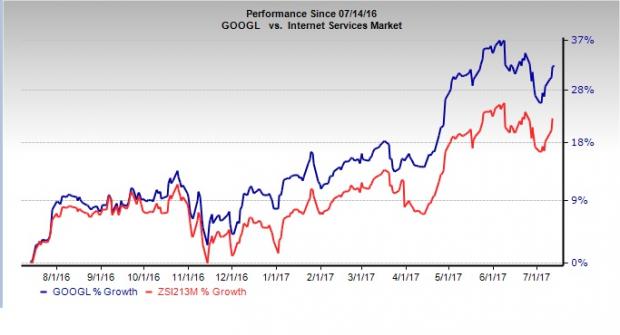

Coming to the price performance, for the last one year, shares of Alphabet have been treading higher. The stock returned 31.6% compared with the Zacks categorized Internet Services industry’s gain of 22.3%.

Details

The latest region, Google Cloud Platform (GCP) London, is the company’s 10th region and joins its existing European region in Belgium. This new London GCP center will have three zones. The center will offer compute, big data, storage, and networking service.

The new data center is expected to improve network and performance by lowering latency for British Isles and Western Europe clients. These GCPs enable businesses to save costs, accelerate innovation, as well as expand their geographic presence within minutes.

Growth Opportunity in the Cloud Market

Per Gartner, the worldwide public cloud services market is anticipated to increase 18% in 2017 to $246.8 billion from $209.2 billion in 2016. Cloud system infrastructure-as-a-service (IaaS) is projected to grow 36.8% in 2017 to $34.6 billion. Cloud application software-as-a-service (SaaS) is expected to grow 20.1% to $46.3 billion.

Talking particularly about Europe, the cloud technology adoption is on the rise here. In order to reduce expenditure, widen productivity and scale, and increase computing power, organizations in Europe have sought to cloud solutions.

We believe that Google is well positioned to take advantage of the projected growth in the cloud segment.

Bottom Line

Google is a late entrant to this fast-growing highly-competitive cloud market but has grown rapidly in the last one year. This expansion appears to be yet another attempt by Google to keep its position in the computing race.

However, competition in this space is fast growing as an increasingly number of big companies are shifting their computing operations to cloud. Amazon is already in control while Microsoft (NASDAQ:MSFT) is taking all the necessary steps to boost its position.

It will be interesting to see how the competitive atmosphere builds up with Google’s new move to get a share of this rapidly growing space.

Zacks Rank and Stock to Consider

Alphabet carries a Zacks Rank #3 (Hold). Another better-ranked stock in the broader technology sector is Alibaba Group Holding Limited (NYSE:BABA) , sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alibaba Group Holding Limited delivered a positive earnings surprise of 20.53%, on average, in the trailing four quarters.

More Stock News: This Is Bigger than the iPhone

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Original post

Zacks Investment Research