Making a strong push toward enhancing its artificial intelligence (AI) capabilities, the world’s leading search engine giant, Alphabet Inc.’s (NASDAQ:GOOGL) Google acquired Moodstocks, a French start-up specialized in instant smartphone image recognition. The financial terms of the deal remain under wraps.

Moodstocks’ “deep-learning” AI technology, allows computers, including smartphones, to identify and remember objects in the real world. The company said that the on-device image recognition technology was developed in 2012 and has been developing object recognition using deep learning approaches.

According to a statement on Moodstocks' site, monthly recurring users can access the services until their subscriptions end. Post acquisition, image recognition API for smartphones will eventually be phased out. Also, Moodstocks' team will join Google's R&D center in Paris.

Though the exact motive behind the acquisition is not clear, Google could integrate the start-up's research into its own image recognition expertise, and build features like those in Google Photos that automatically tag users' snaps.

The deal is expected to be completed in the next few weeks.

The use of artificial intelligence for image recognition has been gaining popularity in the tech sector as an increasing number of people are finding uses for it. Even other key players like Apple (NASDAQ:AAPL) , Amazon (NASDAQ:AMZN) and Facebook (NASDAQ:FB) ramped up their technologies in the recent past to develop more solutions. However, each can have a different approach as to how to use the technology. For instance, Facebook has improved tagging with the technology and recently deployed it to improve its new feature Facebook Mentions.

Just recently, Twitter purchased Magic Pony Technology, a London-based company that has developed techniques of using neural networks – systems inspired by the central nervous system of animals and are essentially designed to think like human brains to interpret functions – and machine learning to provide expanded data for images.

Investments in start-ups have always been one of Google’s key growth strategies. Over the past few years, the company either acquired or partnered with many such companies. We believe that Google’s sustained focus on expanding its business through strategic acquisitions and investments will drive growth in the long run.

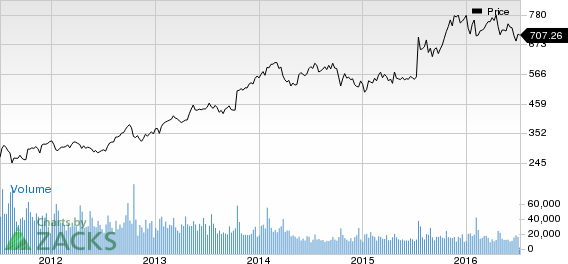

Currently, Alphabet has a Zacks Rank #3 (Hold).

AMAZON.COM INC (AMZN): Free Stock Analysis Report

APPLE INC (AAPL): Free Stock Analysis Report

FACEBOOK INC-A (FB): Free Stock Analysis Report

ALPHABET INC-A (GOOGL): Free Stock Analysis Report

Original post

Zacks Investment Research