Google has appealed against European Commission’s (“EC”) $2.9 billion fine on Monday at the Luxembourg-based General Court, possibly initiating yet another year-long legal confrontation.

The EC slapped this record fine on the Alphabet Inc. (NASDAQ:GOOGL) subsidiary on Jun 27 for favoring Google Shopping/Google Product Search/Froogle over comparison shopping services of competitors.

Details about the appeal are scant but per a court spokesman, Google has not appealed for any interim order to suspend EC’s decision.

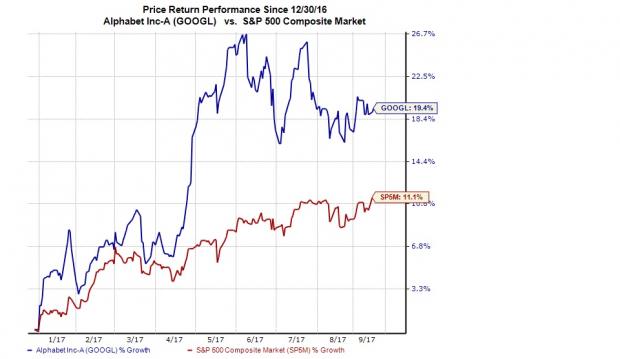

We observe that Alphabet shares have rallied 19.4% year to date, significantly outperforming the S&P 500’s gain of 11.2%.

Intel Ruling a Breather

Google’s step to make its own case comes on the heels of Intel Corporation (NASDAQ:INTC) receiving a partial victory against EC’s decision to fine it $1.20 billion in 2009. It was the biggest antitrust fine ever until Google’s case.

Last week, the European Court of Justice (ECJ) ordered the lower court to re-inspect the case. The ruling may have given some hope to Google.

Alphabet Inc. PE Ratio (TTM)

But the Nightmare Refuses to End

A number of technology giants have run into trouble with the EC over the years. Microsoft (NASDAQ:MSFT) received a landmark judgment in 2004. More targets of the Commission include Amazon (NASDAQ:AMZN) for its e-book deals, Apple (NASDAQ:AAPL) for its tax practices; and Facebook (NASDAQ:FB) and Twitter for the hate speech on their platforms.

Google itself has two other cases pending. One of these is related to Google using the Android platform to force hardware makers bundle Google services and prevent the preloading of rival services on the devices. The other involves restricting access to ads provided by its competitors, which might hit its core AdSense business.

Adding to the woes, Germany, Italy, France and Spain now want technology multinationals to be taxed based on their revenues instead of profits. Finance ministers of these countries have recently sent a joint letter to the EU in this regard.

Alphabet has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Original post

Zacks Investment Research