The Goodyear Tire & Rubber Company (NASDAQ:GT) is set to report second-quarter 2017 results before the market opens on Jul 28. Last quarter, the tire manufacturer delivered a positive earnings surprise of 17.46%. Plus, it has delivered the same in each of the trailing four quarters, with an average beat of 9.77%.

Let us see how things are shaping up for this announcement.

The Goodyear Tire & Rubber Company Price and EPS Surprise

Factors at Play

Goodyear is investing in projects having a high rate of return. Recently, it has invested $485 million to expand its tire factory in Pulandian, Dalian, China. The expansion, scheduled to complete in 2020, will increase the plant’s capacity by about 5 million tires per annum. It will help Goodyear in meeting the growing demand for premium, large-rim-diameter consumer tires in China and the Asia Pacific region.

The company is trying to boost its shareholder value, strengthen the balance sheet and restructure its senior debt. It is also launching innovative products and services to boost sales.

However, Goodyear faces pricing pressure from OEMs (Original Equipment Manufacturer). This will likely create a negative impact on the company’s profit margins as it sells about 30% of its tires to OEMs. Also, it anticipates a total segment operating income for 2017 to be approximately $2 billion, consistent with the 2016 level. Results will be adversely affected due to weaker demand and higher raw material costs.

Earnings Whispers

Our proven model does not conclusively show that Goodyear is likely to beat on earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This is not the case here as you will see below:

Zacks ESP: Goodyear’s Earnings ESP is -13.33% as the Most Accurate estimate of 65 cents is pegged below the Zacks Consensus Estimate of 75 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Goodyear carries a Zacks Rank #3. However, we need to have a positive ESP (as stated above) to be confident of an earnings surprise.

We caution against Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is witnessing negative estimate revisions.

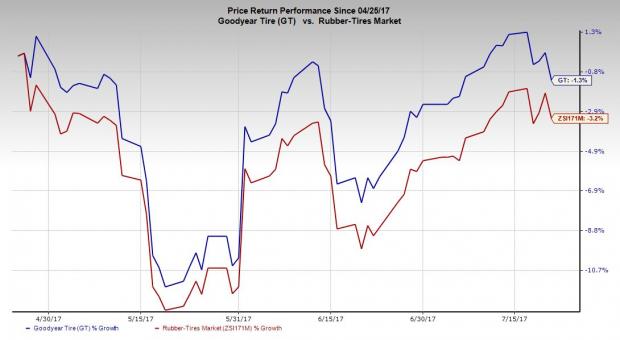

Price Performance

Goodyear’s stock has lost 1.3% in the last three months, thus outperforming the 3.2% decline of the industry it belongs to.

Stocks to Consider

Here are some companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter:

Cummins Inc. (NYSE:CMI) has an Earnings ESP of +3.1% and a Zacks Rank #2. The company is expected to report its second-quarter 2017 results on Aug 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Tenneco Inc. (NYSE:TEN) has an Earnings ESP of +1.67% and a Zacks Rank #3. The company’s second-quarter 2017 financial results are expected to be released on Jul 28.

Horizon Global Corporation (NYSE:HZN) has an Earnings ESP of +2.99% and a Zacks Rank #3. The company is expected to release its second-quarter 2017 results on Aug 1.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Tenneco Inc. (TEN): Free Stock Analysis Report

Horizon Global Corporation (HZN): Free Stock Analysis Report

Cummins Inc. (CMI): Free Stock Analysis Report

The Goodyear Tire & Rubber Company (GT): Free Stock Analysis Report

Original post

Zacks Investment Research