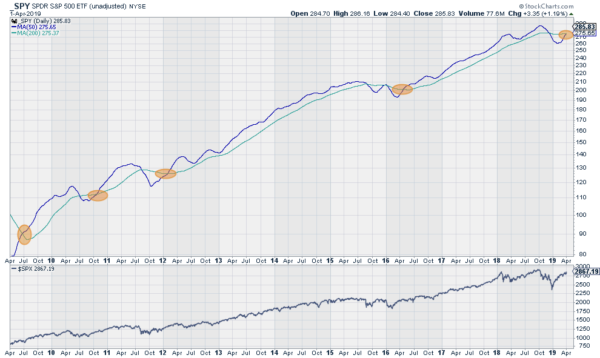

Back in November the Death Cross in the S&P 500 was all anyone could talk about. The 50-day SMA crossing down through the 200-day SMA is a top level indicator of a bear market. Except that since 2009 (at least) it has really just indicated a pause in the uptrend. A digestive rebalancing of investor sentiment. Death Crosses had become a signal to look for a reversal for a buy.

The question on investors minds then was “Is this just another dip to buy?” It was certainly not every investor that was asking this. The prevailing sentiment is that we are either in a recession or on the edge of one since the yield curve is inverting out to the 10-year Note. Last time I checked the definition of a recession was tied to GDP growth, not the yield curve. Yes, inverted yield curves have preceded recessions in the past, but a common demise of many an investor has come from relying on past correlations to continue indefinitely.

So today we come back to our desks to see a Golden Cross in the S&P 500. The 50-day SMA has pushed back up over the 200-day SMA. This is a technical buy signal. It has happened four times since the market bottom in 2009. Each has led to material gains in the market. Will this latest Golden Cross also lead to new highs and big gains for investors?

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.