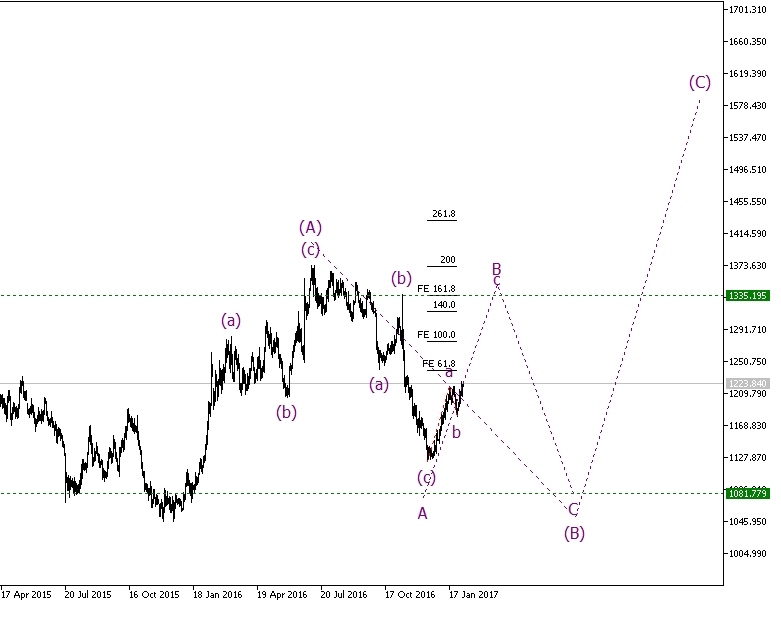

Option 1

XAU/USD pair is currently in the wave 3 of the wave C in flat pattern. This setting would take relatively short time to complete. Probability: low-moderate

Although this setting is from point of view of pure statistic most likely it doesn't seems to be fully in tune with fundamentals which indicate longer period of uncertainty; we are at the beginning of several processes (president Trump's policy implementation, brexit, probable end of economic growth faze...) which are supposed to bring about longer time of increased volatility of XAU/USD and we will likely see plenty of moves up and down in range 1050-1450 in the next 2-3 years therefore the 'Option 2' or 'Option 3' is much more likely to take place.

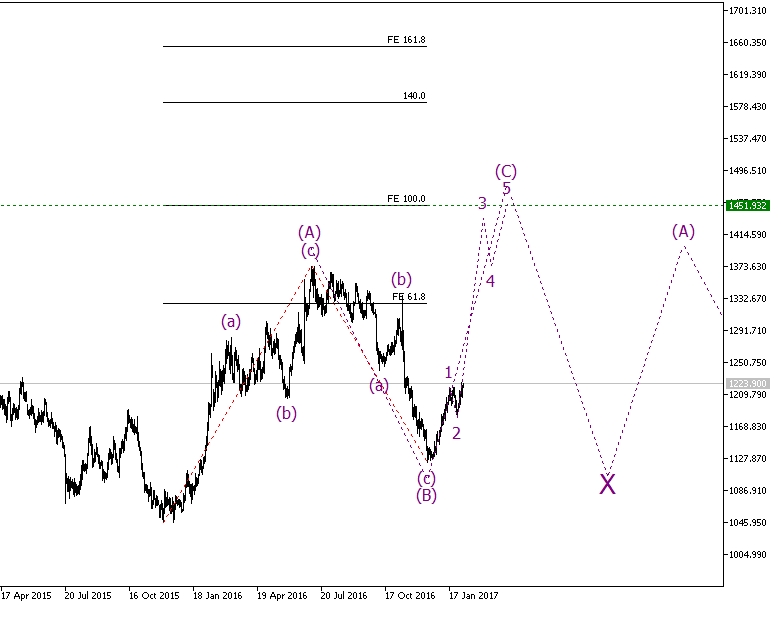

Option 2

XAU/USD pair is in wave c of the wave of the wave B of the wave (B) in flat pattern. This setting would take medium time to complete. Probability: moderate-high

Option 3

XAU/USD will evolve into complex correction such as double or triple flat pattern. This setting would take medium to long time to complete. Probability: moderate-high

Conclusion:

- Regardless of which option will become reality there is very high probability gold will increase its value against US dollar in the next 4-12 weeks before correction will take place.

- The most probable level the pair is supposed to reach is somewhere around 1340 (10% increase) before changing its direction and correcting lower.

- The pair will likely stay in range 1050-1450 in the next 12-36 months before possible final move higher (outside of the mentioned range) take place.

Note: Analysis has been completed on daily charts

Disclaimer: Mentioned above are opinions only and can NOT be considered as investment advice.