What a move in the gold stocks! The sector has refused to correct for more than a few days at a time. All weakness has been bought as a wall of worry has been built and the sector emerges from a historic low that could be on par with the 1942 low in the stock market. I thought the Federal Reserve statement or reaction to it (along with the market’s overbought condition) might cause the sector to correct this week. Instead, GDX and GDXJ powered higher and have gained roughly 13% for the week.

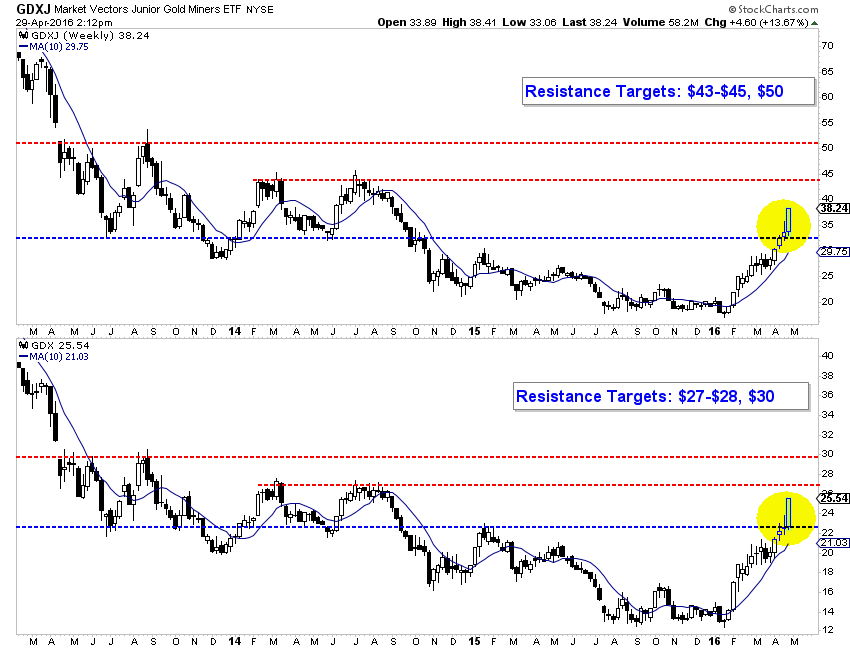

The weekly candle chart (below) shows both GDXJ and GDX are in breakout mode. GDXJ moved beyond previous resistance at $32-$33 and has upside targets at $43-$45 and even $50. Meanwhile, GDX has surpassed resistance at $22-$23 and now has upside to $27-$28 and $30. Furthermore, the 38% retracement of the entire bear in GDX is at $32. Do note that the miners have gapped higher in each of the past two days. For the sake of the bulls on the sideline, I hope to see an immediate pullback in the days ahead.

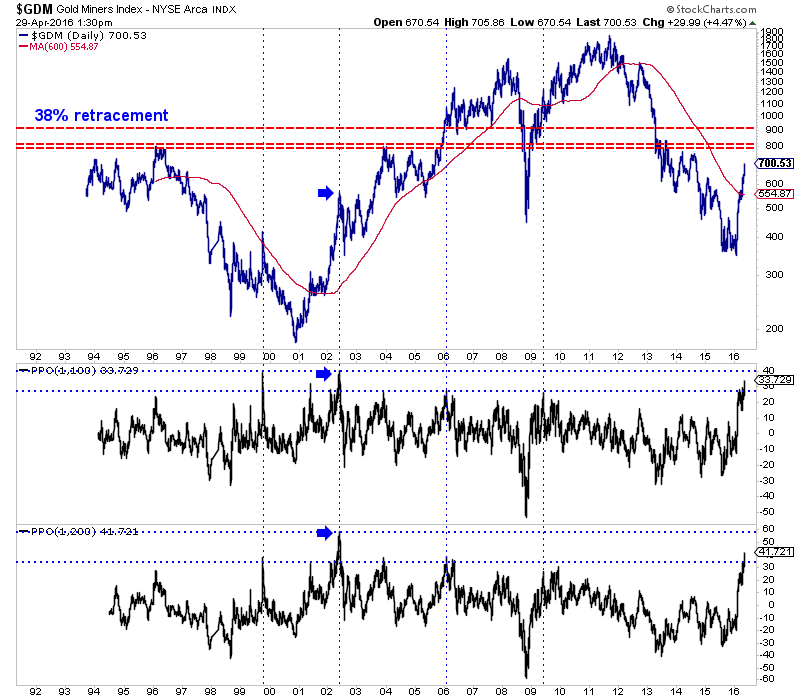

The gold stocks are already very overbought and if they continue higher unabated then we will have to worry about a potential sizeable correction. The chart below shows GDX’s parent index (GDM) along with two oscillators that plot its distance from its 100-day and 200-day exponential moving averages. The oscillators show the gold stocks are the second most overbought they have been in the past 22 years. The most overbought point was early 2002 when GDM corrected 37% before climbing much higher.

Before we worry about a sizeable correction, let me point out some very important data. The 2002 correction began when GDM and HUI rebounded 212% and 311% respectively from the major low in 2000. Thus far, the two have rallied 100% and 128% respectively.

Furthermore, the gold stocks are only three months removed from what could be the greatest buying opportunity of all time in the sector! While this is a sensational statement, it is rooted in data and facts and not your typical gold bug doomer porn. In short, there are three major similarities between the recent bottom in the gold stocks and the 1942 low in the stock market that arguably proved to be the greatest buying opportunity ever. I discuss and analyze the similarities in .

To conclude, the gold stocks have emerged from a historic bottom, have more upside but will eventually correct. How much they correct and when depends on how fast they reach their upside targets and what specific levels they reach. My current guess is anywhere from 25% to 35%. Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.