Gold stocks remain big bargains, still priced for bygone much-lower gold prices. Gold miners are earning enormous record profits, fueled by gold’s powerful bull market. Yet traders have been slow to recognize this, leaving gold stocks seriously undervalued relative to their underlying earnings. This striking anomaly won’t last, as eventually stock prices always mean revert to some reasonable multiple of corporate profits.

One year ago this week, gold was trading around $2,000. Those levels were considered very high then, as gold had just achieved its first nominal record close in 3.3 years of $2,071. Traders were generally still fairly bearish on gold then. But my essay written that week was quite bullish, arguing “While $2,450 is achievable, personally I’m more comfortable looking for a conservative 25% upleg taking gold near $2,275.”

That contrarian call came to pass in early April, and gold kept on blasting higher. In mid-September this gold upleg grew to monster status at 40%+ gains, before peaking in late October skyrocketing 53.1% in 12.9 months. Gold clocked in with an amazing 43 record closes in that span, the last being $2,786 six weeks ago. That left gold extremely-overbought and speculators’ gold-futures positioning extremely-overextended.

Thus gold was at high risk for a healthy selloff to rebalance sentiment and technicals, which soon came to pass. But it merely stretched to an 8.0% pullback at worst by mid-November, showing gold’s monster upleg remains alive and well. This year’s strong gold price action has been fueled by big global demand, from Chinese investors, central banks, and Indian jewelry buyers. Gold is shifting into a higher-price regime.

With 2024 almost over, gold has averaged $2,378 on close this year. That’s way higher than preceding years, with 2021, 2022, and 2023 averaging $1,798, $1,801, and $2,077. Gold-stock prices should reflect these higher prevailing gold prices which overwhelmingly drive their underlying earnings. Yet across these same four years starting in 2021, the leading GDX (NYSE:GDX) gold-stock ETF averaged $33.76, $29.88, $35.85, and $34.79.

From 2021 to 2024, average gold prices soared 32.2%. Yet average gold-stock prices per GDX only edged up 3.1%. This is a stunning anomaly, as historically major gold stocks dominating this ETF have usually amplified material gold moves by 2x to 3x. That’s driven by gold-mining profits really leveraging higher gold prices. As mining costs only rise slowly, gold outpacing them fuels outsized earnings growth.

After every quarterly earnings season, I dive deeply into the latest results reported by GDX’s 25 largest component stocks. The latest published a month ago covers Q3’24, where gold averaged a dazzling record $2,477. Yet the GDX top 25’s average all-in sustaining costs ran far lower at $1,431 per ounce, implying sector unit profits of $1,046. Those skyrocketed 74.0% YoY, the fifth quarter in a row of huge growth.

Starting in Q3’23, GDX-top-25 implied unit profits soared 87.2%, 42.3%, 34.9%, 83.7%, and 74.0% YoY. During 2024’s first three quarters, those averaged $980 per ounce. That was a whopping 94.1% higher than 2022’s average, when prevailing gold prices were 24.3% lower. With earnings nearly doubling, it makes no fundamental sense at all for yearly-average GDX prices to only be running 16.4% better this year.

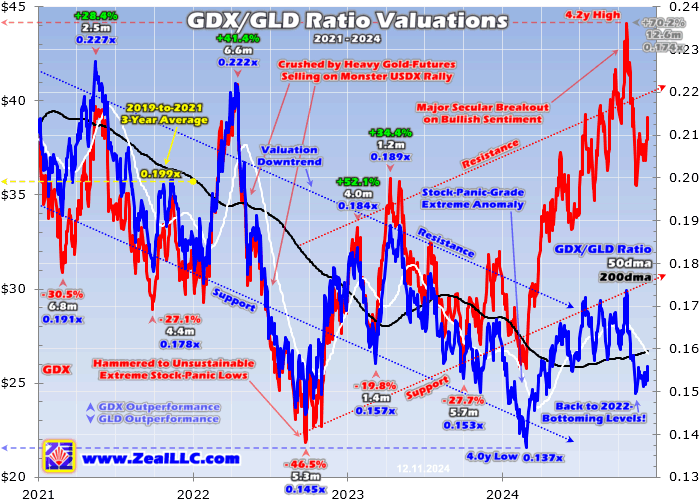

This unsustainable valuation anomaly is even more shocking when charted with another proxy. Since prevailing gold prices overwhelmingly drive gold-mining profits, looking at gold-stock price levels relative to gold reveal undervaluation and overvaluation. Dividing GDX’s daily closes by the mighty GLD (NYSE:GLD) gold ETF’s yields the GDX/GLD Ratio or GGR. It shows if gold stocks are relatively-cheap or relatively-expensive.

Here this GGR in blue along with key technicals are superimposed over the raw GDX in red. The major gold stocks certainly haven’t had a bad run, with GDX surging 70.2% at best during gold’s monster upleg. But that made for fairly-dismal 1.3x upside leverage to gold, far behind that historical 2x-to-3x range. Gold stocks have so greatly lagged their metal that relative to it they are still trading at secular-bottoming levels.

In late October GDX surged to a 4.2-year high, and was less than 1% under its best close in a whopping 11.8 years. That magnitude of secular breakout would’ve worked wonders to improve sentiment and attract traders to gold stocks. But that was torpedoed by the world’s largest gold miner’s Q3 results the next day, as analyzed in my latest quarterlies essay. Newmont missed big on AISCs, so its stock crashed 14.7%.

The only gold stock included in the S&P 500 suffering its worst daily drop in 27 years in the best of times for gold miners seriously tainted sentiment. Gold was still surging to more records, yet GDX rolled over dragged down by NEM. The GGR was decisively breaking out of its multi-year downtrend before that Newmont debacle. GDX’s selloff was soon exacerbated by gold’s own overdue pullback, slamming gold stocks.

GDX naturally bottomed with gold in mid-November, falling 19.5% to the metal’s 8.0% for normal 2.4x downside leverage. But the resulting GGR read of 0.150x was jaw-dropping. While gold stocks had been lower relative to gold earlier in its monster upleg, that was exceedingly-anomalous too. In late February after gold had started surging but gold stocks hadn’t really followed, the GGR slumped to an incredible 0.137x.

That was a 4.0-year low, showing gold stocks were the most undervalued relative to gold since the dark heart of March 2020’s pandemic-lockdown stock panic.

Late February’s stock-panic-grade gold-stock prices relative to gold were an unsustainable anomaly, and those all but guarantee big mean-reversion normalization rallies. While today’s gold prices haven’t plunged to such extremes relative to gold, they aren’t far off. That portends another massive gold-stock surge soon.

GDX falling to just 0.150x GLD prices is very similar to the previous epic gold-stock-buying opportunity back in late September 2022. That followed another extreme anomaly fueled by the Fed’s most-extreme rate-hike cycle ever. Resulting soaring yields catapulted the US dollar stratospheric, unleashing massive gold-futures selling. That hammered gold 20.9% lower, which GDX amplified by 2.2x for a brutal 46.5% plunge.

The lowest the GGR fell in that major secular bottoming’s nadir was 0.145x, and the GGR averaged just 0.154x straddling that in September and October 2022. Those aren’t much under current levels, that 0.150x GGR low in mid-November 2024 and the same 0.154x average since the elections. Gold stocks have rarely been cheaper relative to gold than recently, and such anomalous extremes never last long.

Over the next 4.0 months after that late-2022 episode, GDX blasted 52.1% higher. And in 7.8 months after February 2024’s extreme GGR low, GDX soared 71.0%. Odds are even-bigger gold-stock gains are coming after this latest seriously-undervalued low. So we’ve been aggressively refilling our newsletter trading books with fundamentally-superior fast-growing mid-tier and junior gold miners way outperforming majors.

Past super-low-GGR extremes are always followed by major gold-stock uplegs. And gold miners tend to not only mean revert to normal GGR levels, but overshoot proportionally to the upside. Arguably the last normal market years were 2019 to 2021, before the Fed went crazy with 2022’s blistering rate hikes. In that secular span, the GGR averaged 0.199x. A mean reversion back to there would require a 33% GDX rally.

But a proportional overshoot would double that to 66% in the GDX majors, and the better mid-tiers and juniors would fare much better. And this assumes gold prices remain flat, that gold stocks merely catch up with these prevailing gold levels. There are strong arguments for this gold bull powering much higher, led by American stock investors shockingly not yet chasing gold’s upside. They have enormous buying to do.

Gold’s last two monster-grade uplegs both cresting in 2020 required massive gold-ETF-share buying to catapult gold up 40%+. Yet today’s even-bigger monster gold upleg has yet to see any material GLD and IAU capital inflows. American stock investors have been distracted by this seductive AI stock bubble, mostly ignoring gold. The former is overdue to burst, which ought to spawn a frenzied stampede into the latter.

The GDX-top-25 gold miners continued to earn mind-boggling record profits in this current Q4 too. Mostly over already, gold is averaging $2,670 quarter-to-date which is soaring 35.1% YoY. If that holds over the next couple weeks, it will make for the biggest gold jump in the 34 quarters I’ve been analyzing major gold miners’ latest results. No matter what happens, Q4’24 will see gold’s highest average prices ever by far.

During 2024’s first three quarters, GDX-top-25 all-in sustaining costs averaged $1,315 per ounce. Plenty of gold miners are forecasting lower AISCs in Q4 due to higher production, even Newmont. But just to be conservative, let’s assume they stay really high near $1,400. That implies dazzling record unit profits of $1,270 per ounce, which would skyrocket another 93% YoY. Gold miners are earning money hand-over-fist.

Plenty of gold stocks are already trading at low-double-digit and even single-digit price-to-earnings ratios, incredibly undervalued. And their sixth quarter in a row of enormous earnings growth will force valuations even lower. Such big bargains will increasingly attract value-oriented fund investors, and it won’t take much institutional buying to force this small contrarian sector way higher. Gold stocks will normalize with earnings.

Technically this sector has huge room to rally too. Again gold’s monster upleg has soared 53.1% at best since early October 2023. Assuming it doesn’t continue powering higher on balance, GDX again should leverage that by 2x to 3x based on its own historical precedent. That implies 106%-to-159% major-gold-stock gains off GDX’s own October-2023 bottoming, making for GDX share prices flying to $53 to $67.

Midweek it is only trading at $39, mainly due to poor gold-stock sentiment. Speculators and investors alike enamored with this AI stock bubble continue to overlook gold and its miners’ stocks. That apathy has left them seriously out of favor. But exploding profitability eventually attracts big capital back to any sector. The gold stocks are unequalled in combining really-low valuations with enormous earnings growth.

Popular gold-stock sentiment will shift bullish unleashing increasing buying as gold continues powering higher on balance. The higher gold and gold stocks climb, the more and more-favorably the financial media will cover them, and the more traders will become aware of this big upside and want to rush to chase it. And buying begets buying, driving prices higher exciting more traders attracting more capital inflows.

With gold running just 2.5% under late October’s latest record close midweek, it is shocking and absurd to see gold stocks languishing at major-secular-low levels relative to the metal driving their profits. But this unsustainable anomaly is full of big bargains for smart contrarians. Multiplying wealth requires buying low before later selling high, with that first step being the most important. Gold stocks are certainly relatively-low.

While GDX will see big valuation-mean-reversion gains, smaller mid-tier and junior gold miners with great fundamentals will outperform. Better able to consistently grow their production off smaller bases, they even often operate lower-cost gold mines than majors. Last quarter the GDXJ-top-25 mid-tiers’ average AISCs of $1,331 were actually $100 lower than the GDX-top-25 majors’ $1,431. Smaller miners are great buys.

The bottom line is gold stocks are big bargains today. While gold remains near recent record highs, the major gold stocks of GDX are deeply-undervalued. Shockingly they are trading at similar levels relative to their metal seen during late 2022’s major secular bottoming. Despite gold miners earning record profits and achieving six consecutive quarters of enormous earnings growth, traders continue to mostly ignore them.

This unsustainable anomaly won’t last, as stock prices always eventually normalize to reflect reasonable multiples of their underlying corporate earnings. Gold miners’ rich-and-fat profits will force their stock prices much higher. That overdue mean-reversion buying getting underway will boost bullish sentiment, attracting in increasing numbers of traders to chase gold-stock upside. Buying in ahead of that will prove lucrative.