Gold has opened the year on the front foot as concern about the Chinese economy rear sits ugly head once again. Gold is looking to test the upper level of the range but so far has remained constrained.

The Shanghai stock index took a sharp dive in its first trading day of 2016, closing the day down 6.8% and sending waves of panic through various other markets. The Chinese regulator lifted a ban on selling which had been in effect since the 8th of July. The ban applied to senior executives and investors holding more than 5% of a company, but the expectation of the market that some selling would occur obviously led to further selling. Gold certainly benefited from the sell off as investors sought out safety plays, with the USD and the yen also finding demand.

Once again the market questions the economic strength of China which certainly contributed to the stock plunge and support for gold. The Caixin (formerly the HSBC) manufacturing PMI returned a very poor 48.2, making it 10 months below the 50 mark which denotes expansion. The negative Chinese sentiment spread to US stock markets, with the S&P 500 touching a 10 week low.

The data out of the US has not exactly been impressive which has also contributed to the gold market opening the year strongly. The US ISM manufacturing PMI was poor at 48.2 vs 49.0 expected which raises questions about the US economic strength. The Atlanta Fed has revised its “GDPNow” growth figure down from 1.3% to 0.7%, and last week we saw Unemployment Claims disappoint at 287k vs 270k exp. Gold is heavily (inversely) correlated with US economic strength and found support on the disappointing figures. If the disappointment continues, the Fed is unlikely to raise interest rates further and that will see enormous demand for gold.

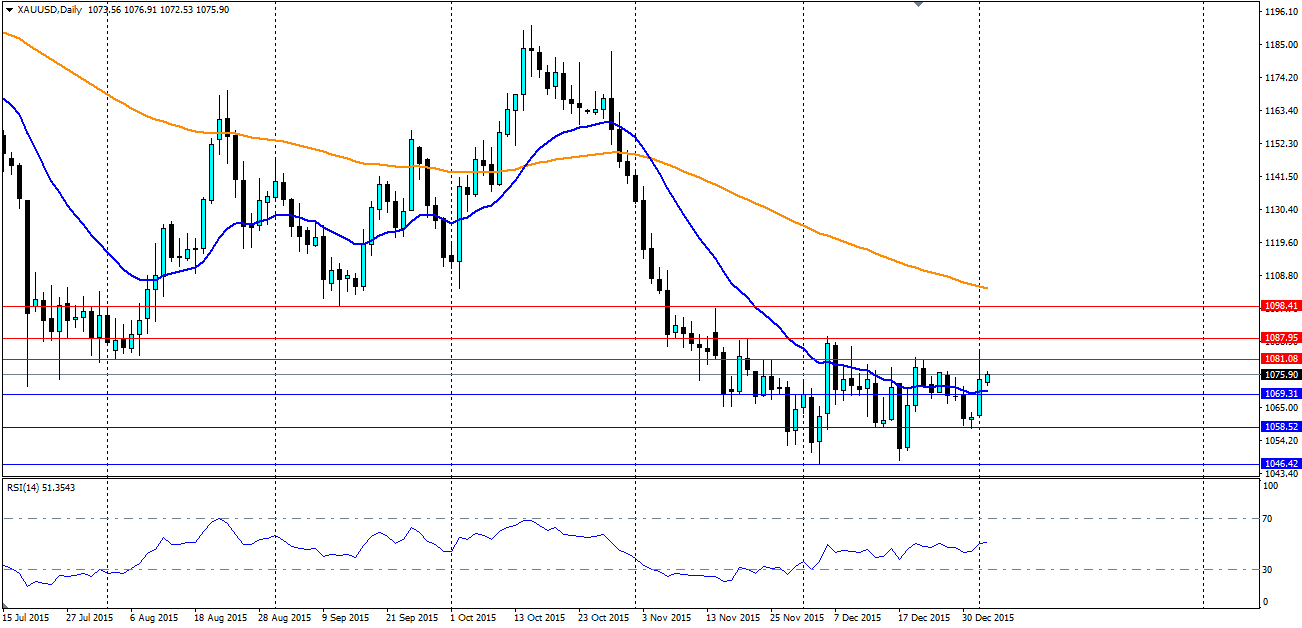

Technicals show gold still constrained within the range it has found itself in recently despite the Chinese economic jitters. The range has remained largely intact with a test of the top yesterday thanks to the uncertainty. The range will most likely stay in play over the next few weeks unless we see a sharp degradation to Chinese or US economic fortunes. Look for support at 1069.31, 1058.52 and the bottom of the range at 1046.42. Resistance is found at 1081.08, 1087.95 and 1098.41.