Gold Today –New York closed at $1,256.50 Friday after closing at$1,254.60 Thursday.London opened at $1,250.20 today.

Overall the dollar was slightly weaker against global currencies, early today. Before London’s opening:

- The USD/EUR was slightly weaker at $1.1188 after Friday’s$1.1174: €1.

- The Dollar Index was slightly weaker at 97.24 after Friday’s 97.34.

- The yen was stronger at 111.18 after Friday’s 111.31:$1.

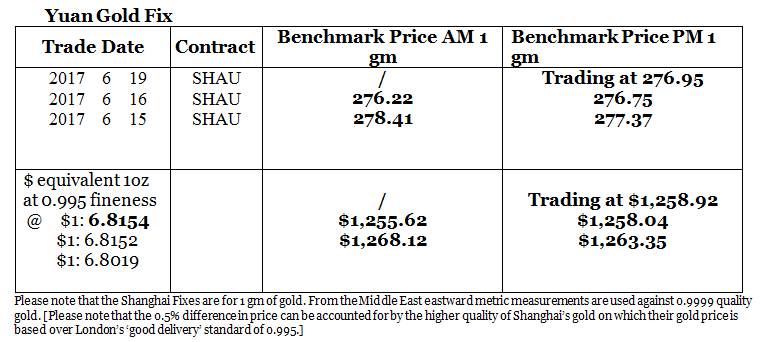

- The yuan was almost unchanged at 6.8154after yesterday’s 6.8152: $1.

- The pound sterling was stronger at $1.2780 after yesterday’s $1.2774: £1.

New York closed at almost the same level as Shanghai Composite did on Friday. This morning see Shanghai $3 higher, but London ahead of its open was trying to pull the price down a few dollars to $1,250, trying to guess the opening mood in London.

Hong Kong’s ‘central bank has stated that it prefers a stable exchange rate against the dollar. It is not independent of Shanghai and, judging by today’s exchange rate the People’s Bank of China agrees as we see the yuan virtually unchanged today. This will allow us to see more clearly the differences between the Shanghai gold Exchange prices and London and New York.

Silver Today –Silver closed at $16.66 Friday after $17.13 at New York’s close Thursday.

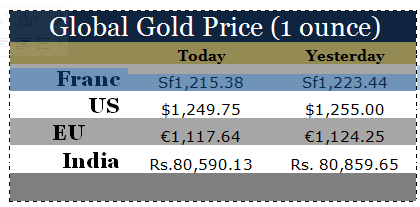

LBMA price setting: The LBMA gold price was set today at $1,251.10 from Friday’s $1,256.60. The gold price in the euro was set at €1,118.90 after Friday’s €1,124.42.

Ahead of the opening of New York the gold price was trading at $1,249.75 and in the euro at €1,117.64. At the same time, the silver price was trading at $16.63.

Gold (very short-term) The gold price should consolidate, in New York this week.

Silver (very short-term) The silver price should consolidate, in New York this week.

Price Drivers

The Fed

The actions of the Fed last week continue to be digested by markets. In view of the weakening inflation and wage figures a consensus is building that the Fed was too hawkish in view of the data.

Of course opinions are irrelevant, it is the action the market takes that counts. The condition for more tightening given by Janet Yellen that ‘the U.S. economy should continue to moderately grow, and continue broadening that growth throughout the economy’ needs to be fulfilled first. The data, so far, in the last couple of weeks is not pointing that way. It may well do so but we need to see that first before we can conclude that it is. We are not convinced.

Today sees the dollar tending weaker. The market opening for gold in London is cautious and can turn either way in a heartbeat. It is drifting sideways with a slightly easier tendency so far today.

Technical position

While the market is giving the impression it is just moving sideways and tranquil, the gold price is at a critical junction. The next strong move in the gold price will tell us the direction for the next few months. But this move has to be several tens of dollars not just a few dollars more or less.

Gold ETFs – Friday, saw no sales or purchases from or into the SPDR Gold Shares (NYSE:GLD) ETF or the Gold Trust.

Their holdings are now at 853.684 tonnes and, at 207.06 tonnes respectively.

Since January 4th 2016, 248.996 tonnes of gold have been added to the SPDR gold ETF and to the Gold Trust. Since January 6th 2017 48.29 tonnes have been added to the SPDR gold ETF and the Gold Trust.