Gold Today –New York closed at $1,241.40 Friday after closing at $1,244.30 Thursday. London opened at $1,235.25 today.

Overall the dollar was stronger against global currencies, early today. Before London’s opening:

- The $: € was stronger at $1.1398 after Friday’s $1.1406: €1.

- The Dollar index was stronger at 95.86 after Friday’s 95.73.

- The Yen was stronger at 111.99 after Friday’s 112.55:$1.

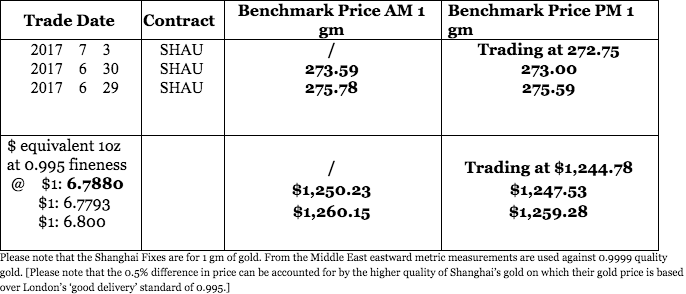

- The Yuan was weaker at 6.7880 after Friday’s 6.7793: $1.

- The Pound Sterling was stronger at $1.3007 after Friday’s $1.2984: £1.

New York weakened on Friday after Shanghai and London weakened. This morning Shanghai weakened further setting the stage for London to fall. As you can see London is also seeing downward pressure as the U.S. dollar strengthened a little against all currencies bar the Pound Sterling.

We have yet to see the authorities in China give a signal that they are happy with any particular level of the Yuan. What we do know is that it is unlikely to approach 7.00 against the dollar in the foreseeable future. One should now focus on the Yuan against all currencies, not just the dollar.

We do see friction increasing between China and the U.S. on the political front and expect to see greater efforts on all fronts to reduce reliance on the U.S. dollar in their reserves as tensions grow.

The Chinese will make far greater efforts to have the Yuan stand on its own two feet to reduce vulnerability to dollar pressures and to ensure the Yuan becomes a much greater part of global reserves. To that end we do expect the People’s Bank of China to continue selling dollars to reinforce the Yuan exchange rate. As the move towards levels the P.B. of C. wants, we expect to see considerably more payments for goods and assets being made in the Yuan.

Silver Today –Silver closed at $16.61 Friday after $16.62 at New York’s close Thursday.

LBMA price setting: The LBMA gold price was set today at $1,235.20 from Friday’s $1,243.25. The gold price in the euro was set at €1,085.65 after Friday’s €1.090.19.

Ahead of the opening of New York the gold price was trading at $1,233.60 and in the euro at €1,085.34. At the same time, the silver price was trading at $16.46.

Gold (very short-term) The gold price should consolidate with a weakening bias, in New York today.

Silver (very short-term) The silver price should consolidate with a weakening bias, in New York today.

Price Drivers

With the U.S. enjoying their Independence Day quiet markets are likely to see prices ‘marked down’. What we mean by this is that prices will move on no volume. Should there be positive news after the holiday for gold, prices will be raised quickly on no trading.

Shanghai Downward Pressure

This morning, the day ahead of the U.S. Independence Day we are seeing Shanghai putting downward pressure on the gold price in dollars. London and New York are falling but the discount they stand at to Shanghai has reduced. We now see it widening as London falls. With a quiet New York today and its absence from the gold market tomorrow we will see more clearly the weight of their pricing power without U.S. influence.

So far in the last week we have seen Shanghai prices fall. Because Shanghai’s prices reflect demand for physical gold, we are seeing demand weakening there. We have no evidence that this drop in demand is going to be more than temporary.

India

The New Tax regime came into being on Saturday. While its impact on Indian retail gold prices is going to be small [0.5% increase] there was a great deal of buying ahead of its impositions ahead of the announcement of the level of the tax. As we move into July the result will be that buying should fall off at least to some extent because needs from July onwards have been filled. On top of that farmers in India now well over a month since the start of an excellent Monsoon, so far, are busy away from the market. We do not expect to see them back in the market until early September.

Gold ETFs – Friday saw sales of 1.183 of gold from the SPDR gold ETF (NYSE:SPY) but we saw no sales or purchases from or into the Gold Trust (NYSE:GLD). Their holdings are now at 852.501 tonnes and at 210.35 tons respectively. This left U.S. gold investors slightly negative before the holiday weekend.

Since January 4 2016, 21.143 tonnes of gold have been added to the SPDR gold ETF and to the Gold Trust. Since January 6 2017 50.437 tonnes have been added to the SPDR gold ETF and the Gold Trust.